Nissan 2006 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2006 Nissan annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FINANCIAL SECTION

Nissan Annual Report 2005 71

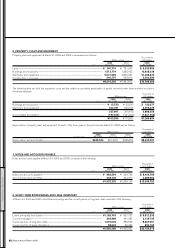

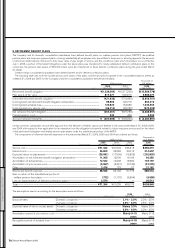

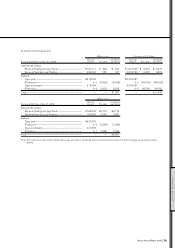

12. OTHER INCOME (EXPENSES)

The components of “Other, net” in “Other income (expenses)” for each of the three years in the period ended March 31, 2006 were as follows:

Thousands of

Millions of yen U.S. dollars

2005 2004 2003 2005

For the years ended Mar. 31, 2006 Mar. 31, 2005 Mar. 31, 2004 Mar. 31, 2006

Dividend income.............................................................................................................................................................. ¥ 3,721 ¥ 1,340 ¥ 1,270 $ 31,803

Gain on sales of fixed assets................................................................................................................................ 16,742 24,038 4,163 143,094

Loss on disposal of fixed assets........................................................................................................................ (22,213) (20,115) (18,449) (189,855)

Net gain (loss) on sales of investment securities................................................................................ 40,223 7,232 (7,113) 343,786

Foreign exchange (loss) gain............................................................................................................................... (34,836) 801 16,444 (297,744)

Amortization of net retirement benefit obligation at transition.................................................. (11,145) (11,795) (13,936) (95,256)

Gain on return of substitutional portion of welfare pension fund plans (Note 9) ................. 772 1,107 5,594 6,598

Loss on restructuring of consolidated subsidiaries’ operations............................................... (9,404) (8,752) (26,164) (80,376)

Settlement loss on withdrawal from multi-employer retirement benefit plan............... —(6,337) — —

Impairment loss on fixed assets (Note 2 (f)) ..................................................................................................... (26,827) ——(229,291)

Net loss on implementation of defined contribution plans........................................................... (3,570) ——(30,513)

Expenses related to share appreciation rights plan........................................................................... (18,332) ——(156,684)

Other......................................................................................................................................................................................... (26,693) (80,514) (44,821) (228,143)

....................................................................................................................................................................................................... ¥(91,562) ¥(92,995) ¥(83,012) $(782,581)

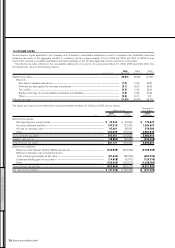

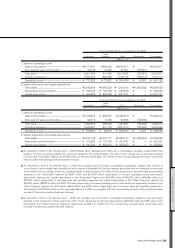

11. RESEARCH AND DEVELOPMENT COSTS

Research and development costs included in selling, general and administrative expenses and manufacturing costs for the years ended March

31, 2006, 2005 and 2004 amounted to ¥447,582 million ($3,825,487 thousand), ¥398,148 million and ¥354,321 million, respectively.

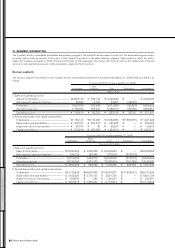

10. SHAREHOLDERS’ EQUITY

In accordance with the Commercial Code of Japan (the “Code”), the Company has provided a legal reserve, which is included in retained

earnings. The Code provides that an amount equal to at least 10% of the amount to be disbursed as distributions of earnings be appropriated to

the legal reserve until the total of such reserve and the additional paid-in capital account equals 25% of the common stock account. The legal

reserve amounted to ¥53,838 million ($460,154 thousand) at both March 31, 2006 and 2005.

The Code provides that neither additional paid-in capital nor the legal reserve is available for dividends, but both may be used to reduce or

eliminate a deficit by resolution of the shareholders or may be transferred to common stock by resolution of the Board of Directors. The Code

also provides that if the total amount of additional paid-in capital and the legal reserve exceeds 25% of the amount of common stock, the excess

may be distributed to the shareholders either as a return of capital or as dividends subject to the approval of the shareholders.

The new Corporation Law of Japan (“the Law”), which superseded most of the provisions of the Commercial Code of Japan, went into effect

on May 1, 2006. The Law stipulates requirements on distributions of earnings similar to those of the Code. Under the Law, however, such

distributions can be made at any time by resolution of the shareholders, or by the Board of Directors if certain conditions are met.