Nissan 2006 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2006 Nissan annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Nissan Annual Report 2005

28

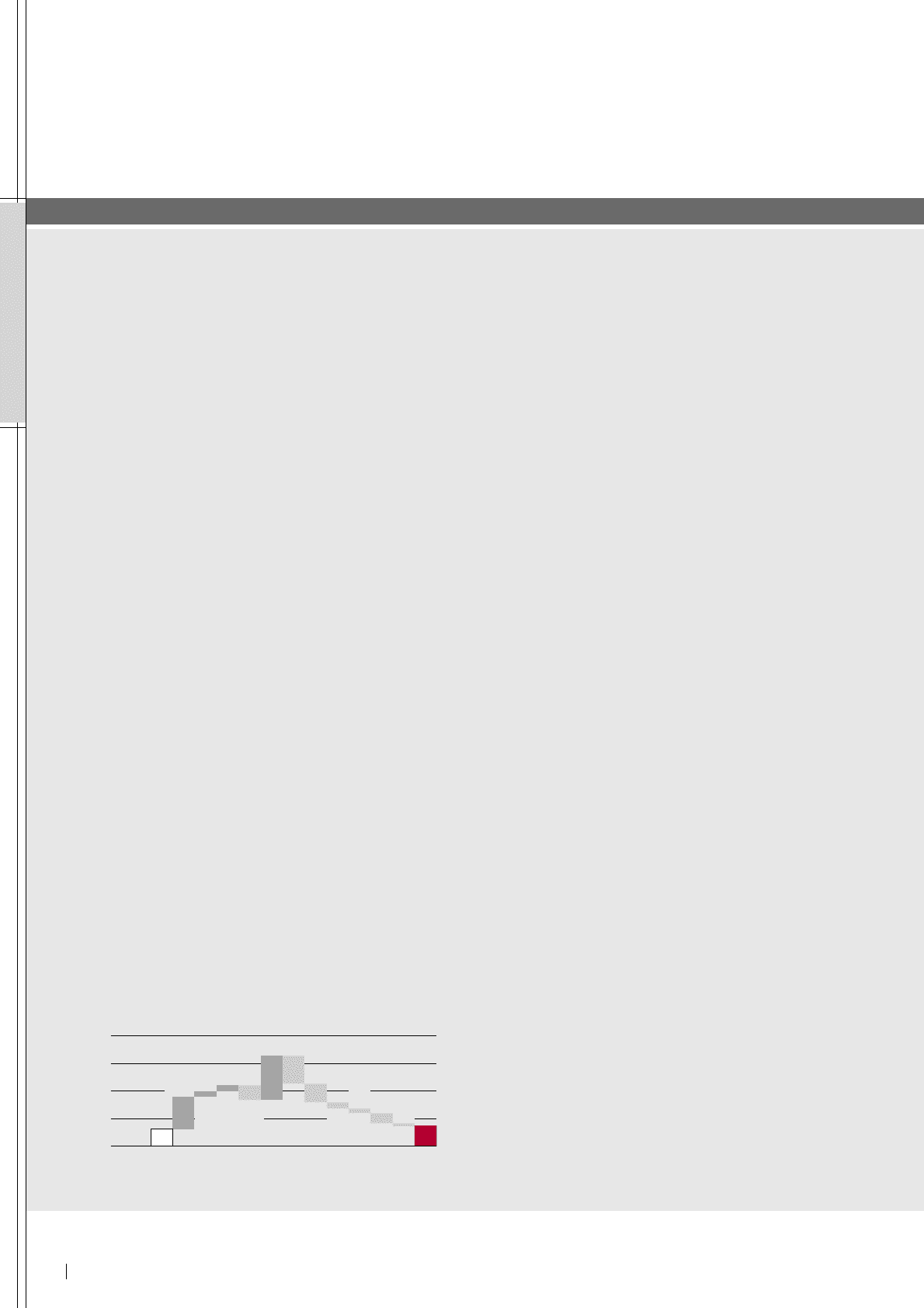

1,100

1,200

1,000

900

800

FY04

OP

FY05

OP

Forex Scope

of con-

solidation

Price/

volume

mix

Sales

expenses

(incl.

incentives)

Pur-

chasing

cost

reduc-

tion Product

enrichment &

regulations

R&D

expenses

Manu-

facturing

expenses

Warranty

expenses

G&A

and

others

861.2

+117.8 +21.0 +20.4 –52.9

+160.0

Row

material

energy

cost

+100.0

–69.0

–22.6 –16.9 –37.0 –10.2

871.8

Impact on Operating Profit

(Billion Yen)

FISCAL 2005 FINANCIAL REVIEW

NISSAN ACHIEVED RECORD REVENUES, OPERATING INCOME, NET INCOME, SALES AND PRODUCTION

VOLUME IN FISCAL 2005. CONSOLIDATED NET INCOME TOTALED ¥518.1 BILLION, UP 1.1 PERCENT,

A RECORD FOR A SIXTH CONSECUTIVE YEAR. GLOBAL SALES REACHED A HISTORIC HIGH OF 3,569,000

UNITS, A 5.3 PERCENT INCREASE IN A FIERCELY COMPETITIVE MARKET.

THIS WAS THE FIRST YEAR OF NISSAN VALUE-UP, THE COMPANY’S THIRD MID-TERM BUSINESS PLAN, AND

MARKED OUR TRANSITION FROM THE REVIVAL PHASE TO THAT OF SUSTAINABLE AND PROFITABLE GROWTH.

Net Sales

Consolidated net sales came to ¥9,428.3 billion, up

9.9 percent from last year. Favorable changes in

foreign exchange rates resulted in a ¥301 billion

improvement. Changes in the scope of consolidation,

such as the inclusion of Calsonic Kansei, added

¥117.8 billion.

Operating Income

Consolidated operating profit improved by 1.2

percent from last year to a record ¥871.8 billion,

resulting in an operating profit margin of 9.2 percent.

The following factors affected operating profit:

• Foreign exchange rate fluctuations produced a

¥117.8 billion gain for the year. Of that total,

¥77.2 billion came from the appreciation of the

U.S. dollar against the yen. The appreciation of

the euro resulted in a positive impact of ¥6.3

billion. Forex activity in other currencies brought

in ¥34.3 billion, with trades involving the

Mexican peso accounting for ¥15.3 billion.

• Scope of consolidation changes, primarily from

the consolidation of Calsonic Kansei, had a

positive impact of ¥21 billion.

• Price, volume and mix had a combined positive

impact of ¥20.4 billion.

• Selling expenses increased by ¥52.9 billion,

mainly due to the higher level of incentives,

particularly in the U.S. market.

• Lower purchasing costs resulted in a

contribution of ¥160 billion. However, we had to

absorb ¥100 billion in additional costs from

increases in the price of raw materials and oil.

• Product enrichment and the cost of new

regulations had a negative impact of ¥69 billion.

• R&D expenses increased by ¥22.6 billion to

upgrade technology and develop new products.

• Manufacturing and logistics expenses went up

by ¥16.9 billion, reflecting the cost of added

capacity and product-specific investment

needed to support the seventy product

launches during the Nissan Value-Up period.

• Warranty expenses had a negative impact of

¥37 billion, a side effect of growing sales and

swift, proactive customer service actions.

• General, administrative and other expenses rose

¥10.2 billion.

PERFORMANCE