Nissan 2006 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2006 Nissan annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Nissan Annual Report 2005 3

operational targets in order to exercise their options.

This way, the interests of shareholders and

employees are closely aligned.

But whether maximizing our intrinsic value in the

first stage leads to maximizing shareholder value

depends on the second stage, investor

communications. Obviously, if the improvement in

intrinsic value is not reflected in the market value,

it does not reward shareholders at all. Therefore, the

role investor communications plays in our VBM

is significant.

The role of investor communications is to ensure

that our market value tracks our intrinsic value. The

benefit of being fairly valued is that we can learn

from market signals. Since we believe that our share

price is the most objective measure of our future

performance, we use that feedback at the highest

levels of the company. Obviously, obtaining this

objective view is a benefit of being a public company.

Therefore, if our share price fails to reflect our

fundamentals due to noise and speculation, we lose

the benefit of this effective tool. This is why we aim

to maintain equity between our intrinsic value and

market value.

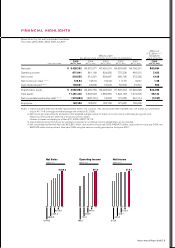

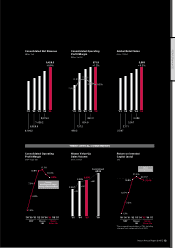

Result of shareholder value creation in

fiscal 2005

Although our share price appreciated 27.2 percent

from the end of March 2005 to March 2006, it is

clear that our financial performance has failed to

meet the market expectations. Our share

performance was lower than those of our key

competitors and the overall market.

One apparent reason is that our profit growth

appears to have flattened, despite another record

year in terms of operating profit and net income.

Through reverse-engineering our share price

at fiscal year-end – ¥1398 – another factor we

identified is that the market expects lower long-term

earnings growth from Nissan, when compared to

our key competitors. Since long-term earnings

growth is a key value driver, this pessimistic market

expectation resulted in the significantly lower

share performance.

While our fiscal 2005 financial performance,

as a snapshot of the company, was an average

performance, we have made progress in terms of

maximizing our intrinsic value. And as data from

several third-party sources show, our non-financial

leading indicators are moving in the right direction.

For example, our product value has been

increasing. In the U.S., according to the J.D. Power

and Associates 2005 Automotive Performance,

Execution and Layout (APEAL) Study, a measure of

owners’ delight with the design, content, layout and

performance of their new vehicles, both Nissan and

Infiniti advanced their scores. Nissan maintained a

significant gap against the non-luxury average and

Infiniti moved past the luxury average. In addition,

according to the Automotive Leasing Guide (ALG),

key models for both Nissan and Infiniti are now fully

competitive in their respective segments in terms of

36-month residual value. By model, the Altima has

steadily improved its competitiveness in its segment

and the Infiniti G35 sedan, the G35 coupe, and

the M are competitive against well-established

luxury models.

In China, Teana and Tiida were awarded the Car

of the Year in 2004 and 2005 respectively. In

addition, according to the J.D. Power Asia Pacific

2005 China APEAL Study, the two cars were ranked

at the top in their segments. We also demonstrated

significant improvements in customer service.

According to the J.D. Power Asia Pacific 2005

China Customer Satisfaction Index (CSI) Study,

Nissan was ranked as the top automaker and set a

new benchmark with user-friendly service and

service quality.