Nissan 2006 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2006 Nissan annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Nissan Annual Report 2005 31

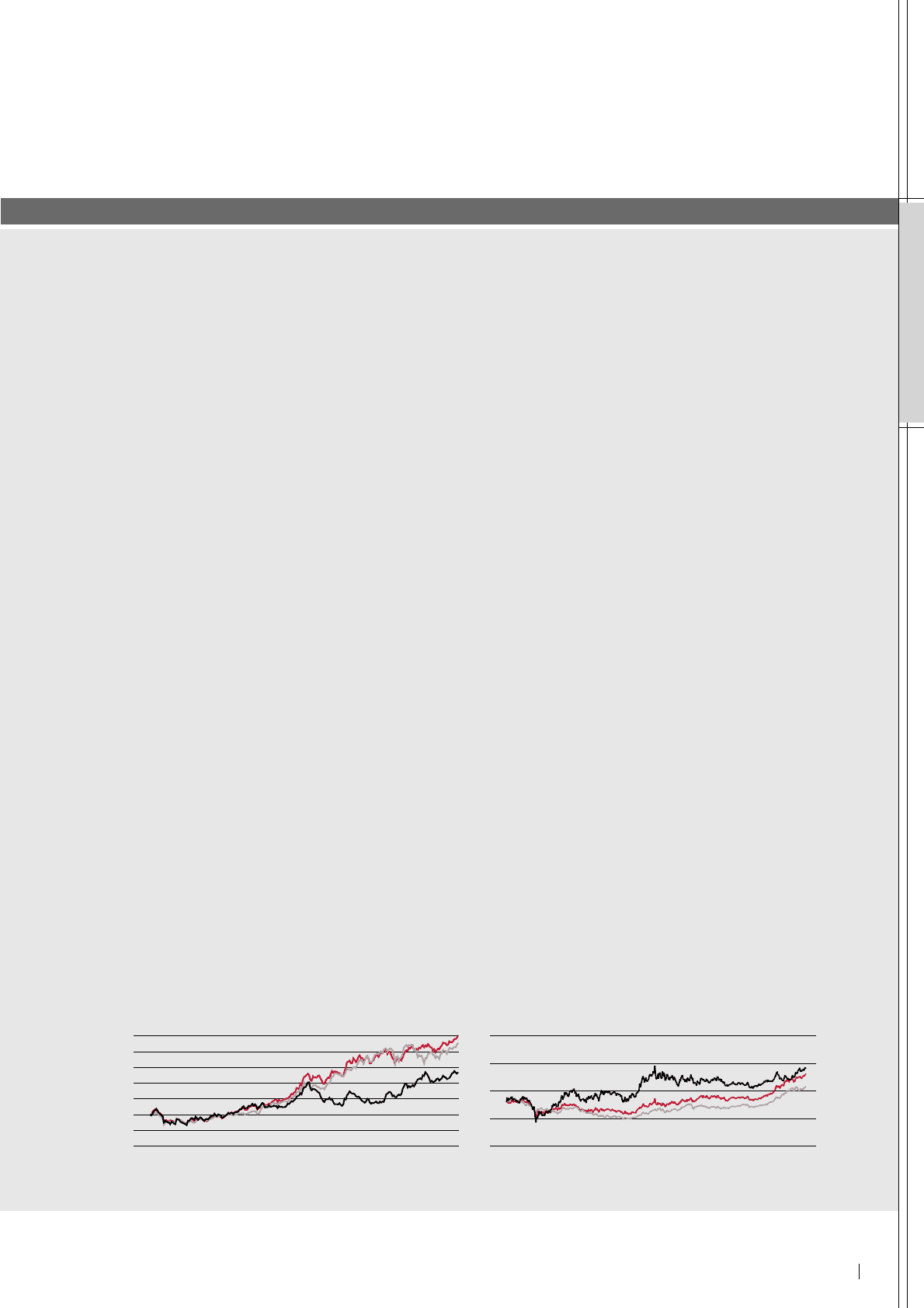

Share performance in fiscal 2005

Nissan’s share price began at ¥1,099 at the end of

fiscal 2004 and ended fiscal 2005 at ¥1,398,

generating a positive return of 27.2 percent. With the

dividend of ¥29, total return to shareholder (TRS) was

a positive return of 29.8 percent. On a market-

adjusted basis, however, our performance was

negative. Since our product cycle was at a low point,

our profit growth has declined. As a result, we assume

that has made investors less confident about our

future. While it is true that our financial result was not

strong enough, there are many activities going

forward which are not reflected in our current result.

In this report, corporate officers explain what actions

Nissan has undertaken and will undertake to ensure

better performance for the future.

Payout Policy

Nissan announced its Nissan Value-Up three-year

dividend policy, covering the period from fiscal 2005

to fiscal 2007, at the annual general meeting of

shareholders on June 23, 2004. Nissan proposes a

long-term dividend policy to give more visibility and

improve transparency into the ways in which Nissan

rewards its shareholders. Nissan believes that a

long-term dividend policy reduces uncertainty for

investors who already own or are considering

acquiring Nissan stock.

IR Activities

Under Nissan Value-Up, the IR team’s performance

will be evaluated based on the price-earnings ratio

(PER) and volatility relative to our major competitors.

PER is used to measure how successfully the IR

team can manage market expectations about Nissan

in order to maintain the Nissan share price close to

an intrinsic value. The other measure, volatility, is

used to measure the risk perceived by investors in

Nissan stock. If Nissan can successfully reduce

volatility, the minimum return required by investors

should decline. The IR team believes that a

strengthening of disclosure activities is required to

improve both measures. The team plans to disclose

not only financial results but also more forward-

looking information about Nissan fundamentals such

as technology and product. Such forward-looking

information helps investors forecast future performance

more precisely and reduces uncertainty about the

future. In addition, our top management team will

increase their availability to communicate directly

with investors. We believe that will further enhance

investor understanding of Nissan’s future strategy.

FISCAL 2005 SHARE PERFORMANCE

DESPITE NISSAN’S RECORD OPERATING RESULT IN FISCAL 2005, ITS MARKET-ADJUSTED STOCK

PERFORMANCE WAS NEGATIVE. THE ROLE OF OUR INVESTOR RELATIONS TEAM IS TO BETTER ADDRESS

THE NEEDS OF INVESTORS AND ENHANCE THEIR UNDERSTANDING OF NISSAN’S PERFORMANCE. WE ARE

COMMITTED TO ENSURING THAT INVESTORS ARE ABLE TO GAIN A MORE IN-DEPTH VIEW OF THE

COMPANY’S OPERATIONS AND PERFORMANCE INDICATORS.

150

140

130

120

110

100

90

80 Apr.

2005 2006

May June July Aug. Sept Oct. Nov Dec. Jan. Feb Mar.

TOPIX Transportation Equipment Index

Nissan

TOPIX

Fiscal 2005 Share Performance

(Index: March 31, 2005=100)

200

150

100

50

0

’02 ’03 ’04 ’05 ’06

TOPIX Transportation Equipment Index

Nissan

TOPIX

Five-Year Share Performance

(Index: March 30, 2001=100)

PERFORMANCE