Nissan 2006 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2006 Nissan annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

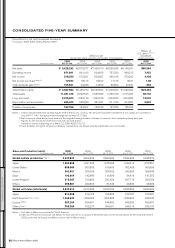

SSaalleess FFiinnaannccee

SALES FINANCE

Nissan Annual Report 2005

52

Supplying Sales Support,

Profits and Solid Customer Connections

Rising interest rates worldwide squeezed

our margins and made the sales finance

business tougher in fiscal 2005. Our overall

profitability was relatively good, however, and

we managed losses and delinquencies very

well. Net loss ratios at our main sales finance

companies in the U.S., Japan, Canada and

Mexico, for example, were among the lowest

in Nissan’s history.

We also had great market penetration. In the U.S.,

Nissan Motor Acceptance Corporation took almost

50 percent of the market. Nissan Financial Services,

Japan had 36 percent, a slight increase over 2004.

Nissan Canada Finance was at 73 percent thanks to

more lease demand. NR Finance Mexico also had

the highest penetration at 34 percent. That’s a 43

percent average, so our contribution to sales was

very high.

Because of this higher penetration and increased

sales, our total assets have grown. Asset-backed

securities represent nearly 50 percent of our finance

funding. They’re an effective, low-cost source of

money, and one we will continue to use. However,

we’ve increased the proportion of funding coming

from commercial paper and corporate bonds in

Japan and the U.S. We are also setting up

commercial paper and bond programs in Mexico.

Basically we’re trying to spread out our funding

and rely less on asset-backed securities and group

financing. Our credit rating has improved in recent

years, and I think we’ll be able to diversify our funding

further once we are officially upgraded from BBB+

to A. The secondary markets already price our bonds

at the A level.

The risk that a sales finance company should pay

is the interest rate risk. This comes from duration

mismatches between assets and liabilities. We aren’t

interested in speculative trading, so we utilize a

natural hedging system that doesn’t involve too many

complicated derivative transactions. Term-match

hedging is the best way to do that.

There is no foreign exchange risk for us from an

asset and liability management standpoint. For

example, all funding for our U.S. finance company

comes from U.S. dollars. Our other entities are

similarly funded through local currency.

Another way we maintain a stable natural hedge

position is to utilize our equity position or cash flow

from our automotive operations. Nissan’s automotive

business has excellent positive cash flow. Of course

the first priority for that money is R&D, capital

expenditure, dividend payments and so on, but we

use some of that excess cash to fund our finance

activities rather than depositing it. If the market

interest rate goes up, the finance company may

suffer from the increase in the cost of funds. The

automotive company simultaneously recognizes

higher interest rate income because it is lending to

the sales finance company.

A finance company is a capital-intensive

business and requires considerable investment,

particularly for IT. One thing we evaluate before

setting up in a country is the minimum annual volume

of contracts necessary to justify the expense. We’ve

just established a finance company in Thailand

JOJI TAGAWA

Corporate Vice President

INVESTMENT FOR THE FUTURE