Nissan 2006 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2006 Nissan annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Nissan Annual Report 2005 53

because we anticipate a significant increase in sales

there, and we are also considering setting one up in

China. Of course a finance company cannot expect

to get 100 percent of the car sales, so we usually

plan for a minimum of 50,000 or 60,000 units in

retail sales, anticipating that we’ll get 30 to 40

percent penetration.

Coordination and cooperation with Renault is

also a major driver for our sales financing business.

Having Nissan and Renault set up an Alliance

finance company to provide financing to our

respective dealers is our favored solution. That is

what we did in Mexico. We rely on the larger sales

company in the country to take the leadership role.

We are currently planning to use the same

method in Korea, where Renault has more sales

volume than Nissan. If Nissan is slightly ahead in

a market and establishes a finance company,

Renault can piggyback on that. That may happen in

Thailand, where Nissan already has a company.

We’re looking at China, Russia and other countries in

which we’ll have the necessary volume and deciding

which company should establish the finance

business. Utilizing Nissan and Renault’s expertise,

people and systems, we have both become much

more powerful.

The sales finance business will also act as a

buffer. The auto industry is cyclical, going up and

down. Nissan’s sales do, too, but the finance portfolio

is usually pretty stable. Once you book a contract,

you have revenue coming in over a three- or five-year

period. If you don’t have a finance company in place,

you’re missing a crucial tool for selling vehicles and

making a profit contribution. If you rely on banks to

finance your sales, you’re just letting them make the

money and providing them with a customer base to

sell their products to.

A finance company is an excellent tool for

marketing and boosting sales, enhancing customer

loyalty and maintaining our customer database. A

dealer may lose track of a customer after selling the

vehicle, but a sales finance company, having a three-

or five-year contract, contacts customers regularly.

You know their living situation and how their income

has changed. We can also offer them future vehicle

contracts, and insurance products, and pursue other

related business.

To me, sales finance mirrors the automotive

business. You could just play in the big markets—the

U.S., Europe and Japan—and ignore the rest. But

everyone expects the volume in the rest of the world

to grow, and sales finance can play an important role

in that growth. We’re not anticipating big initial profits

in China, Thailand and elsewhere. Once the volume

catches up, however, we’ve got a strong chance to

maximize profits on both the automotive side and

financing side.

In April, we formed a virtual organization to

control all of Nissan’s sales finance companies and

work closely with Renault’s sales finance division.

The organization’s head, an American, travels

constantly to ensure that each finance company is

working well. He has six people reporting to him

with plenty of experience in sales finance, including

IS. I’m very pleased to have this organization

overseeing operations.

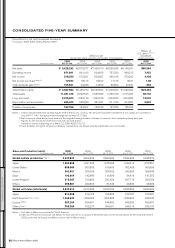

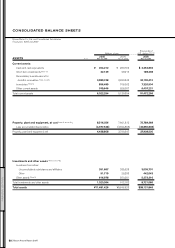

75

60

(%)

(FY)

45

30

15

0’04 ’05 ’04 ’05 ’04 ’05

NFS NMAC NCI

NFS: Nissan Financial Service, sales finance company in Japan

NMAC: Nissan Motor Acceptance Corporation, sales finance company in USA

NCI: Nissan Canada Inc., sales financing division in Canada

Lease

Retail

3%

26%

3%

30%

15% 22%

35% 27%

50%

42%

23%

17%

Penetration

Total funding

amount*

5,447

billion Yen

Equity 7.5%

ABS Off B/S 4.4%

ABS On B/S 39.3%

* (= Total assets – Other liabilities + Off balance sources)

Group Finance 17.8%

S/T Loan 9.2%

L/T Loan 9.8%

Bonds 6.9%

CP 5.1%

Funding Sources

INVESTMENT FOR THE FUTURE