Nissan 2006 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2006 Nissan annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Nissan Annual Report 2005 23

Preparing for Local and Global Growth

THAILAND

In 2005 our profit improved,

but we lost some sales

volume. However, we knew

in 2004 when we took over

Siam Nissan Automobile

Co., Ltd. that 2005 and the

first half of 2006 would

be difficult.

There were several reasons

we didn’t chase volume in

2005. First and foremost, two of our major volume-

selling models, the Pickup and the Sunny, were both

at the end of their model cycle. I also discovered how

poor our sales network was in terms of showroom

quality and the way salespeople and service

technicians handled customers.

An additional problem was that the locations of

our showrooms didn’t match up with where our

customers were living. We found that they had

moved from central Bangkok to the suburbs, but the

company had not done any market analysis for over

ten years and was unaware of that. Chasing volume

under these conditions was more likely to increase

customer dissatisfaction than sales.

The first thing I decided to do was prepare for

new products. I also implemented market

representation activities, particularly for Bangkok.

Bangkok represents half of the total demand in

Thailand, but our sales performance there was quite

weak. We began identifying ideal locations for

showrooms and establishing standards for the

showroom and after-sales service.

Through market representation activities, we

discovered the need to find both new dealer

candidates and current dealers willing to make a

bigger investment. By the end of 2005, we’d added

13 showrooms in Bangkok, and we’ll open up 16

more during 2006. We plan to have 201 showrooms

nationwide by the end of this year, with their facilities

and management elevated to Nissan’s global standard.

Last year was a record for sales in the Thai

market, with a total industry volume of 703,000

vehicles. At the beginning of 2006, the consensus in

the industry was to expect 4 to 5 percent growth.

However, total industry volume has remained virtually

flat. There are three primary reasons. Fuel prices are

high and continue to rise, and interest rates are also

high. Political turmoil is also a factor. The courts

rejected the results of the recent general election, so

Thailand has to go to the polls again. Consumer

confidence has subsequently dropped a bit.

One clear plus for us was the Teana. Just a year

after we introduced it in June 2004, the Teana had

become one of the best sellers among large

passenger cars. Besides being affordable, the

Teana’s fuel consumption makes it attractive in the

fuel crisis. Our previous entry, the Cefiro, had a very

small market presence, but the Teana was

competitive against the segment’s other dominant

models. Since our network was so poor, Teana’s

sales were even more impressive.

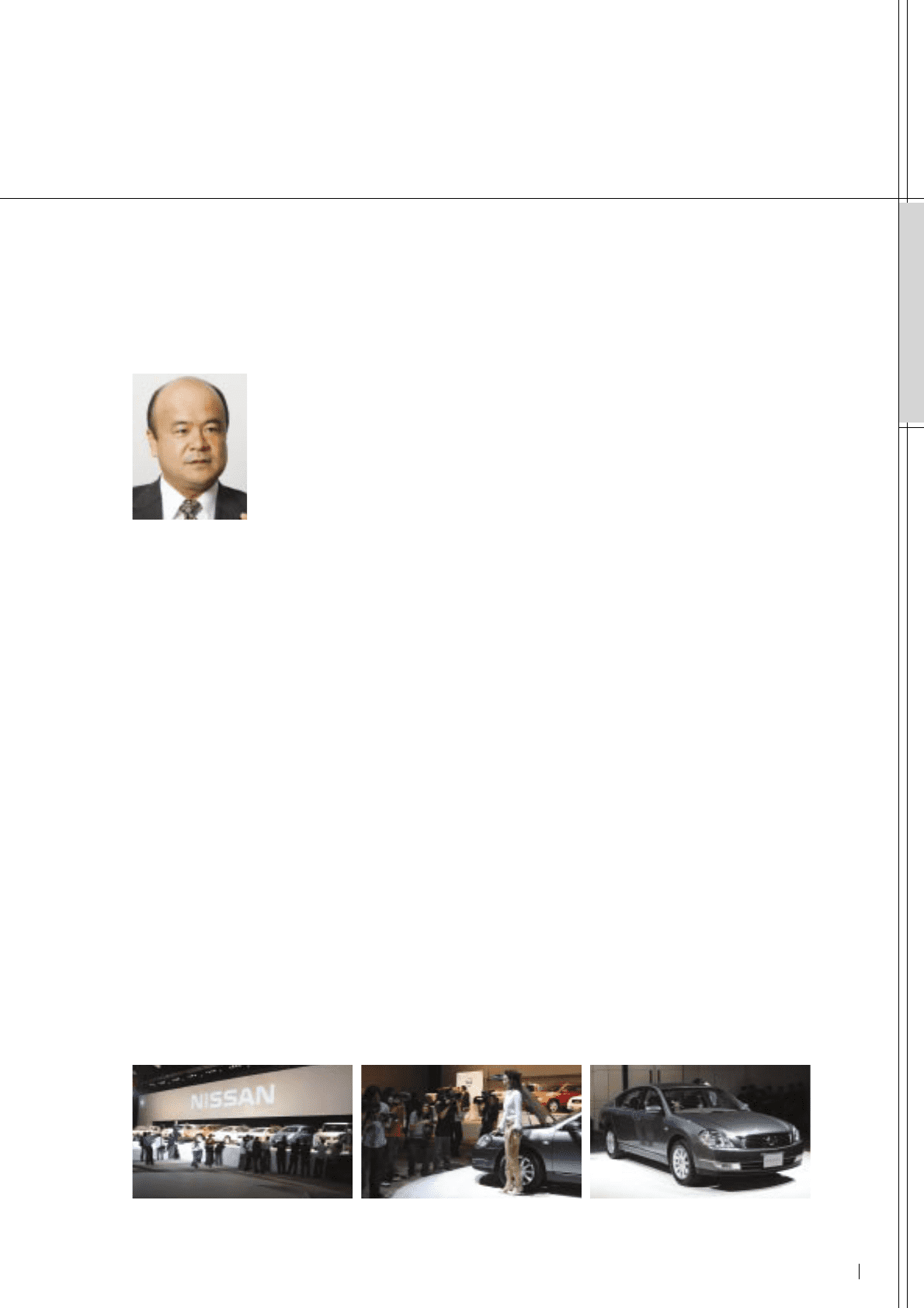

KOSAKU HOSOKAWA

President

Siam Nissan Automobile

Co., Ltd.

GEOGRAPHIC EXPANSION

PERFORMANCE

“Shift_”event in Thailand in May 2006 New Teana in “Shift_”event New Teana