Nissan 2006 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2006 Nissan annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Nissan Annual Report 2005

6

overflowing somewhere, we want to know why. Just

waiting for results is not management—we need to

be proactive. That’s the Nissan Way in action.

In addition to my role and responsibilities as COO,

I serve as the chairman of the GOM countries. I also

oversee quality, human resources, and treasury. My

priority now, however, is the Japanese market. None

of us is satisfied with the results we’re getting.

Although we derive much of our profitability from

overseas, we remain vulnerable to exchange rate

fluctuations, so we still need to deliver solid revenues

from Japan.

Japan’s market remains highly competitive. Since

the early 1990s, total industry volume has gone from

8 million to under 6 million. In this diminishing

market, many manufacturers have maintained

multiple sales channels as a way to try to retain

customers and increase market share.

Nissan had two different sales channels until

2005. Now we sell our entire lineup through both.

This is the right long-term strategy for us, because it

is both customer-driven and profit-driven. However,

we still need to rationalize our dealership network.

Of our 150 dealers and 2500 outlets, 52 are Nissan

subsidiaries representing around 1200 outlets.

Each subsidiary had its own management, business

plan and assets, including non-core assets like

driving schools.

This is clearly inefficient, so in April we separated

the asset management business and the dealer

business. We put all assets—land, buildings and

showrooms—into one new company called Nissan

Network Holdings (NNH). We will close some

unprofitable outlets, but NNH can invest if we

consider one salvageable.

My three strategies for improving profitability in

Japan are to improve the efficiency of our product

range, further strengthen the effectiveness of the

dealer network, and deliver superior customer

satisfaction. Given a choice of profit or volume, we

choose profit.

Providing agile, responsible, and personalized

customer treatment, based on the Nissan Sales and

Service Way, is also essential. We have hundreds of

supervisors observing and giving feedback on how

well our salespeople interact with customers. We

constantly evaluate customer and sales satisfaction

indices and conduct surveys at every outlet. As a

result, our customer satisfaction scores in Japan are

very high.

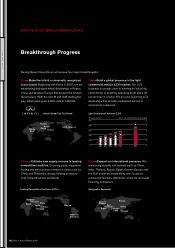

In fiscal 2006, the second year of Nissan Value-

Up, we are focusing on four breakthrough areas

globally: Infiniti, LCVs, geographic expansion, and

sourcing from leading competitive countries. The first

six months will be tough, since we will have fewer

new models. Yet even in this enormously competitive

industry, we are confident that our products,

discipline and customer-driven approach will deliver

profits and sustained value to our shareholders.

Toshiyuki Shiga

Chief Operating Officer