Nissan 2006 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2006 Nissan annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Nissan Annual Report 2005

30

40

50

30

20

10

0’00 ’01 ’02 ’03 ’04 ’05 ’06* ’07*

FY

’99

*Forecast

0

14

24

34

40

78

19

NRP Nissan 180 Nissan

Value-Up

29

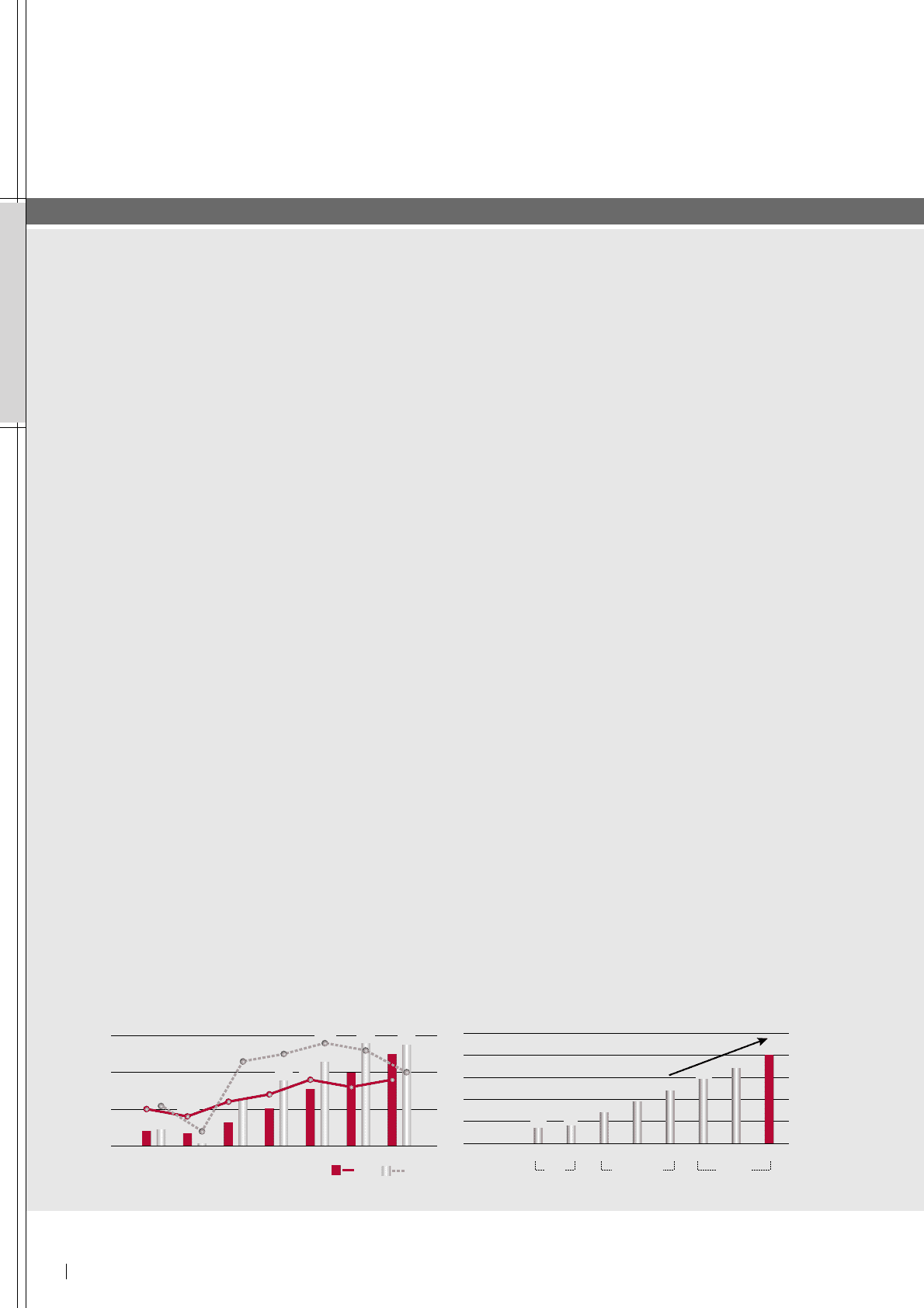

Dividend Policy

(Dividend per share, in yen)

Automotive Net Cash Change

Cash from operations totaled ¥1,106 billion. Despite

a lump-sum contribution of ¥222.2 billion to Nissan

Group pension funds, working capital and proceeds

from asset sales helped to generate free cash flow

of ¥271.3 billion. Cash from financing activities

totaled ¥154.2 billion, including ¥105.7 billion for

dividend payments.

We had a net cash position of ¥372.9 billion at

the close of fiscal 2005, which represented an

improvement of ¥167.1 billion compared to the

beginning of the fiscal year.

Credit Rating

R&I had Nissan’s long-term credit rating listed as A as

of May 16, 2006. S&P upgraded our rating from BBB

to BBB+ on July 20, 2004, and Moody’s upgraded us

from Baa3 to Baa1 on January 29, 2004.

Investment Policy

Capital expenditures decreased by ¥2.5 billion to

¥475 billion, or 5 percent of net revenue. This

included the investment needed to complete the new

Dongfeng Nissan Technical Center. R&D

expenditures increased by ¥49.5 billion to ¥447.6

billion. The funds were used for developing new

technologies and products. Our R&D resources are

focused on projects that will add value for our

customers and deliver an expected return in both the

short and long term.

Dividend

At the annual general meeting of shareholders on

June 27, 2006, the company proposed increasing its

dividend to ¥29 per share in fiscal 2005, up from

¥24 in 2004. In fiscal 2006, the second year of the

Nissan Value-Up dividend policy, the company plans

to increase dividend per share to ¥34. By the end of

Nissan Value-Up in March 2008, Nissan intends to

pay an annual dividend of no less than ¥40 per share.

Return on Invested Capital

Nissan’s investments are made within the strict

guidelines of its automotive operating return on

invested capital (ROIC). Based on these guidelines,

Nissan reached 19.4 percent at the end of fiscal

2005. This is in line with our ROIC commitment to

average 20 percent over the three-year period of

Nissan Value-Up.

Canton plant investment included from fiscal 2001

239244 232

206

262

326

300

378

354

427

398

478

4.0% 3.8%

5.3% 5.5%

5.8%

5.6%

4.2% 4.4%

4.8%

4.6%

448

475

5.0%

4.8%

3.4%

4.1%

500

400

300

200

6

5

4

3

’99 ’00 ’01 ’02 ’03 ’04 ’05

FY

R&D CAPEX

Investment in Our Future

(Billion Yen) (% of net revenue)

PERFORMANCE