NetFlix 2011 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2011 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

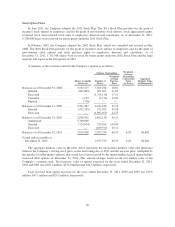

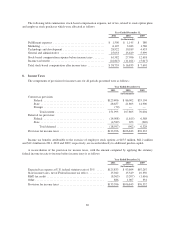

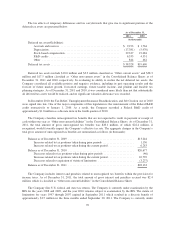

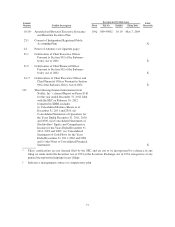

The following table summarizes stock-based compensation expense, net of tax, related to stock option plans

and employee stock purchases which were allocated as follows:

Year Ended December 31,

2011 2010 2009

(in thousands)

Fulfillment expenses .................................... $ 1,500 $ 1,145 $ 380

Marketing ............................................. 6,107 3,043 1,786

Technology and development ............................. 28,922 10,189 4,453

General and administrative ............................... 25,053 13,619 5,999

Stock-based compensation expense before income taxes ........ 61,582 27,996 12,618

Income tax benefit ...................................... (22,847) (11,161) (5,017)

Total stock-based compensation after income taxes ............ $38,735 $ 16,835 $ 7,601

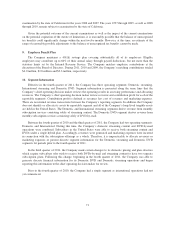

8. Income Taxes

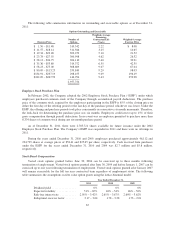

The components of provision for income taxes for all periods presented were as follows:

Year Ended December 31,

2011 2010 2009

(in thousands)

Current tax provision:

Federal .......................................... $123,406 $ 86,002 $55,104

State ............................................ 28,657 21,803 14,900

Foreign .......................................... (70) — —

Total current .................................. 151,993 107,805 70,004

Deferred tax provision:

Federal .......................................... (14,008) (1,615) 6,568

State ............................................ (4,589) 653 (240)

Total deferred ................................. (18,597) (962) 6,328

Provision for income taxes ............................... $133,396 $106,843 $76,332

Income tax benefits attributable to the exercise of employee stock options at $45.5 million, $62.2 million

and $12.4 million in 2011, 2010 and 2009, respectively, are recorded directly to additional paid-in-capital.

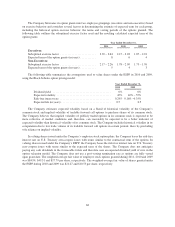

A reconciliation of the provision for income taxes, with the amount computed by applying the statutory

federal income tax rate to income before income taxes is as follows:

Year Ended December 31,

2011 2010 2009

(in thousands)

Expected tax expense at U.S. federal statutory rate of 35% ..... $125,833 $ 93,694 $67,267

State income taxes, net of Federal income tax effect ........... 15,042 15,349 10,350

R&D tax credit ........................................ (8,365) (3,207) (1,616)

Other ................................................ 886 1,007 331

Provision for income taxes ............................... $133,396 $106,843 $76,332

69