NetFlix 2011 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2011 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

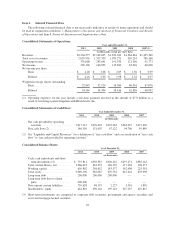

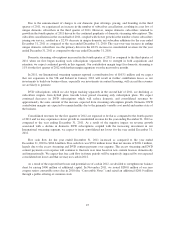

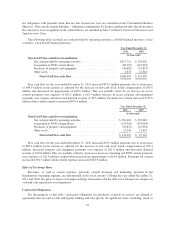

Year ended December 31, Change

2010 2009 2010 vs. 2009

(in thousands, except percentages)

Cost of subscription ............................... $1,154,109 $ 909,461 26.9%

Fulfillment expenses .............................. 203,246 169,810 19.7%

Total cost of revenues ......................... $1,357,355 $1,079,271 25.8%

As a percentage of revenues ........................ 62.8% 64.6%

The $278.1 million increase in cost of revenues was due to the following factors:

• Content acquisition and licensing expenses increased by $165.9 million. This increase was primarily

attributable to investments in streaming content, partially offset by decreases in DVD content

acquisitions.

• Content delivery expenses increased $78.7 million primarily due to a 9.7% increase in the number of

DVDs mailed to paying subscribers. The increase in the number of DVDs mailed was driven by a 40.9%

increase in the domestic average number of paying subscribers, partially offset by a 21.6% decline in

monthly DVD rentals per average paying DVD subscriber primarily attributed to the growing popularity

of our lower priced plans and growth in streaming. In addition, content delivery expenses increased due

to higher costs associated with our use of third-party delivery networks resulting from an increase in the

total number of hours of streaming content viewed by our subscribers.

• Fulfillment costs associated with content processing and customer service centers expenses increased

$13.5 million primarily due to a $12.4 million increase in personnel costs resulting from a 10.0%

increase in headcount to support the higher volume of content delivery and growth in subscribers. In

addition, encoding costs increased $7.0 million in support of the increasing number of titles and

platforms offered for streaming content. These increases were partially offset by a $4.7 million increase

in costs related to free-trials allocated to marketing due primarily to the 74.7% increase in gross

subscriber additions.

• Credit card fees increased $20.0 million as a result of the 29.5% growth in revenues.

Operating Expenses

Marketing

Marketing expenses consist primarily of advertising expenses and also include payments made to our

affiliates and consumer electronics partners and payroll related expenses. Advertising expenses include

promotional activities such as television and online advertising, as well as allocated costs of revenues relating to

free trial periods. Payments to our affiliates and consumer electronics partners may be in the form of a fixed-fee

or may be a revenue sharing payment.

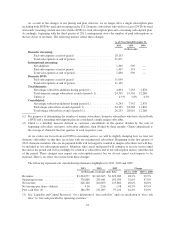

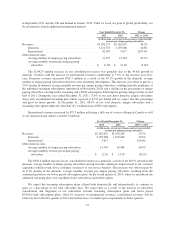

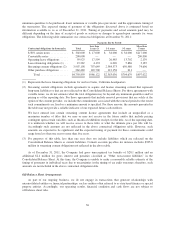

Year ended December 31, Change

2011 2010 2011 vs. 2010

(in thousands, except percentages and

subscriber acquisition cost)

Marketing .................................... $402,638 $293,839 37.0%

As a percentage of revenues .................. 12.6% 13.6%

Other domestic data:

Gross unique subscriber additions ............. 21,544 15,648 37.7%

Subscriber acquisition cost ................... $ 15.04 $ 18.21 (17.4)%

The $108.8 million increase in marketing expenses was primarily attributable to a $119.6 million increase in

marketing program spending, attributable to increased spending in television, radio and online advertising

29