NetFlix 2011 Annual Report Download - page 62

Download and view the complete annual report

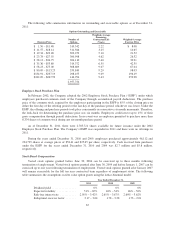

Please find page 62 of the 2011 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.4. Long-term Debt

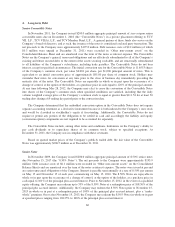

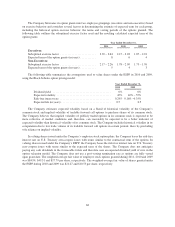

Senior Convertible Notes

In November 2011, the Company issued $200.0 million aggregate principal amount of zero coupon senior

convertible notes due on December 1, 2018 (the “Convertible Notes”) in a private placement offering to TCV

VII, L.P., TCV VII(A), L.P., and TCV Member Fund, L.P.,. A general partner of these funds also serves on the

Company’s board of directors, and as such, the issuance of the notes is considered a related party transaction. The

net proceeds to the Company were approximately $197.8 million. Debt issuance costs of $2.2 million (of which

$0.3 million were unpaid at December 31, 2011) were recorded in “Other non-current assets” on the

Consolidated Balance Sheet and are amortized over the term of the notes as interest expense. The Convertible

Notes are the Company’s general, unsecured obligations and are effectively subordinated to all of the Company’s

existing and future secured debt, to the extent of the assets securing such debt, and are structurally subordinated

to all liabilities of the Company’s subsidiaries, including trade payables. The Convertible Notes do not bear

interest, except in specified circumstances. The initial conversion rate for the Convertible Notes is 11.6553 shares

of the Company’s common stock, par value $0.001 per share, per $1,000 principal amount of notes. This is

equivalent to an initial conversion price of approximately $85.80 per share of common stock. Holders may

surrender their notes for conversion at any time prior to the close of business day immediately preceding the

maturity date of the notes. The Convertible Notes are repayable in whole or in part upon the occurrence of a

change of control, at the option of the holders, at a purchase price in cash equal to 120% of the principal amount.

At any time following May 28, 2012, the Company may elect to cause the conversion of the Convertible Notes

into shares of the Company’s common stock when specified conditions are satisfied, including that the daily

volume weighted average price of the Company’s common stock is equal or greater than $111.54 for at least 50

trading days during a 65 trading day period prior to the conversion date.

The Company determined that the embedded conversion option in the Convertible Notes does not require

separate accounting treatment as a derivative instrument because it is both indexed to the Company’s own stock

and would be classified in stockholder’s equity if freestanding. Additionally, the Convertible Notes do not

require or permit any portion of the obligation to be settled in cash and accordingly the liability and equity

(conversion option) components are not required to be accounted for separately.

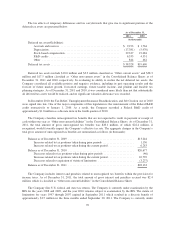

The Convertible Notes include, among other terms and conditions, limitations on the Company’s ability to

pay cash dividends or to repurchase shares of its common stock, subject to specified exceptions. At

December 31, 2011, the Company was in compliance with these covenants.

Based on quoted market prices of the Company’s publicly traded debt, the fair value of the Convertible

Notes was approximately $206.5 million as of December 31, 2011.

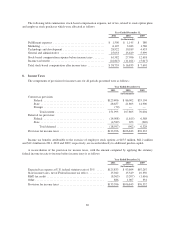

Senior Notes

In November 2009, the Company issued $200.0 million aggregate principal amount of 8.50% senior notes

due November 15, 2017 (the “8.50% Notes”). The net proceeds to the Company were approximately $193.9

million. Debt issuance costs of $6.1 million were recorded in “Other non-current assets” on the Consolidated

Balance Sheets and are amortized over the term of the notes as interest expense. The notes were issued at par and

are senior unsecured obligations of the Company. Interest is payable semi-annually at a rate of 8.50% per annum

on May 15 and November 15 of each year, commencing on May 15, 2010. The 8.50% Notes are repayable in

whole or in part upon the occurrence of a change of control, at the option of the holders, at a purchase price in

cash equal to 101% of the principal plus accrued interest. Prior to November 15, 2012, in the event of a qualified

equity offering, the Company may redeem up to 35% of the 8.50% Notes at a redemption price of 108.50% of the

principal plus accrued interest. Additionally, the Company may redeem the 8.50% Notes prior to November 15,

2013 in whole or in part at a redemption price of 100% of the principal plus accrued interest, plus a “make-

whole” premium. On or after November 15, 2013, the Company may redeem the 8.50% Notes in whole or in part

at specified prices ranging from 104.25% to 100% of the principal plus accrued interest.

60