NetFlix 2011 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2011 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

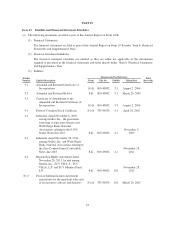

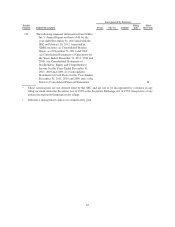

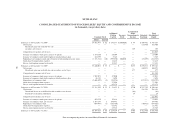

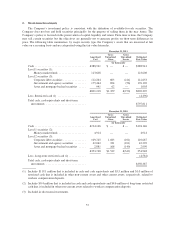

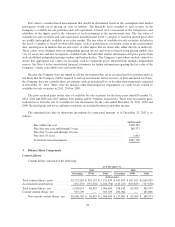

NETFLIX, INC.

CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY AND COMPREHENSIVE INCOME

(in thousands, except share data)

Common Stock

Additional

Paid-in

Capital

Treasury

Stock

Accumulated

Other

Comprehensive

Income

Retained

Earnings

Total

Stockholders’

Equity

Shares Amount

Balances as of December 31, 2008 .............................................. 58,862,478 $ 62 $ 338,577 $(100,020) $ 84 $ 108,452 $ 347,155

Net income ............................................................... — — — — — 115,860 115,860

Unrealized gains on available-for-sale ........................................

securities, net of taxes .................................................... — — — — 189 — 189

Comprehensive income, net of taxes ........................................... — — — — — — 116,049

Issuance of common stock upon exercise of options ............................... 1,724,110 1 29,508 — — — 29,509

Issuance of common stock under employee stock purchase plan ..................... 224,799 — 5,765 — — — 5,765

Repurchases of common stock and retirement of outstanding treasury stock ............ (7,371,314) (10) (398,850) 100,020 — (25,495) (324,335)

Stock-based compensation expense ............................................ — — 12,618 — — — 12,618

Excess stock option income tax benefits ........................................ — — 12,382 — — — 12,382

Balances as of December 31, 2009 .............................................. 53,440,073 $ 53 $ — $ — $273 $ 198,817 $ 199,143

Net income ............................................................... — — — — — 160,853 160,853

Unrealized gains on available-for-sale securities, net of taxes ..................... — — — — 477 — 477

Comprehensive income, net of taxes ........................................... — — — — — — 161,330

Issuance of common stock upon exercise of options ............................... 1,902,073 2 47,080 — — — 47,082

Issuance of common stock under employee stock purchase plan ..................... 46,112 — 2,694 — — — 2,694

Repurchases of common stock ............................................... (2,606,309) (2) (88,326) — — (121,931) (210,259)

Stock-based compensation expense ............................................ — — 27,996 — — — 27,996

Excess stock option income tax benefits ........................................ — — 62,178 — — — 62,178

Balances as of December 31, 2010 .............................................. 52,781,949 $ 53 $ 51,622 $ — $750 $ 237,739 $ 290,164

Net income ............................................................... — — — — — 226,126 226,126

Unrealized losses on available-for-sale securities, net of taxes ..................... — — — — (68) — (68)

Cumulative translation adjustment .......................................... 24 24

Comprehensive income, net of taxes ........................................... — — — — — — 226,082

Issuance of common stock upon exercise of options ............................... 659,370 — 19,614 — — — 19,614

Issuance of common stock, net of costs ......................................... 2,857,143 3 199,483 — — — 199,486

Repurchases of common stock ............................................... (899,847) (1) (158,730) — — (40,935) (199,666)

Stock-based compensation expense ............................................ — — 61,582 — — — 61,582

Excess stock option income tax benefits ........................................ — — 45,548 — — — 45,548

Balances as of December 31, 2011 .............................................. 55,398,615 $ 55 $ 219,119 $ — $706 $ 422,930 $ 642,810

See accompanying notes to consolidated financial statements.

50