NetFlix 2011 Annual Report Download - page 27

Download and view the complete annual report

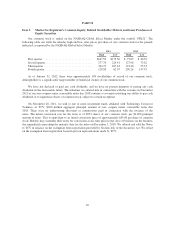

Please find page 27 of the 2011 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Due to the announcement of changes to our domestic plan offerings, pricing, and branding in the third

quarter of 2011, we experienced an increase in the number of subscriber cancellations, resulting in a net loss of

unique domestic subscribers in the third quarter of 2011. However, unique domestic subscribers returned to

growth in the fourth quarter of 2011 driven by the continued popularity of domestic streaming subscriptions. The

subscriber cancellations in the second half of 2011, coupled with slower growth in the number of new subscribers

joining our service, resulted in a 32.3% decrease in unique domestic net subscriber additions for the year ended

December 31, 2011 as compared to the year ended December 31, 2010. The year-over-year increase in ending

unique domestic subscribers was the primary driver in the 48.2% increase in consolidated revenues for the year

ended December 31, 2011 as compared to the year ended December 31, 2010.

Domestic streaming subscriptions increased in the fourth quarter of 2011 as compared to the third quarter of

2011 when we first began tracking such subscriptions separately. Due to strength in both acquisitions and

retention, we expect continued growth in this segment. Our contribution margin target for domestic streaming is

11% for the first quarter of 2012 with further margin expansion over the next twelve months.

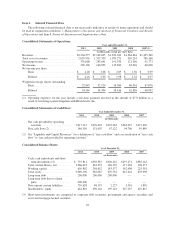

In 2011, our International streaming segment reported a contribution loss of $103.1 million and we expect

that our expansion to the UK and Ireland in January 2012 will result in further contribution losses as our

investments to build our business there, especially our investments in content licensing, will exceed the revenues

we are likely to generate.

DVD subscriptions, which we also began tracking separately in the second half of 2011, are declining as

subscribers migrate from hybrid plans towards lower priced streaming only subscription plans. We expect

continued decreases in DVD subscriptions which will reduce domestic and consolidated revenues by

approximately the same amount of the increase expected from streaming subscription growth. Domestic DVD

contribution margins are expected to remain healthy due to the primarily variable cost model and mature state of

the business.

Consolidated revenues for the first quarter of 2012 are expected to be flat as compared to the fourth quarter

of 2011 and we may experience slower growth in consolidated revenue for the year ending December 31, 2012 as

compared to the year ending December 31, 2011. As a result of the negative impact on revenue growth

associated with a decline in domestic DVD subscriptions coupled with the increasing investment in our

International streaming segment, we expect to incur consolidated net losses for the year ended December 31,

2012.

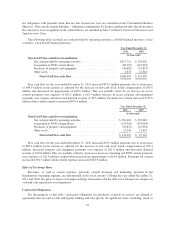

Free cash flow for the year ended December 31, 2011 increased as compared to the year ended

December 31, 2010 to $186.6 million. Free cash flow was $39.6 million lower than net income of $226.1 million,

largely due to the excess streaming and DVD content payments over expense. The excess streaming and DVD

content payments over expense will continue to fluctuate over time based on new content licenses domestically

and internationally. We expect that free cash flow in future periods will be negatively impacted by our expected

consolidated net losses and that we may use cash in 2012.

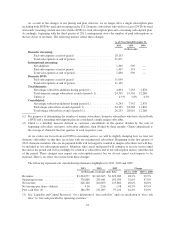

As a result of the expected net losses and potential use of cash in 2012, we decided to strengthen our balance

sheet by raising $400 million of additional capital. In November 2011, we issued $200.0 million of our zero

coupon senior convertible notes due in 2018 (the “Convertible Notes”) and raised an additional $200.0 million

through a public offering of common stock.

25