NetFlix 2011 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2011 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

and short-term investments in a variety of securities. These securities are classified as available-for-sale and are

recorded at fair value with unrealized gains and losses, net of tax, included in “Accumulated other

comprehensive income” within stockholders equity in the Consolidated Balance Sheets.

For the year ended December 31, 2011, we had no material impairment charges associated with our short-

term investment portfolio. Although we believe our current investment portfolio has very little risk of material

impairment, we cannot predict future market conditions or market liquidity and can provide no assurance that our

investment portfolio will remain materially unimpaired. Some of the securities we invest in may be subject to

market risk due to changes in prevailing interest rates which may cause the principal amount of the investment to

fluctuate. For example, if we hold a security that was issued with a fixed interest rate at the then-prevailing rate

and the prevailing interest rate later rises, the value of our investment will decline. At December 31, 2011, our

cash equivalents were generally invested in money market funds, which are not subject to market risk because

the interest paid on such funds fluctuates with the prevailing interest rate. Our short-term investments were

comprised of corporate debt securities, government and agency securities and asset and mortgage-backed

securities.

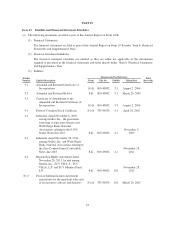

As of December 31, 2011, we had securities classified as short-term investments of $289.8 million. Changes

in interest rates could adversely affect the market value of these investments. The table below separates these

investments, based on stated maturities, to show the approximate exposure to interest rates.

(in thousands)

Due within one year .............................................. $108,382

Due within five years ............................................. 180,373

Due within ten years ............................................. —

Due after ten years ............................................... 1,003

Total .......................................................... $289,758

A sensitivity analysis was performed on our investment portfolio as of December 31, 2011. The analysis is

based on an estimate of the hypothetical changes in market value of the portfolio that would result from an

immediate parallel shift in the yield curve of various magnitudes. This methodology assumes a more immediate

change in interest rates to reflect the current economic environment.

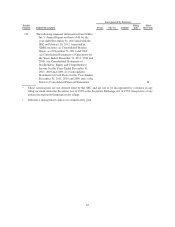

The following table presents the hypothetical fair values (in $ thousands) of our debt securities classified as

short-term investments assuming immediate parallel shifts in the yield curve of 50 basis points (“BPS”), 100 BPS

and 150 BPS. The analysis is shown as of December 31, 2011:

Fair Value December 31, 2011

(in thousands)

-150 BPS -100 BPS -50 BPS +50 BPS +100 BPS +150 BPS

$295,788 $293,778 $291,768 $287,747 $285,737 $283,727

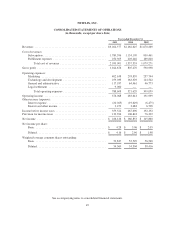

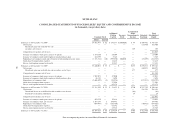

Item 8. Financial Statements and Supplementary Data

The consolidated financial statements and accompanying notes listed in Part IV, Item 15(a)(1) of this

Annual Report on Form 10-K are included elsewhere in this Annual Report on Form 10-K.

Item 9. Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

None.

40