NetFlix 2011 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2011 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

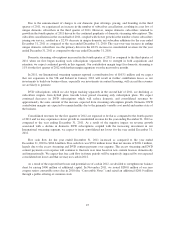

in September 2011 and the UK and Ireland in January 2012. Until we reach our goal of global profitability, we

do not intend to launch additional international markets.

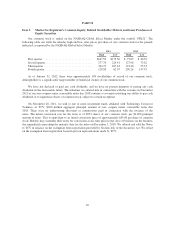

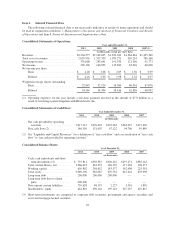

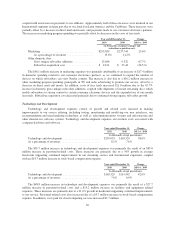

Year Ended December 31, Change

2011 2010 2011 vs. 2010

(in thousands, except percentages and average monthly

revenue per unique paying subscriber)

Revenues .......................................... $3,204,577 $2,162,625 48.2%

Domestic ...................................... 3,121,727 2,159,008 44.6%

International ................................... 82,850 3,617 2190.6%

Other domestic data:

Average number of unique paying subscribers ......... 21,977 14,744 49.1%

Average monthly revenue per unique paying

subscriber ................................... $ 11.84 $ 12.20 (3.0)%

The $1,042.0 million increase in our consolidated revenues was primarily due to the 44.6% growth in

domestic revenues with the increase in international revenues contributing to 7.6% of the increase year-over-

year. Domestic revenues increased $962.7 million as a result of the 49.1% growth in the domestic average

number of unique paying subscribers driven by new streaming subscriptions. This increase was offset in part by a

3.0% decline in domestic average monthly revenue per unique paying subscriber, resulting from the popularity of

the unlimited streaming subscription (introduced in November 2010) and a decline in the percentage of unique

paying subscribers electing both a streaming and a DVD subscription following the pricing changes in the second

half of 2011. During the year ended December 31, 2011, 73.6% of our new gross domestic unique subscribers

chose only an unlimited streaming plan which is priced at $7.99 per month and we expect that this percentage

will grow in future periods. At December 31, 2011, 88.9% of our total domestic unique subscribers had a

streaming subscription while less than half (11.1 million) had a DVD subscription.

International revenues increased by $79.2 million reflecting a full year of service offering in Canada as well

as our launch in Latin America and the Caribbean.

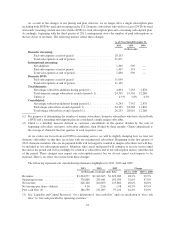

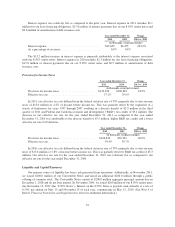

Year Ended December 31, Change

2010 2009 2010 vs. 2009

(in thousands, except percentages and average monthly

revenue per unique paying subscriber)

Revenues ........................................ $2,162,625 $1,670,269 29.5%

Domestic .................................... 2,159,008 1,670,269 29.3%

International .................................. 3,617 — 100.0%

Other domestic data:

Average number of unique paying subscribers ....... 14,744 10,464 40.9%

Average monthly revenue per unique paying

subscriber .................................. $ 12.20 $ 13.30 (8.3)%

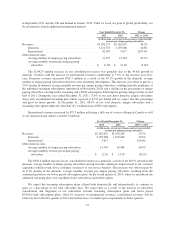

The $492.4 million increase in our consolidated revenues was primarily a result of the 40.9% growth in the

domestic average number of unique paying subscribers arising from the continuous improvement to our customer

experience which in turn, drove consumer awareness of our service benefits. This increase was offset in part by

an 8.3% decline in the domestic average monthly revenue per unique paying subscriber, resulting from the

continued growth in our lower priced subscription plans. In the fourth quarter of 2010, when we introduced the

unlimited streaming plan, over one-third of new subscribers elected this option.

We expect the streaming subscription plans offered both domestically and internationally to continue to

grow as a percentage of our total subscriber base. We expect that as a result of the increase in subscriber

cancellations and migration of our subscribers towards streaming subscription plans and lower priced

DVD-by-mail subscription plans, offset by increases in international revenues, consolidated revenues will be

relatively flat in the first quarter of 2012 and will increase at a modest pace sequentially in future quarters.

27