NetFlix 2011 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2011 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Our primary uses of cash included the acquisition and licensing of content, content delivery expenses,

marketing, our stock repurchase programs, payroll related expenses, and capital expenditures related to

information technology and automation equipment. We expect to continue to make significant investments to

license streaming content both domestically and internationally. These investments could impact our liquidity

and in particular our operating cash flows.

As a result of the significant increase in subscriber cancellations negatively impacting domestic and

consolidated revenues, coupled with increased investments in our International streaming segment, and in

international content in particular, we expect consolidated net losses and negative operating cash flows for 2012.

Although we currently anticipate that our available funds will be sufficient to meet our cash needs for the

foreseeable future, we may be required or choose to obtain additional financing. Our ability to obtain additional

financing will depend on, among other things, our development efforts, business plans, operating performance,

current and projected compliance with our debt covenants, and the condition of the capital markets at the time we

seek financing. We may not be able to obtain such financing on terms acceptable to us or at all. If we raise

additional funds through the issuance of equity, equity-linked or debt securities, those securities may have rights,

preferences or privileges senior to the rights of our common stock, and our stockholders may experience dilution.

On June 11, 2010, we announced that our Board of Directors authorized a stock repurchase program

allowing us to repurchase $300 million of our common stock through the end of 2012. As of December 31, 2011,

$41.0 million of this authorization is remaining. The timing and actual number of shares repurchased will depend

on various factors, including price, corporate and regulatory requirements, debt covenant requirements,

alternative investment opportunities and other market conditions. As we expect to have negative operating cash

flows in future periods, we do not expect to make further stock repurchases for the foreseeable future.

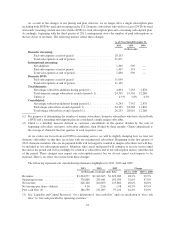

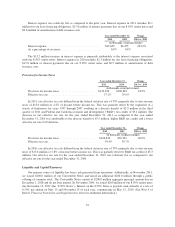

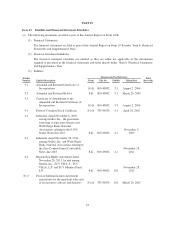

The following highlights selected measures of our liquidity and capital resources as of December 31, 2011,

2010 and 2009:

Year Ended December 31, Change

2011 2010 2011 vs. 2010

(in thousands, except percentages)

Cash and cash equivalents ........................... $508,053 $ 194,499 161.2%

Short-term investments .............................. 289,758 155,888 85.9 %

$ 797,811 $ 350,387 127.7 %

Net cash provided by operating activities ............... $317,712 $ 276,401 14.9 %

Net cash used in investing activities .................... $(265,814) $(116,081) 129.0%

Net cash provided by (used in) financing activities ........ $261,656 $(100,045) (361.5)%

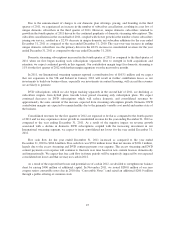

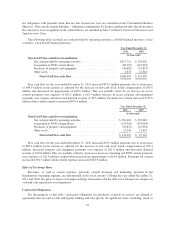

Cash provided by operating activities increased $41.3 million or 14.9%, primarily due to an increase

subscription revenues of $1,042.0 million or 48.2%. This increase was partially offset by increased payments for

content acquisition and licensing other than DVD library of $766.3 million or 138.4%. Operating cash flows

were further impacted by increases in payroll expenses and payments for advertising and affiliates transactions.

Cash used in investing activities increased $149.7 million or 129.0%, primarily due to a $164.0 million

increase in the purchases, net of proceeds from sales and maturities, of short-term investments. In addition,

purchases of property and equipment increased $15.8 million primarily due to purchases of automation

equipment for our various DVD shipping centers. These increases were partially offset by a $38.7 million

decrease in acquisitions of DVD content library.

Cash provided by financing activities increased $361.7 million or 361.5%, primarily due to our public

offering of 2.9 million shares of common stock for net proceeds of $199.9 million and $198.1 million net

proceeds received from the issuance of our Convertible Notes in the fourth quarter of 2011. In addition,

33