NetFlix 2011 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2011 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of

Equity Securities

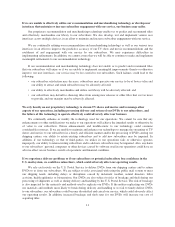

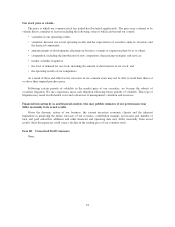

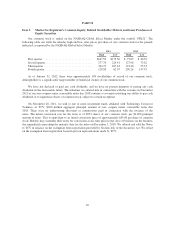

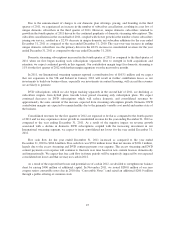

Our common stock is traded on the NASDAQ Global Select Market under the symbol “NFLX”. The

following table sets forth the intraday high and low sales prices per share of our common stock for the periods

indicated, as reported by the NASDAQ Global Select Market.

2011 2010

High Low High Low

First quarter ................................... $247.55 $173.50 $ 75.65 $ 48.52

Second quarter ................................. 277.70 224.41 127.96 73.62

Third quarter .................................. 304.79 107.63 174.40 95.33

Fourth quarter ................................. 128.50 62.37 209.24 147.35

As of January 31, 2012, there were approximately 198 stockholders of record of our common stock,

although there is a significantly larger number of beneficial owners of our common stock.

We have not declared or paid any cash dividends, and we have no present intention of paying any cash

dividends in the foreseeable future. The indenture we entered into in connection with the issuance in November

2011 of our zero coupon senior convertible notes due 2018 contains a covenant restricting our ability to pay cash

dividends or to repurchase shares of common stock, subject to certain exceptions.

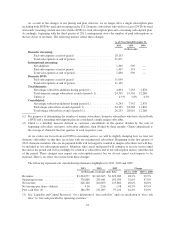

On November 28, 2011, we sold to one or more investment funds affiliated with Technology Crossover

Ventures, or TCV, $200 million aggregate principal amount of zero coupon senior convertible notes due

2018. There were no underwriting discounts or commissions paid in connection with the issuance of the

notes. The initial conversion rate for the notes is 11.6553 shares of our common stock, per $1,000 principal

amount of notes. This is equivalent to an initial conversion price of approximately $85.80 per share of common

stock. Holders may surrender their notes for conversion at any time prior to the close of business on the business

day immediately preceding the maturity date for the notes on December 1, 2018. We offered and sold the Notes

to TCV in reliance on the exemption from registration provided by Section 4(2) of the Securities Act. We relied

on the exemption from registration based in part on representations made by TCV.

20