NetFlix 2011 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2011 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

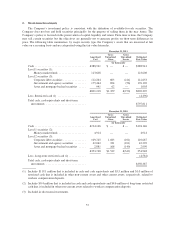

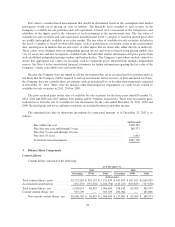

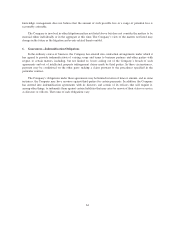

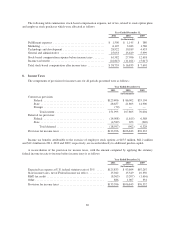

Consolidated Balance Sheet. The remaining future minimum payments under the lease financing obligation are

$19.3 million. The lease financing obligation balance at the end of the extended lease term will be approximately

$25.8 million which approximates the net book value of the buildings to be relinquished to the lessor.

Future minimum payments under lease financing obligations and non-cancelable operating leases as of

December 31, 2011 are as follows:

Year Ending December 31,

Future

Minimum

Payments

(in thousands)

2012 .......................................................... $21,773

2013 .......................................................... 18,310

2014 .......................................................... 14,195

2015 .......................................................... 11,008

2016 .......................................................... 8,580

Thereafter ...................................................... 5,326

Total minimum payments ......................................... $79,192

Rent expense associated with the operating leases was $16.9 million, $14.9 million and $14.5 million for the

years ended December 31, 2011, 2010 and 2009, respectively.

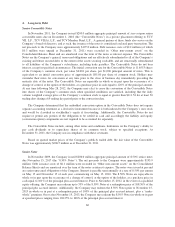

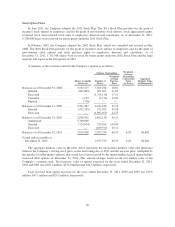

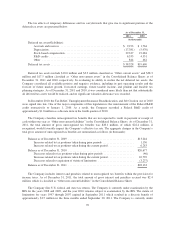

Streaming Content

The Company had $3.91 billion and $1.12 billion of obligations at December 31, 2011 and December 31,

2010, respectively, including agreements to acquire and license streaming content that represent long-term

liabilities or that are not reflected on the Consolidated Balance Sheets because they do not meet content library

asset recognition criteria. The license agreements do not meet content library asset recognition criteria because

either the fee is not known or reasonably determinable for a specific title or it is known but the title is not yet

available for streaming to subscribers. For those agreements with variable terms, the Company does not estimate

what the total obligation may be beyond any minimum quantities and/or pricing as of the reporting date. For

those agreements that include renewal provisions that are solely at the option of the content provider, the

Company includes the commitments associated with the renewal period to the extent such commitments are fixed

or a minimum amount is specified.

The expected timing of payments as of December 31, 2011 for these commitments is as follows:

(in thousands)

Less than one year ............................................... $ 797,649

Due after one year and through 3 years ............................... 2,384,373

Due after 3 years and through 5 years ................................ 650,480

Due after 5 years ................................................ 74,696

Total streaming content obligations .................................. $3,907,198

The Company has entered into certain license agreements that include an unspecified or a maximum number

of titles that the Company may or may not receive in the future and /or that include pricing contingent upon

certain variables, such as theatrical exhibition receipts for the title. As of the reporting date, it is unknown

whether the Company will receive access to these titles or what the ultimate price per title will be. Accordingly,

such amounts are not reflected in the commitments described above. However such amounts are expected to be

significant and the expected timing of payments could range from less than one year to more than five years.

62