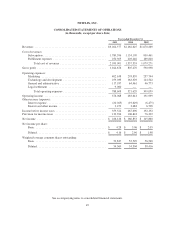

NetFlix 2011 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2011 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

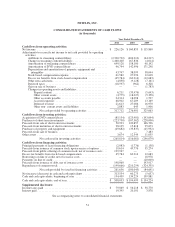

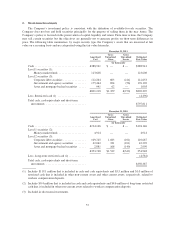

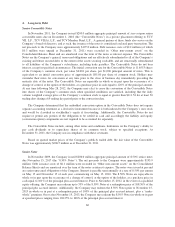

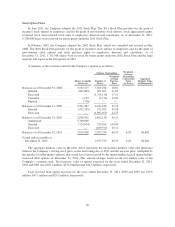

2. Short-term Investments

The Company’s investment policy is consistent with the definition of available-for-sale securities. The

Company does not buy and hold securities principally for the purpose of selling them in the near future. The

Company’s policy is focused on the preservation of capital, liquidity and return. From time to time, the Company

may sell certain securities but the objectives are generally not to generate profits on short-term differences in

price. The following table summarizes, by major security type, the Company’s assets that are measured at fair

value on a recurring basis and are categorized using the fair value hierarchy.

December 31, 2011

Amortized

Cost

Gross

Unrealized

Gains

Gross

Unrealized

Losses

Estimated

Fair Value

(in thousands)

Cash .................................... $388,941 $ — $ — $388,941

Level 1 securities (1):

Money market funds ................... 123,608 — — 123,608

Level 2 securities (3):

Corporate debt securities ................ 112,264 603 (214) 112,653

Government and agency securities ........ 175,464 694 (56) 176,102

Asset and mortgage-backed securities ..... 941 62 — 1,003

$801,218 $1,359 $(270) $802,307

Less: Restricted cash (1) .................... (4,496)

Total cash, cash equivalents and short-term

investments ............................ $797,811

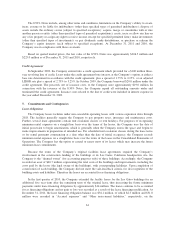

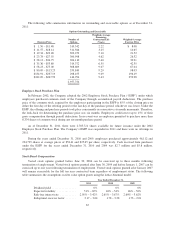

December 31, 2010

Amortized

Cost

Gross

Unrealized

Gains

Gross

Unrealized

Losses

Estimated

Fair Value

(in thousands)

Cash .................................... $194,146 $ — $ — $194,146

Level 1 securities (2):

Money market funds ................... 4,914 — — 4,914

Level 2 securities (3):

Corporate debt securities ................ 109,745 1,043 (101) 110,687

Government and agency securities ........ 42,062 331 (101) 42,292

Asset and mortgage-backed securities ..... 2,881 168 (140) 2,909

$353,748 $1,542 $(342) 354,948

Less: Long-term restricted cash (2) ............ (4,561)

Total cash, cash equivalents and short-term

investments ............................ $350,387

(1) Includes $119.1 million that is included in cash and cash equivalents and $3.5 million and $1.0 million of

restricted cash that is included in other non-current assets and other current assets, respectively, related to

workers compensation deposits.

(2) Includes $0.4 million that is included in cash and cash equivalents and $4.6 million of long-term restricted

cash that is included in other non-current assets related to workers compensation deposits.

(3) Included in short-term investments.

57