NetFlix 2011 Annual Report Download - page 65

Download and view the complete annual report

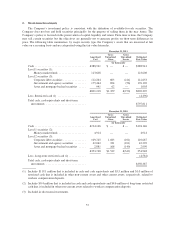

Please find page 65 of the 2011 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.In addition to the streaming content obligations above, the Company has licenses with certain performing

rights organizations (“PRO”), and is currently involved in negotiations with other PROs, that hold certain rights

to music used in connection with streaming content. For the latter, the Company accrues for estimated royalties

that are due to PROs and adjusts these accruals based on any changes in estimates. While the Company

anticipates finalizing these negotiations, the outcome of these negotiations is uncertain. Additionally, pending

litigation between certain PROs and other third parties could impact the Company’s negotiations. If the Company

is unable to reach mutually acceptable terms with the PROs, the Company could become involved in similar

litigation. The results of any negotiation or litigation may be materially different from management’s estimates.

Litigation

From time to time, in the normal course of its operations, the Company is a party to litigation matters and

claims, including claims relating to employee relations, business practices and patent infringement. Litigation can

be expensive and disruptive to normal business operations. Moreover, the results of complex legal proceedings

are difficult to predict and the Company’s view of these matters may change in the future as the litigation and

events related thereto unfold. The Company expenses legal fees as incurred. The Company records a provision

for contingent losses when it is both probable that a liability has been incurred and the amount of the loss can be

reasonably estimated. An unfavorable outcome to any legal matter, if material, could have an adverse effect on

the Company’s operations or its financial position, liquidity or results of operations.

On January 27, 2012, a purported shareholder class action suit was filed in the United States District Court

for the Northern District of California against the Company and certain of its officers and directors. The

complaint alleges that the Company issued materially false and misleading statements regarding the Company’s

business practices and its contracts with content providers, which lead to artificially inflated stock prices. The

complaint alleges violation of the federal securities laws and seeks unspecified compensatory damages and other

relief. A second suit was filed on January 27, 2012, alleging virtually identical claims. Management has

determined a potential loss is reasonably possible however, based on its current knowledge, management does

not believe that the amount of such possible loss or a range of potential loss is reasonably estimable.

On November 23, 2011, a purported shareholder derivative suit was filed in the United States District Court

for the Northern District of California against the Company and certain of its officers and directors. The

complaint alleges, among other claims, that the Company’s officers and members of its Board of Directors

breached their fiduciary duties, wasted valuable corporate assets, and were unjustly enriched as a result of

causing the Company to buy back stock at artificially inflated prices to the detriment of the Company and its

shareholders. The complaint seeks unspecified compensatory damages and other relief. Management has

determined a potential loss is reasonably possible however, based on its current knowledge, management does

not believe that the amount of such possible loss or a range of potential loss is reasonably estimable.

In January through April of 2009, a number of purported anti-trust class action suits were filed against the

Company in various United States Federal Courts. Wal-Mart Stores, Inc. and Walmart.com USA LLC

(collectively, Wal-Mart) were also named as defendants in these suits. These cases have been consolidated in the

Northern District of California and have been assigned the multidistrict litigation number MDL-2029. A number

of substantially similar suits were filed in California State Courts, and have been consolidated in Santa Clara

County. The plaintiffs, who are current or former Netflix customers, generally alleged that Netflix and Wal-Mart

entered into an agreement to divide the markets for sales and online rentals of DVDs in the United States, which

resulted in higher Netflix subscription prices. A number of other cases had been filed in Federal and State courts

by current or former subscribers to the online DVD rental service offered by Blockbuster Inc., alleging injury

arising from similar facts. These cases have been related to MDL 2029 or, in the case of the California State

cases, coordinated with the cases in Santa Clara County. The complaint(s) sought unspecified compensatory and

enhanced damages, interest, costs and fees and other equitable relief. On November 22, 2011, the court granted

the Company’s motion for summary judgment. On December 22, 2011, plaintiff appealed the summary judgment

ruling. Management has determined a potential loss is reasonably possible; however, based on its current

63