NetFlix 2011 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2011 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

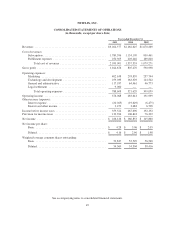

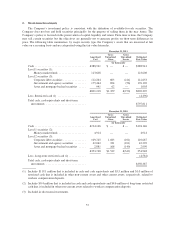

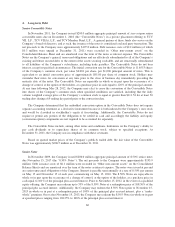

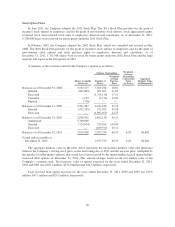

Content Liabilities

Content liabilities consisted of the following:

As of December 31,

2011 2010

Streaming DVD and other Total Streaming DVD and other Total

(in thousands)

Content accounts payable .......... $ 905,792 $18,914 $ 924,706 $136,841 $31,854 $168,695

Non-current content liabilities ....... 739,628 — 739,628 48,179 — 48,179

Total content liabilities ............ $1,645,420 $18,914 $1,664,334 $185,020 $31,854 $216,874

The Company typically enters into multi-year licenses with studios and other distributors that may result in

an increase in content library and a corresponding increase in content accounts payable and non-current content

liabilities. The payment terms for these license fees may extend over the term of the license agreement, which

could range from six months to five years. As of December 31, 2011, content accounts payable and non-current

content liabilities increased $1.45 billion, over December 31, 2010, as compared to an increase in total content

library, net, of $1.60 billion.

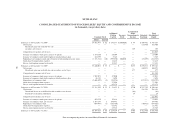

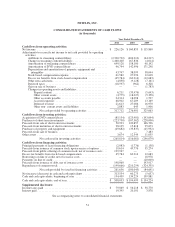

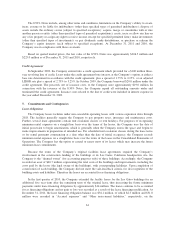

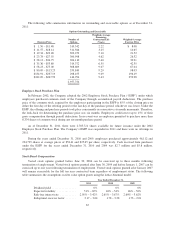

Property and Equipment, Net

Property and equipment and accumulated depreciation consisted of the following:

As of December 31,

2011 2010

(in thousands)

Computer equipment ................... 3years $ 67,090 $ 60,289

Operations and other equipment .......... 5years 100,306 72,368

Software, including internal-use software . . 3 years 35,356 26,961

Furniture and fixtures .................. 3years 17,310 11,438

Building ............................ 30years 40,681 40,681

Leasehold improvements ............... Over life of lease 44,473 36,530

Capital work-in-progress ................................ 822 16,882

Property and equipment, gross ............................ 306,038 265,149

Less: Accumulated depreciation ........................... (169,685) (136,579)

Property and equipment, net .............................. $136,353 $ 128,570

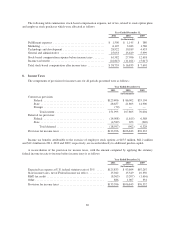

Accrued Expenses

Accrued expenses consisted of the following:

As of December 31,

2011 2010

(in thousands)

Accrued state sales and use tax ............................... $14,557 $14,983

Accrued payroll and employee benefits ........................ 17,763 8,520

Accrued interest on debt .................................... 2,125 2,125

Accrued content related costs ................................ 10,774 6,950

Accrued legal settlement .................................... 9,000 —

Current portion of lease financing obligations ................... 2,319 2,083

Other ................................................... 7,155 3,911

Accrued expenses ......................................... $63,693 $38,572

59