NetFlix 2011 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2011 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

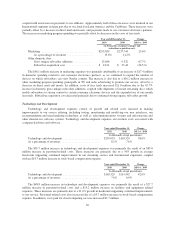

Interest expense was relatively flat as compared to the prior year. Interest expense in 2011 includes $2.1

million for our lease financing obligations, $17.0 million of interest payments due on our 8.50% senior notes and

$0.6 million of amortization of debt issuance costs.

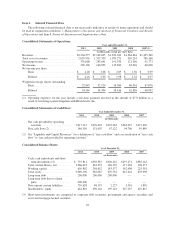

Year ended December 31, Change

2010 2009 2010 vs. 2009

(in thousands, except percentages)

Interest expense ..................................... $19,629 $6,475 203.2%

As a percentage of revenues ............................ 0.9% 0.4%

The $13.2 million increase in interest expense is primarily attributable to the interest expense associated

with our 8.50% senior notes. Interest expense in 2010 includes $2.3 million for our lease financing obligations,

$17.0 million of interest payments due on our 8.50% senior notes and $0.5 million of amortization of debt

issuance costs.

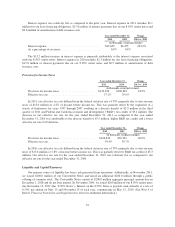

Provision for Income Taxes

Year ended December 31, Change

2011 2010 2011 vs. 2010

(in thousands, except percentages)

Provision for income taxes ........................ $133,396 $106,843 24.9%

Effective tax rate ................................ 37.1% 39.9%

In 2011, our effective tax rate differed from the federal statutory rate of 35% primarily due to state income

taxes of $15.0 million or 4.2% of income before income tax. This was partially offset by the expiration of a

statute of limitations for years 1997 through 2007 resulting in a discrete benefit of $3.5 million in the third

quarter of 2011 and Federal and California research and development (“R&D”) tax credits of $5.1 million. The

decrease in our effective tax rate for the year ended December 31, 2011 as compared to the year ended

December 31, 2010 was attributable to the discrete benefit of $3.5 million, higher R&D tax credits and a lower

effective tax rate for California.

Year ended December 31, Change

2010 2009 2010 vs. 2009

(in thousands, except percentages)

Provision for income taxes ......................... $106,843 $76,332 40.0%

Effective tax rate ................................. 39.9% 39.7%

In 2010, our effective tax rate differed from the federal statutory rate of 35% primarily due to state income

taxes of $15.6 million or 5.8% of income before income tax. This was partially offset by R&D tax credits of $3.3

million. Our effective tax rate for the year ended December 31, 2010 was relatively flat as compared to our

effective tax rate for the year ended December 31, 2009.

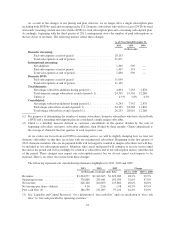

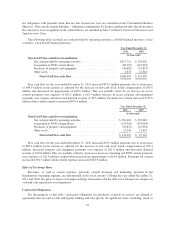

Liquidity and Capital Resources

Our primary source of liquidity has been cash generated from operations. Additionally, in November 2011,

we issued $200.0 million of our Convertible Notes and raised an additional $200.0 million through a public

offering of common stock. The Convertible Notes consist of $200.0 million aggregate principal amount due on

December 1, 2018 and do not bear interest. In November 2009, we issued $200 million of our 8.50% senior notes

due November 15, 2017 (the “8.50% Notes”). Interest on the 8.50% Notes is payable semi-annually at a rate of

8.50% per annum on May 15 and November 15 of each year, commencing on May 15, 2010. (See Note 4 of

Item 8, Financial Statements and Supplementary Data for additional information.)

32