NetFlix 2011 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2011 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

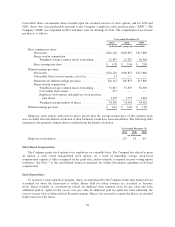

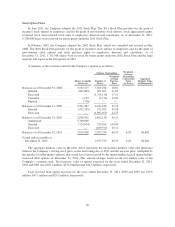

Convertible Notes, incremental shares issuable upon the assumed exercise of stock options, and for 2010 and

2009, shares that were purchasable pursuant to the Company’s employee stock purchase plan (“ESPP”). The

Company’s ESPP was suspended in 2011 and there were no offerings in 2011. The computation of net income

per share is as follows:

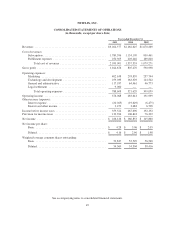

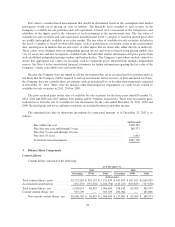

Year ended December 31,

2011 2010 2009

(in thousands, except per share data)

Basic earnings per share:

Net income ...................................... $226,126 $160,853 $115,860

Shares used in computation:

Weighted-average common shares outstanding ...... 52,847 52,529 56,560

Basic earnings per share ............................ $ 4.28 $ 3.06 $ 2.05

Diluted earnings per share:

Net income ...................................... $226,126 $160,853 $115,860

Convertible Notes interest expense, net of tax ........... 17 — —

Numerator for diluted earnings per share ............... 226,143 160,853 115,860

Shares used in computation:

Weighted-average common shares outstanding ...... 52,847 52,529 56,560

Convertible Notes shares ....................... 217 — —

Employee stock options and employee stock purchase

plan shares ................................ 1,305 1,775 1,856

Weighted-average number of shares .............. 54,369 54,304 58,416

Diluted earnings per share .............................. $ 4.16 $ 2.96 $ 1.98

Employee stock options with exercise prices greater than the average market price of the common stock

were excluded from the diluted calculation as their inclusion would have been anti-dilutive. The following table

summarizes the potential common shares excluded from the diluted calculation:

Year ended December 31,

2011 2010 2009

(in thousands)

Employee stock options ........................................... 225 14 64

Stock-Based Compensation

The Company grants stock options to its employees on a monthly basis. The Company has elected to grant

all options as fully vested non-qualified stock options. As a result of immediate vesting, stock-based

compensation expense is fully recognized on the grant date, and no estimate is required for post-vesting option

forfeitures. See Note 7 to the consolidated financial statements for further information regarding stock-based

compensation.

Stock Repurchases

To facilitate a stock repurchase program, shares are repurchased by the Company in the open market and are

accounted for when the transaction is settled. Shares held for future issuance are classified as Treasury

stock. Shares formally or constructively retired are deducted from common stock for par value and from

additional paid in capital for the excess over par value. If additional paid in capital has been exhausted, the

excess over par value is deducted from Retained earnings. Direct costs incurred to acquire the shares are included

in the total cost of the shares.

56