NetFlix 2011 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2011 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

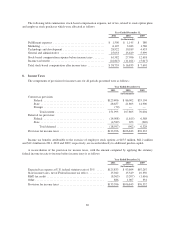

It is not possible to make a reasonable estimate of the maximum potential amount of future payments under

these or similar agreements due to the conditional nature of the Company’s obligations and the unique facts and

circumstances involved in each particular agreement. No amount has been accrued in the accompanying financial

statements with respect to these indemnification guarantees.

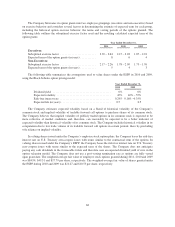

7. Stockholders’ Equity

On November 28, 2011, the Company issued 2.9 million shares of common stock upon the closing of a

public offering for $200 million net of issuance costs of $0.5 million, the majority of which were unpaid as of

December 31, 2011.

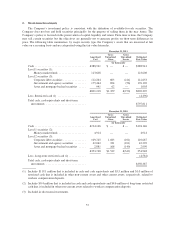

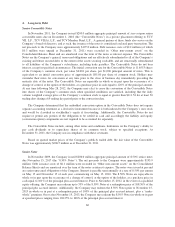

Stock Repurchase Program

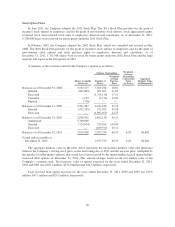

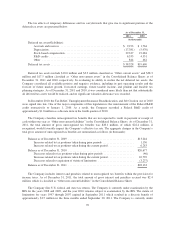

The following table presents a summary of the Company’s stock repurchases:

Year ended December 31,

2011 2010 2009

(in thousands, except per share data)

Total number of shares repurchased .... 900 2,606 7,371

Dollar amount of shares repurchased . . . $ 199,666 210,259 324,335

Average price paid per share .......... $ 221.88 $ 80.67 $ 44.00

Range of price paid per share ......... $160.11 – 248.78 $60.23 – $126.01 $34.70 – $60.00

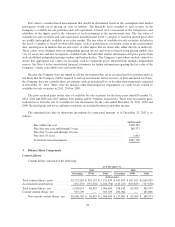

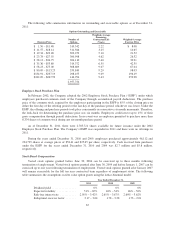

Under the current stock repurchase plan, announced on June 11, 2010, the Company is authorized to

repurchase up to $300 million of its common stock through the end of 2012. As of December 31, 2011, $41.0

million of this authorization is remaining. The timing and actual number of shares repurchased is at

management’s discretion and will depend on various factors including price, corporate and regulatory

requirements, debt covenant requirements, alternative investment opportunities and other market conditions.

Shares repurchased by the Company are accounted for when the transaction is settled. There were no

unsettled share repurchases at December 31, 2011. Shares repurchased and retired are deducted from common

stock for par value and from additional paid-in capital for the excess over par value. If additional paid-in capital

has been exhausted, the excess over par value is deducted from retained earnings. Direct costs incurred to acquire

the shares are included in the total cost of the shares. During the year ended December 31, 2011, $40.9 million

was deducted from retained earnings related to share repurchases.

In the fourth quarter of 2009, the Company determined that all shares held in treasury stock would be

retired. Accordingly, these constructively retired shares were deducted from common stock for par value and

from additional paid in capital for the excess over par value, until additional paid in capital was exhausted and

then from retained earnings.

Preferred Stock

The Company has authorized 10,000,000 shares of undesignated preferred stock with par value of $0.001

per share. None of the preferred shares were issued and outstanding at December 31, 2011 and 2010.

Voting Rights

The holders of each share of common stock shall be entitled to one vote per share on all matters to be voted

upon by the Company’s stockholders.

65