Neiman Marcus 2012 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2012 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

including but not limited to, 1) the appointment or termination of certain members of management, 2) the disposal of all or substantially all assets, 3) the

declaration of a dividend, 4) an initial public offering, 5) the grant of future registration rights and 6) any liquidation, bankruptcy, reorganization or similar

transaction. Other decisions of the board of directors of Holding require the approval of at least two directors appointed by each of the Principal Stockholders.

In both cases, these requirements are subject to the Principal Stockholders’ respective ownership percentage in Holding being at least 30% of their initial

ownership interests.

Registration Rights Agreement

The Principal Stockholder Funds and the Co-Investors entered into a registration rights agreement with us upon completion of the Acquisition.

Pursuant to this agreement, the Principal Stockholder Funds can cause us to register their interests in us under the Securities Act and to maintain a shelf

registration statement effective with respect to such interests. The Principal Stockholder Funds and the Co-Investors are also entitled to participate on a pro

rata basis in any registration of our equity interests under the Securities Act that we may undertake. Under the registration rights agreement, we have agreed to

indemnify the Principal Stockholders, each member, limited or general partner thereof, each member, limited or general partner of each such member, limited

or general partner, each of their respective affiliates, officers, directors, stockholders, employees, advisors, and agents, controlling persons and each of their

respective representatives against any losses or damages arising out of any untrue statement or omission of material fact in any registration statement or

prospectus pursuant to which we sell shares of our common stock, unless such liability arose from such indemnified party’s misstatement or omission, and

the Principal Stockholders have agreed to indemnify us against all losses caused by their misstatements or omissions.

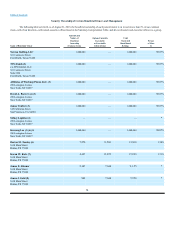

Management Services Agreement

In connection with the Acquisition, we entered into a management services agreement with affiliates of the Principal Stockholders pursuant to which

affiliates of one of the Principal Stockholders received on the closing date of the Acquisition a transaction fee of $25 million in cash in connection with the

Acquisition. Affiliates of the other Principal Stockholder waived any cash transaction fee in connection with the Acquisition. In addition, pursuant to such

agreement, and in exchange for consulting and management advisory services provided to us by the Principal Stockholders and their affiliates, affiliates of the

Principal Stockholders receive an aggregate annual management fee equal to the lesser of 1) 0.25% of consolidated annual revenue and 2) $10 million. We

paid management fees of $10.0 million in each of fiscal years 2013, 2012 and 2011, in each case split equally between the two Principal Stockholders. The

management services agreement includes customary exculpation and indemnification provisions in favor of the Principal Stockholders and their affiliates.

Pursuant to the management services agreement, upon completion of the Future Sponsors’ Acquisition, we expect to pay a one-time success fee to the Principal

Stockholders in an amount to be determined as provided for in the management services agreement based on our total enterprise value and our consolidated

EBITDA for the four fiscal quarters immediately preceding closing of the merger. See Note 14 of the Notes to Consolidated Financial Statements for a further

description of the management services agreement.

Certain Charter and By-Laws Provisions

Our Certificate of Incorporation and our Amended and Restated By-Laws contain provisions limiting directors’ obligations in respect of corporate

opportunities.

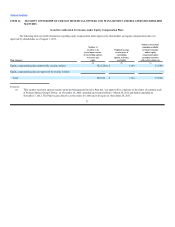

Management Stockholders’ Agreement

Subject to the management stockholders’ agreement, certain members of management, including Burton M. Tansky, Karen W. Katz, James E.

Skinner, and James J. Gold, along with 21 other current or former members of management, elected to invest in us by contributing cash or equity interests in

NMG, or a combination of both, to us prior to the merger and receiving equity interests in the Company in exchange thereof immediately after completion of

the merger pursuant to rollover agreements with NMG and we entered into prior to the effectiveness of the merger. The aggregate amount of this investment was

approximately $25.6 million.

The management stockholders’ agreement creates certain rights and restrictions on these equity interests, including transfer restrictions and tag-

along, drag-along, put, call, and registration rights in certain circumstances.

83