Neiman Marcus 2012 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2012 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

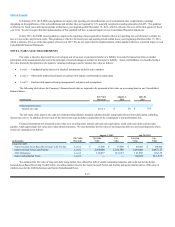

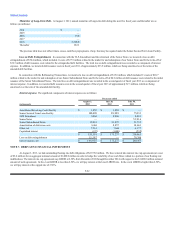

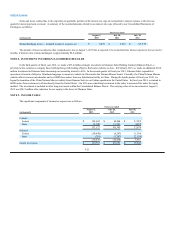

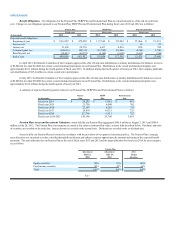

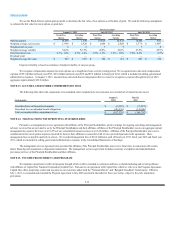

A reconciliation of income tax expense to the amount calculated based on the federal and state statutory rates is as follows:

Fiscal year ended

(in thousands)

August 3,

2013

July 28,

2012

July 30,

2011

Income tax expense at statutory rate $97,101 $79,918 $ 17,242

State income taxes, net of federal income tax benefit 11,672 8,672 874

Unbenefitted losses in foreign subsidiary 4,594 530 —

Tax expense (benefit) related to tax settlements and other changes in tax

liabilities 525 (1,137) 153

Impact of non-taxable income (13)(18)(169)

Impact of non-deductible expenses 683 1,000 77

Other (829) (714) (536)

Total $113,733 $88,251 $17,641

Effective tax rate 41.0%38.7%35.8%

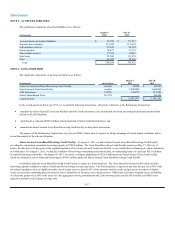

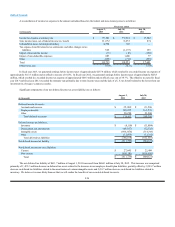

In fiscal year 2013, we generated earnings before income taxes of approximately $277.4 million, which resulted in a recorded income tax expense of

approximately $113.7 million and an effective tax rate of 41.0%. In fiscal year 2012, we generated earnings before income taxes of approximately $228.3

million, which resulted in a recorded income tax expense of approximately $88.3 million and an effective tax rate of 38.7%. The effective tax rates for fiscal

year 2013 and fiscal year 2012 exceeded the statutory rate primarily due to state income taxes and the lack of a U.S. tax benefit related to the losses from our

investment in a foreign e-commerce retailer.

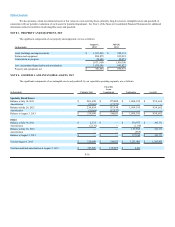

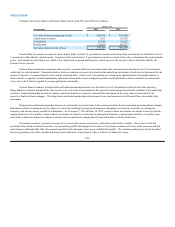

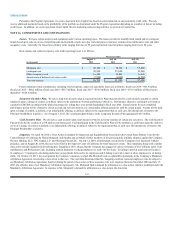

Significant components of our net deferred income tax asset (liability) are as follows:

(in thousands)

August 3,

2013

July 28,

2012

Deferred income tax assets:

Accruals and reserves $25,909 $23,596

Employee benefits 128,225 161,539

Other 20,298 23,260

Total deferred tax assets $174,432 $208,395

Deferred income tax liabilities:

Inventory $(8,110) $ (11,809)

Depreciation and amortization (69,167)(72,732)

Intangible assets (696,056)(714,743)

Other (12,835) (13,232)

Total deferred tax liabilities (786,168)(812,516)

Net deferred income tax liability $(611,736) $ (604,121)

Net deferred income tax asset (liability):

Current $27,645 $22,484

Non-current (639,381) (626,605)

Total $(611,736)$(604,121)

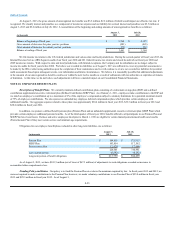

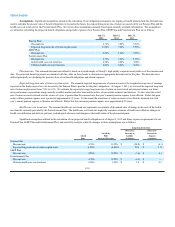

The net deferred tax liability of $611.7 million at August 3, 2013 increased from $604.1 million at July 28, 2012. This increase was comprised

primarily of 1) $33.3 million decrease in deferred tax assets related to the decrease in our employee benefit plan liabilities, partially offset by 2) $18.7 million

decrease in deferred tax liabilities related to the amortization of certain intangible assets and 3) $3.7 million decrease in deferred tax liabilities related to

inventory. We believe it is more likely than not that we will realize the benefits of our recorded deferred tax assets.

F-24