Neiman Marcus 2012 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2012 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177

|

|

Table of Contents

· do not reflect our considerable interest expense, or the cash requirements necessary to service interest or principal payments, on our debt;

· exclude tax payments that represent a reduction in available cash; and

· do not reflect any cash requirements for assets being depreciated and amortized that may have to be replaced in the future.

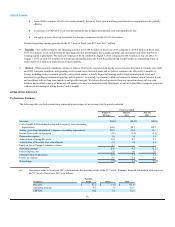

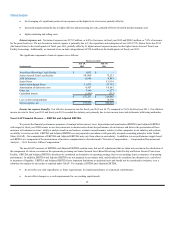

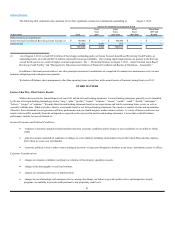

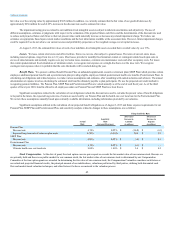

The following table reconciles net earnings as reflected in our Consolidated Statements of Earnings prepared in accordance with GAAP to EBITDA:

Fiscal year ended

August 3, July 28, July 30, July 31, August 1,

(dollars in millions) 2013 2012 2011 2010 2009

Net earnings (loss) $ 163.7 $ 140.1 $ 31.6 $ (1.8) $ (668.0)(1)

Income tax expense (benefit) 113.7 88.3 17.7 (3.5)(220.5)

Interest expense, net 169.0 175.2 280.5 237.1 235.6

Depreciation expense 141.5 130.1 132.4 141.8 150.8

Amortization of intangible assets and favorable lease

commitments 47.4 50.1 62.5 73.3 72.7

EBITDA $ 635.3 $ 583.8 $ 524.7 $ 446.9 $ (429.4)(1)

EBITDA as a percentage of revenues 13.7%13.4%13.1%12.1%(11.8)%

(1) For fiscal year 2009, net loss and EBITDA include pretax impairment charges related to 1) $329.7 million for the writedown to fair value of

goodwill, 2) $343.2 million for the writedown to fair value of the net carrying value of tradenames and 3) $30.3 million for the writedown to fair

value of the net carrying value of certain long-lived assets. Excluding pretax impairment charges of $703.2 million, fiscal year 2009 Adjusted

EBITDA was $273.8 million, or 7.5% of revenues.

36