Neiman Marcus 2012 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2012 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

2013, we do not believe we will be required to make contributions to the Pension Plan for fiscal year 2014. We will continue to evaluate voluntary

contributions to our Pension Plan based upon the unfunded position of the Pension Plan, our available liquidity and other factors.

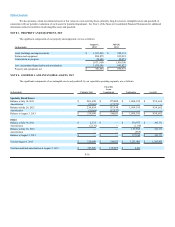

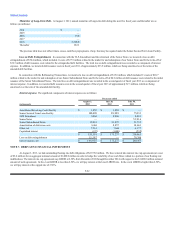

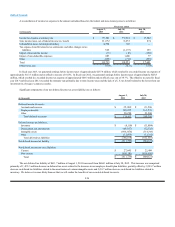

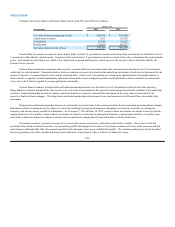

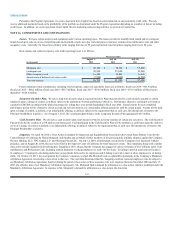

The funded status of our Pension Plan, SERP Plan and Postretirement Plan is as follows:

Pension Plan SERP Plan Postretirement Plan

Fiscal years Fiscal years Fiscal years

(in thousands) 2013 2012 2013 2012 2013 2012

Projected benefit obligation $489,856 $565,852 $103,854 $117,562 $12,429 $17,466

Fair value of plan assets 385,838 389,899 — — — —

Accrued obligation $(104,018)$(175,953)$(103,854)$(117,562)$ (12,429)$(17,466)

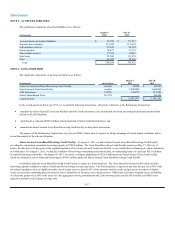

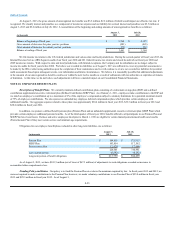

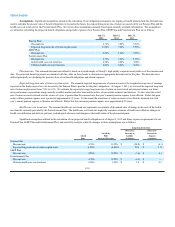

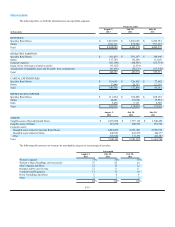

Cost of Benefits. The components of the expenses we incurred under our Pension Plan, SERP Plan and Postretirement Plan are as follows:

Fiscal year ended

(in thousands)

August 3,

2013

July 28,

2012

July 30,

2011

Pension Plan:

Interest cost $21,243 $24,761 $24,215

Expected return on plan assets (26,381) (27,097) (26,210)

Net amortization of losses 6,287 2,616 2,176

Pension Plan expense $1,149 $280 $ 181

SERP Plan:

Interest cost $4,037 $4,816 $4,919

Net amortization of losses 522 — —

SERP Plan expense $4,559 $4,816 $4,919

Postretirement Plan:

Service cost $34 $ 35 $ 61

Interest cost 650 780 871

Net amortization of prior service cost (1,556)(1,556)(1,556)

Net amortization of losses 589 423 690

Postretirement Plan (income) expense $(283)$(318)$66

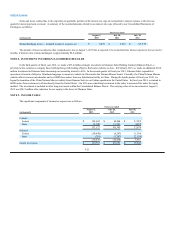

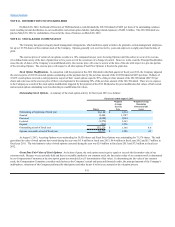

For purposes of determining pension expense, the expected return on plan assets is calculated using the market related value of plan assets. The

market related value of plan assets does not immediately recognize realized gains and losses. Rather, these effects of realized gains and losses are deferred

initially and amortized over three years in the determination of the market related value of plan assets. At August 3, 2013, the market related value of plan

assets exceeded the fair value by $16.5 million.

F-26