Neiman Marcus 2012 Annual Report Download - page 130

Download and view the complete annual report

Please find page 130 of the 2012 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

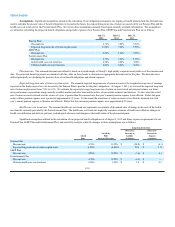

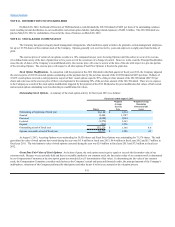

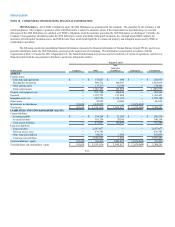

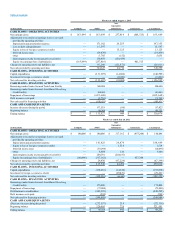

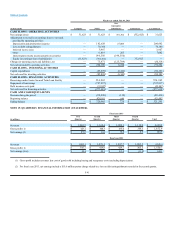

NOTE 18. CONDENSED CONSOLIDATING FINANCIAL INFORMATION

2028 Debentures. All of NMG’s obligations under the 2028 Debentures are guaranteed by the Company. The guarantee by the Company is full

and unconditional. The Company’s guarantee of the 2028 Debentures is subject to automatic release if the requirements for legal defeasance or covenant

defeasance of the 2028 Debentures are satisfied, or if NMG’s obligations under the indenture governing the 2028 Debentures are discharged. Currently, the

Company’s non-guarantor subsidiaries under the 2028 Debentures consist principally of Bergdorf Goodman, Inc., through which NMG conducts the

operations of its Bergdorf Goodman stores, and NM Nevada Trust, which holds legal title to certain real property and intangible assets used by NMG in

conducting its operations.

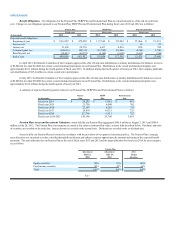

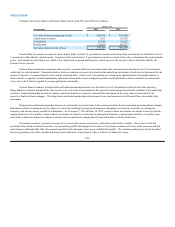

The following condensed consolidating financial information represents the financial information of Neiman Marcus Group LTD Inc. and its non-

guarantor subsidiaries under the 2028 Debentures, prepared on the equity basis of accounting. The information is presented in accordance with the

requirements of Rule 3-10 under the SEC’s Regulation S-X. The financial information may not necessarily be indicative of results of operations, cash flows or

financial position had the non-guarantor subsidiaries operated as independent entities.

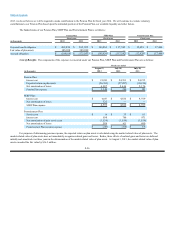

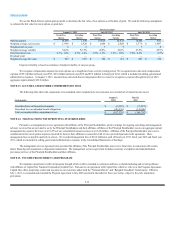

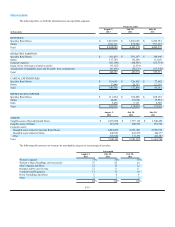

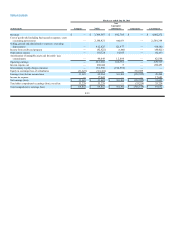

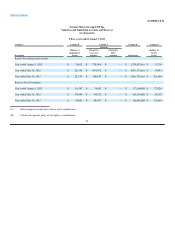

August 3, 2013

(in thousands) Company NMG

Non-

Guarantor

Subsidiaries Eliminations Consolidated

ASSETS

Current assets:

Cash and cash equivalents $ — $ 135,827 $ 849 $ — $ 136,676

Merchandise inventories — 909,332 109,507 —1,018,839

Other current assets —117,313 13,149 — 130,462

Total current assets —1,162,472 123,505 —1,285,977

Property and equipment, net —795,798 106,046 — 901,844

Goodwill —1,107,753 155,680 —1,263,433

Intangible assets, net —245,756 1,536,392 —1,782,148

Other assets — 38,835 28,004 —66,839

Investments in subsidiaries 831,038 1,845,022 —(2,676,060) —

Total assets $831,038 $5,195,636 $1,949,627 $(2,676,060) $ 5,300,241

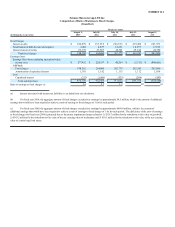

LIABILITIES AND STOCKHOLDERS’ EQUITY

Current liabilities:

Accounts payable $ — $ 354,249 $ 32,289 $ — $ 386,538

Accrued liabilities —319,358 70,810 —390,168

Total current liabilities —673,607 103,099 — 776,706

Long-term liabilities:

Long-term debt —2,697,077 — — 2,697,077

Deferred income taxes —639,381 — — 639,381

Other long-term liabilities —354,533 1,506 —356,039

Total long-term liabilities —3,690,991 1,506 —3,692,497

Total stockholders’ equity 831,038 831,038 1,845,022 (2,676,060)831,038

Total liabilities and stockholders’ equity $831,038 $5,195,636 $1,949,627 $(2,676,060)$5,300,241

F-36