Neiman Marcus 2012 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2012 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

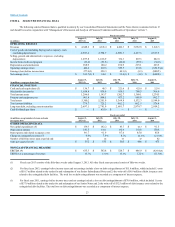

Fiscal Year Ended August 3, 2013 Compared to Fiscal Year Ended July 28, 2012

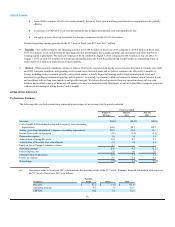

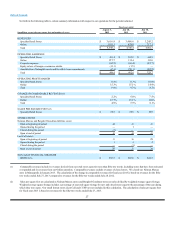

Revenues. Our revenues for fiscal year 2013 of $4,648.2 million increased by $302.8 million, or 7.0%, from $4,345.4 million in fiscal year 2012.

The increase in revenues was due to increases in comparable revenues resulting from a higher level of customer demand, most notably in our Online segment,

and revenues generated in the 53 week of fiscal year 2013. New stores generated revenues of $41.2 million for the fifty-two weeks ended July 27, 2013 while

revenues for the 53 week were $61.9 million.

Comparable revenues for the fifty-two weeks ended July 27, 2013 were $4,545.1 million compared to $4,331.8 million in fiscal year 2012,

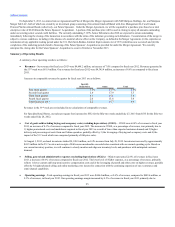

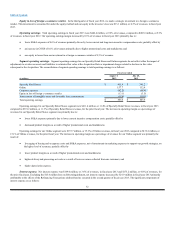

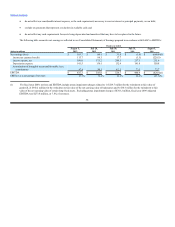

representing an increase of 4.9%. Changes in comparable revenues, by quarter and by reportable segment, were:

Fiscal year 2013 Fiscal year 2012

Specialty

Retail Stores Online Total

Specialty

Retail Stores Online Total

First fiscal quarter 3.5%13.5%5.4%6.4%15.2%8.0%

Second fiscal quarter 2.0 17.9 5.3 7.8 13.5 9.0

Third fiscal quarter 0.7 15.1 3.6 4.3 17.5 6.7

Fourth fiscal quarter 2.6 15.6 5.4 5.3 18.8 7.9

Total fiscal year 2.2 15.7 4.9 6.0 16.1 7.9

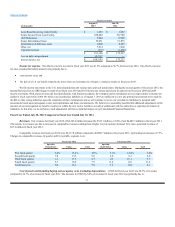

Cost of goods sold including buying and occupancy costs (excluding depreciation). COGS for fiscal year 2013 was 64.4% of revenues

compared to 64.3% of revenues for fiscal year 2012. The increase in COGS of 0.1% of revenues in fiscal year 2013 was primarily due to:

· decreased product margins of approximately 0.1% of revenues due to higher promotional costs and markdowns as a result of lower than

expected customer demand; and

· higher delivery and processing net costs of approximately 0.1% of revenues as a result of lower revenues collected from our customers; partially

offset by

· the leveraging of buying and occupancy costs on higher revenues by 0.1% of revenues; and

· the improvement in product margins related to the impact of the 53 week revenues, comprised primarily of full-price sales, of approximately

0.1% of revenues.

Selling, general and administrative expenses (excluding depreciation). SG&A expenses as a percentage of revenues decreased to 22.8% of

revenues in fiscal year 2013 compared to 23.4% of revenues in fiscal year 2012. The decrease in SG&A expenses by 0.6% of revenues in fiscal year 2013 was

primarily due to:

· favorable payroll and other costs of approximately 0.4% of revenues primarily due to the leveraging of these expenses on higher revenues;

· lower current incentive compensation costs of approximately 0.3% of revenues; and

· adjustments of long-term incentive compensation costs of approximately 0.2% of revenues; partially offset by

· higher planned selling and online marketing costs of approximately 0.2% of revenues incurred in connection with the continuing expansion of

our e-commerce and omni-channel capabilities.

Income from credit card program. We earned credit card Program Income of $53.4 million, or 1.1% of revenues, in fiscal year 2013 compared to

$51.6 million, or 1.2% of revenues, in fiscal year 2012.

Depreciation and amortization expenses. Depreciation expense was $141.5 million, or 3.0% of revenues, in fiscal year 2013 compared to

$130.1 million, or 3.0% of revenues, in fiscal year 2012.

Amortization of intangible assets (primarily customer lists and favorable lease commitments) aggregated $47.4 million, or 1.0% of revenues, in fiscal

year 2013 compared to $50.1 million, or 1.1% of revenues, in fiscal year 2012. The decrease in amortization expense is primarily due to certain short-lived

intangible assets becoming fully amortized.

31

rd

rd

rd