Neiman Marcus 2012 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2012 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

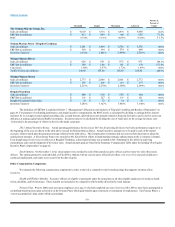

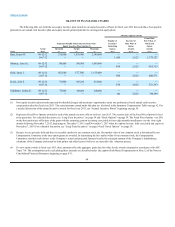

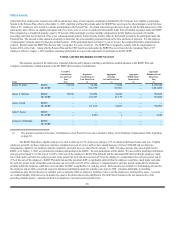

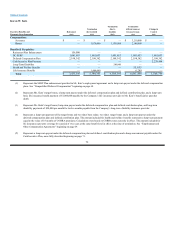

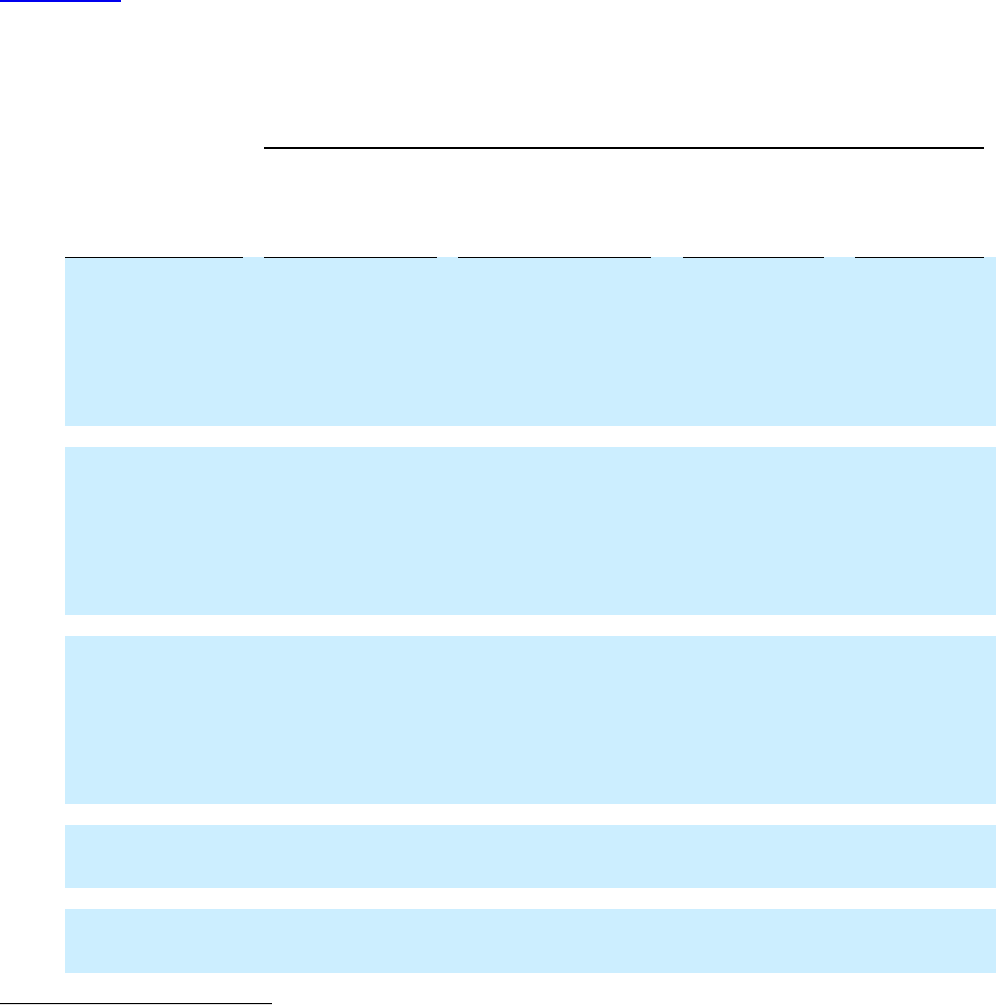

OUTSTANDING EQUITY AWARDS AT FISCAL YEAR END

The following table sets forth certain information regarding the total number and aggregate value of stock options held by each of our named executive

officers at August 3, 2013.

Option Awards

Name

Number of Securities

Underlying

Unexercised Options

(#) Exercisable

Number of

Securities

Underlying

Unexercised

Options (#)

Unexercisable

Option

Exercise Price

($)(1)

Option

Expiration

Date

Karen W. Katz 5,341 —(2) 1,227.50(2) 12-15-2017

2,003 —(3) 1,091.75(3) 12-15-2017

1,187 371(3) 852.50(3) 12-15-2017

1,523 —(4) 1,358.50(4) 09-30-2017

1,523 1,254(4) 1,141.00(4) 09-30-2017

578 1,000(5) 1,556.50(5) 10-01-2018

1,075 1,856(6) 1,415.00(6) 10-01-2018

— 1,450(7) 2,025.00(7) 11-07-2019

James E. Skinner 2,671 —(2) 1,227.50(2) 12-15-2017

1,001 —(3) 1,091.75(3) 12-15-2017

593 186(3) 852.50(3) 12-15-2017

779 —(4) 1,358.50(4) 09-30-2017

779 642(4) 1,141.00(4) 09-30-2017

313 540(5) 1,556.50(5) 10-01-2018

581 1,003(6) 1,415.00(6) 10-01-2018

—650(7) 2,025.00(7) 11-07-2019

James J. Gold 2,671 —(2) 1,227.50(2) 12-15-2017

1,001 —(3) 1,091.75(3) 12-15-2017

593 186(3) 852.50(3) 12-15-2017

779 —(4) 1,358.50(4) 09-30-2017

779 642(4) 1,141.00(4) 09-30-2017

313 540(5) 1,556.50(5) 10-01-2018

581 1,003(6) 1,415.00(6) 10-01-2018

— 850(7) 2,025.00(7) 11-07-2019

John E. Koryl 513 887(5) 1,556.50(5) 10-01-2018

953 1,647(6) 1,415.00(6) 10-01-2018

—550(7) 2,025.00(7) 11-07-2019

Joshua G. Schulman 204 671(8) 1,993.20(8) 05-25-2019

379 1,246(9) 1,812.00(9) 05-25-2019

—400(7) 2,025.00(7) 11-07-2019

(1) The exercise prices of all outstanding stock options granted under the Management Incentive Plan prior to the declaration of the 2012 Dividend were

adjusted following the declaration of the 2012 Dividend on March 28, 2012. The exercise prices of the unvested Fixed Price Options and unvested

Accreting Options were reduced by the amount of the 2012 Dividend, or by $435. The exercise prices of the vested Fixed Price Options and vested

Accreting Options were reduced by 50% of the 2012 Dividend, or by $217.50. The exercise prices of the vested and unvested Accreting Options will

continue to accrete in accordance with the terms of the Management Incentive Plan based on the adjusted exercise prices. For a detailed discussion, see

“Long-Term Incentives” on page 54.

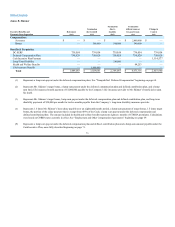

(2) Nonqualified stock options designated as Fixed Price Options granted on November 29, 2005 at the initial exercise price of $1,445 per share, adjusted to

$1,227.50 following the 2012 Dividend declaration on March 28, 2012, which vested 20% on the first anniversary of October 6, 2005 and thereafter in

forty-eight equal monthly installments over the forty-eight months following the first anniversary of October 6, 2005, beginning on the one-month

anniversary of such first anniversary and became fully vested on October 6, 2010.

(3) Nonqualified stock options designated as Accreting Options exchanged in a tender offer for underwater options at the ratio of 1.5 to 1 on December 15,

2009 which vested 25% on the first anniversary of December 15, 2009 and thereafter in thirty-six equal monthly installments over the thirty-six months

following the first anniversary of December 15, 2009, beginning on January 15, 2011 and becoming fully vested on December 15, 2013. The options

were granted at the initial exercise price of $1,000 per share which will increase at a 10% compound rate on each anniversary of December 15, 2009 until

the earlier to occur of 1) the exercise of the option, 2) December 15, 2013, or 3) the occurrence of a change of control, or in the event the equity investors

sell a portion of their investment, with respect to a portion of the options bearing the same ratio as the portion of the equity investor’s equity sold. On