Neiman Marcus 2012 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2012 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

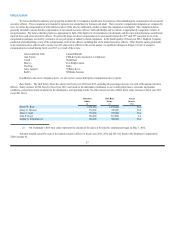

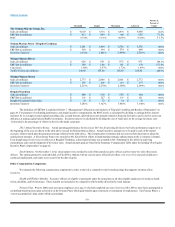

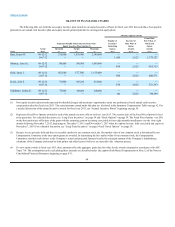

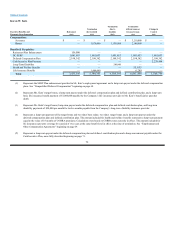

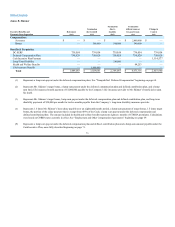

GRANTS OF PLAN-BASED AWARDS

The following table sets forth the non-equity incentive plan awards to our named executive officers for fiscal year 2013 that could have been payable

pursuant to our annual cash incentive plan and equity awards granted pursuant to our long-term equity plans.

All Other Option Awards

Grant Date

Number of Exercise Or Fair Value of

Estimated Possible Future Payouts Under Non- Securities Base Price of Stock and

Equity Incentive Plan Awards (1) Underlying Option Option

Name

Grant

Date

Threshold

($)

Target

($)

Maximum

($)

Options

(#)(2)

Awards

($)(3)

Awards

($)(4)

Katz, Karen W. 09-12-12 535,000 1,070,000 2,140,000 — — —

11-07-12 — — — 1,450 2,025 1,379,327

Skinner, James E. 09-12-12 180,000 540,000 1,080,000 — — —

11-07-12 — — — 650 2,025 618,319

Gold, James J. 09-12-12 192,500 577,500 1,155,000 — — —

11-07-12 — — — 850 2,025 808,571

Koryl, John E. 09-12-12 76,800 307,200 614,400 — — —

11-07-12 — — — 550 2,025 523,193

Schulman, Joshua G. 09-12-12 75,000 300,000 600,000 — — —

11-07-12 — — — 400 2,025 380,504

(1) Non-equity incentive plan awards represent the threshold, target and maximum opportunities under our performance-based annual cash incentive

compensation plan for fiscal year 2013. The actual amounts earned under this plan are disclosed in the Summary Compensation Table on page 62. For

a detailed discussion of the annual incentive awards for fiscal year 2013, see “Annual Incentive Bonus” beginning on page 58.

(2) Represents Fixed Price Options awarded to each of the named executive officers in fiscal year 2013. The exercise price of the Fixed Price Options is fixed

at the grant date. For a detailed discussion, see “Long-Term Incentives” on page 54 and “Stock Options” on page 59. The Fixed Price Options vest 20%

on the first anniversary of the date of the grant with the remaining portion becoming exercisable in forty-eight monthly installments over the forty-eight

months following November 7, 2013, beginning on December 7, 2013, until November 7, 2017 when the options become fully exercisable and expire on

November 7, 2019. For a detailed discussion, see “Long-Term Incentives” on page 54 and “Stock Options” on page 59.

(3) Because we are privately held and there is no public market for our common stock, the fair market value of our common stock is determined by our

Compensation Committee at the time option grants are awarded. In determining the fair market value of our common stock, the Compensation

Committee considers such factors as the Company’s actual and projected financial results, the principal amount of the Company’s indebtedness,

valuations of the Company performed by third parties and other factors it believes are material to the valuation process.

(4) For new option awards in fiscal year 2013, these amounts reflect the aggregate grant date fair value for the awards computed in accordance with ASC

Topic 718. The assumptions used in calculating these amounts are described under the caption Stock-Based Compensation in Note 12 of the Notes to

Consolidated Financial Statements beginning on page F-31.

64