Neiman Marcus 2012 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2012 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

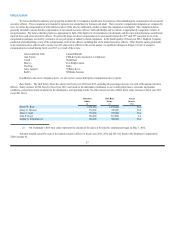

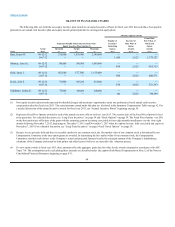

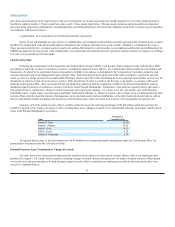

(4) Nonqualified stock options designated as Fixed Price Options granted on September 30, 2010 at the initial exercise price of $1,576 per share which

vested 25% on the first anniversary of September 30, 2010 and thereafter in thirty-six equal monthly installments over the thirty-six months following

the first anniversary of September 30, 2010, beginning on October 30, 2011 and becoming fully vested on September 30, 2014, subject to earlier vesting

in certain circumstances following a change of control (as defined in the Management Incentive Plan). Following the 2012 Dividend declaration on

March 28, 2012, the exercise price of the vested Fixed Price Options was adjusted to $1,358.50 and the exercise price of the unvested Fixed Price

Options was adjusted to $1,141.00. These grants were made to Ms. Katz and Messrs. Skinner and Gold pursuant to their entering into new employment

contracts effective October 6, 2010. See “Employment and Other Compensation Agreements” beginning on page 69.

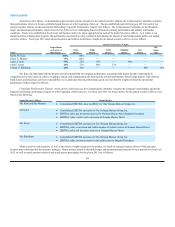

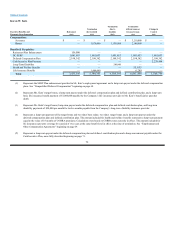

(5) Nonqualified stock options designated as Accreting Options granted on October 1, 2011 which vested 20% on the first anniversary of October 1, 2011

and thereafter in forty-eight equal monthly installments over the forty-eight months following the first anniversary of October 1, 2011, beginning on

November 1, 2012 and becoming fully vested on October 1, 2016. The options were granted at the initial exercise price of $1,850 per share, adjusted to

$1,415.00 following the 2012 Dividend declaration on March 28, 2012, which will increase at a 10% compound rate on each anniversary of October 1,

2011 until the earlier to occur of 1) the exercise of the option, 2) October 1, 2016, or 3) the occurrence of a change of control, or in the event the equity

investors sell a portion of their investment, with respect to a portion of the options bearing the same ratio as the portion of the equity investor’s equity

sold. On October 1, 2013, the option price of the Accreting Options will increase to $1,712.15 per share per 10% compound rate annual increase as

described above in this footnote.

(6) Nonqualified stock options designated as Fixed Price Options granted on October 1, 2011 at the initial exercise price of $1,850 per share, adjusted to

$1,415.00 following the 2012 Dividend declaration on March 28, 2012, which vested 20% on the first anniversary of October 1, 2011 and thereafter in

forty-eight equal monthly installments over the forty-eight months following the first anniversary of October 1, 2011, beginning on the one-month

anniversary of such first anniversary and becoming fully vested on October 1, 2016, subject to earlier vesting in certain circumstances following a

change of control.

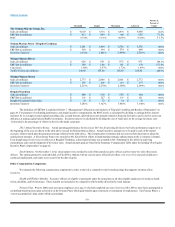

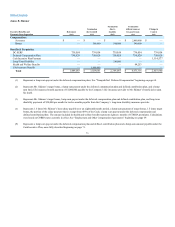

(7) Nonqualified stock options designated as Fixed Price Options granted on November 7, 2012 at the exercise price of $2,025 per share which vest 20% on

the first anniversary of November 7, 2012 and thereafter in forty-eight equal monthly installments over the forty-eight months following the first

anniversary of November 7, 2012, beginning on the one-month anniversary of such first anniversary and becoming fully vested on November 7, 2017,

subject to earlier vesting in certain circumstances following a change of control.

(8) Nonqualified stock options designated as Accreting Options granted on May 25, 2012 which vested 20% on the first anniversary of May 25, 2012 and

thereafter in forty-eight equal monthly installments over the forty-eight months following the first anniversary of May 25, 2012, beginning on June 25,

2013 and becoming fully vested on May 25, 2017. The options were granted at the initial exercise price of $1,812 per share which will increase at a 10%

compound rate on each anniversary of May 25, 2012 until the earlier to occur of 1) the exercise of the option, 2) May 25, 2017, or 3) the occurrence of a

change of control, or in the event the equity investors sell a portion of their investment, with respect to a portion of the options bearing the same ratio as

the portion of the equity investor’s equity sold. On May 25, 2014, the option price of the Accreting Options will increase to $2,192.52 per share per

10% compound rate annual increase as described above in this footnote. These options were granted in connection with Mr. Schulman’s commencing

employment with us.

(9) Nonqualified stock options designated as Fixed Price Options granted on May 25, 2012 at the commencing exercise price of $1,812 per share which

vest 20% on the first anniversary of May 25, 2012 and thereafter in forty-eight equal monthly installments over the forty-eight months following the first

anniversary of May 25, 2012, beginning on the one-month anniversary of such first anniversary and becoming fully vested on May 25, 2017, subject

to earlier vesting in certain circumstances following a change of control.

66