Neiman Marcus 2012 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2012 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

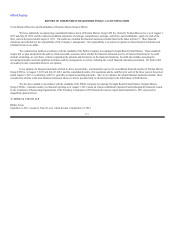

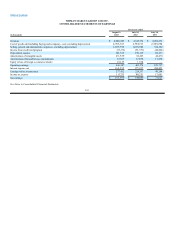

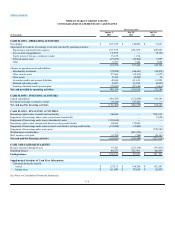

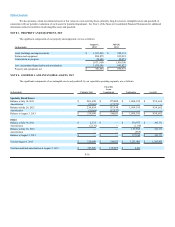

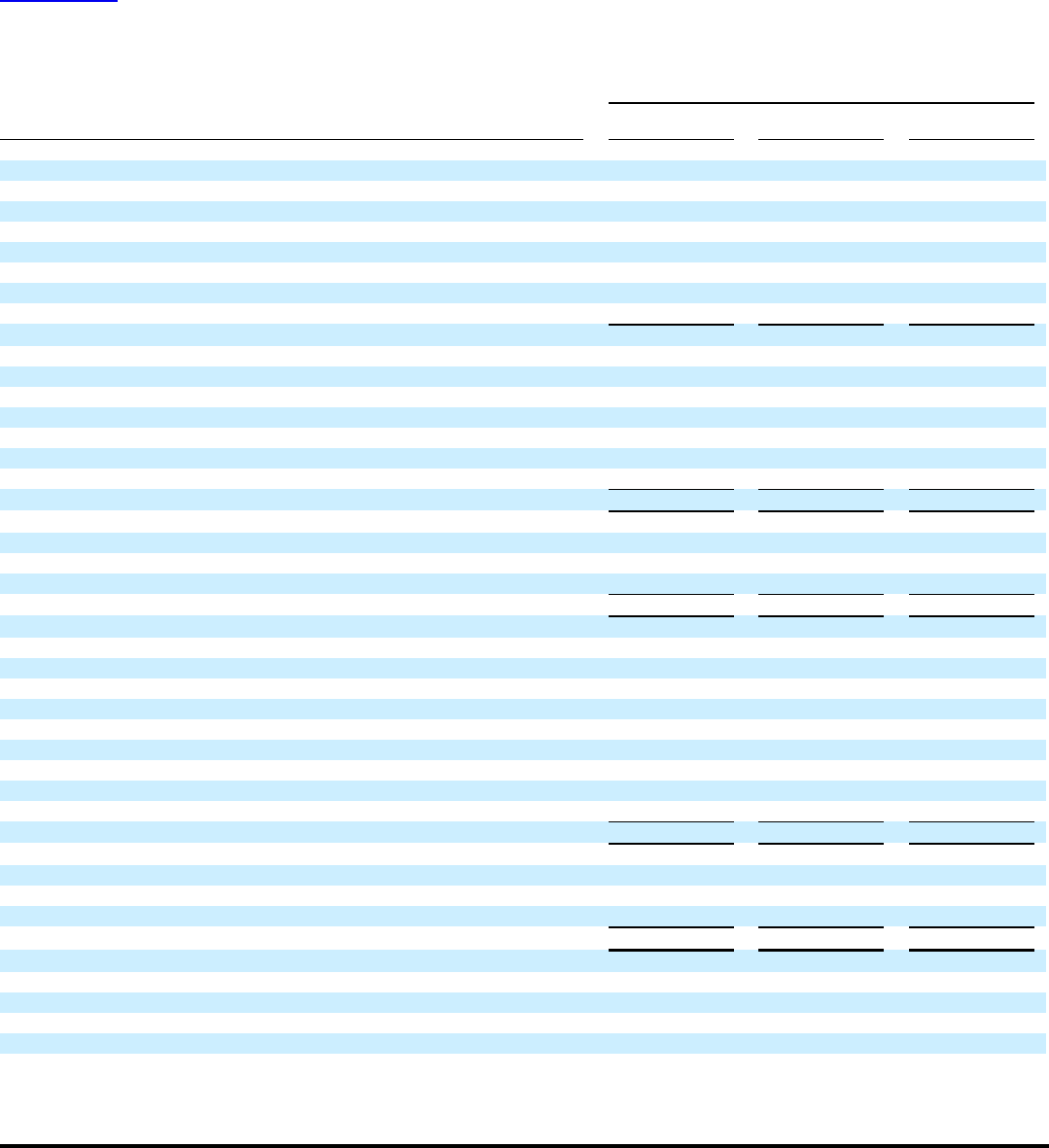

NEIMAN MARCUS GROUP LTD INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

Fiscal year ended

(in thousands)

August 3,

2013

July 28,

2012

July 30,

2011

CASH FLOWS - OPERATING ACTIVITIES

Net earnings $163,699 $140,086 $ 31,623

Adjustments to reconcile net earnings to net cash provided by operating activities:

Depreciation and amortization expense 197,355 188,699 209,642

Loss on debt extinguishment 15,597 —70,388

Equity in loss of foreign e-commerce retailer 13,125 1,514 —

Deferred income taxes (19,439) (10,094)3,967

Other 5,633 7,004 7,082

375,970 327,209 322,702

Changes in operating assets and liabilities:

Merchandise inventories (79,022) (100,483)(48,818)

Other current assets 27,664 (10,810) (3,527)

Other assets 2,495 (4,495) 79

Accounts payable and accrued liabilities 42,604 62,611 21,520

Deferred real estate credits 4,697 15,059 10,428

Funding of defined benefit pension plan (25,049) (29,281)(30,000)

Net cash provided by operating activities 349,359 259,810 272,384

CASH FLOWS - INVESTING ACTIVITIES

Capital expenditures (146,505) (152,838) (94,181)

Investment in foreign e-commerce retailer (10,000) (29,421) —

Net cash used for investing activities (156,505)(182,259) (94,181)

CASH FLOWS - FINANCING ACTIVITIES

Borrowings under senior secured term loan facility 500,000 —554,265

Repayment of borrowings under senior secured term loan facility — — (7,648)

Repayment of borrowings under senior subordinated notes (510,668) — —

Borrowings under senior secured asset-based revolving credit facility 100,000 175,000 —

Repayment of borrowings under senior secured asset-based revolving credit facility (185,000)(75,000) —

Repayment of borrowings under senior notes — — (790,289)

Distributions to stockholders —(449,295) —

Debt issuance costs paid (9,763) (594) (33,947)

Net cash used for financing activities (105,431) (349,889) (277,619)

CASH AND CASH EQUIVALENTS

Increase (decrease) during the year 87,423 (272,338)(99,416)

Beginning balance 49,253 321,591 421,007

Ending balance $136,676 $49,253 $321,591

Supplemental Schedule of Cash Flow Information:

Cash paid during the year for:

Interest $ 153,131 $ 164,700 $195,543

Income taxes $111,085 $78,854 $22,458

See Notes to Consolidated Financial Statements.

F-8