Neiman Marcus 2012 Annual Report Download - page 123

Download and view the complete annual report

Please find page 123 of the 2012 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177

|

|

Table of Contents

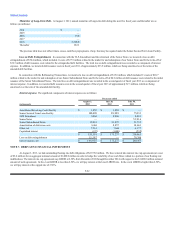

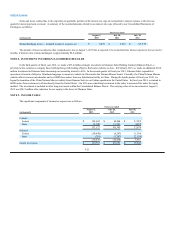

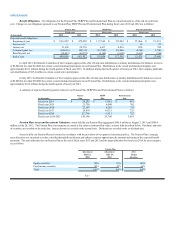

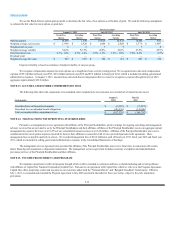

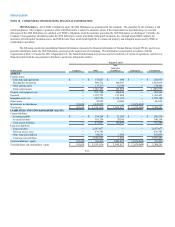

The following tables set forth by level, within the fair value hierarchy, the Pension Plan’s assets at fair value as of August 3, 2013 and July 28,

2012.

August 3, 2013

(in thousands) Level 1 Level 2 Level 3 Total

Equity securities:

Common/collective trusts $ — $ 12,279 $ — $ 12,279

Hedge funds — — 176,951 176,951

Limited partnership interests — — 4,197 4,197

Fixed income securities:

Corporate debt securities —34,204 —34,204

Mutual funds 93,033 — — 93,033

U.S. government securities 12,630 — — 12,630

Common/collective trusts — 47,178 — 47,178

Other —5,366 —5,366

Total investments $105,663 $99,027 $ 181,148 $ 385,838

July 28, 2012

(in thousands) Level 1 Level 2 Level 3 Total

Equity securities:

Corporate stock $ 7,036 $ — $ — $ 7,036

Mutual funds 10,387 — — 10,387

Common/collective trusts —57,630 —57,630

Hedge funds — — 109,026 109,026

Limited partnership interests — — 23,048 23,048

Fixed income securities:

Corporate debt securities —44,149 —44,149

Mutual funds 126,585 — — 126,585

U.S. government securities 6,952 — — 6,952

Other —5,086 —5,086

Total investments $150,960 $106,865 $132,074 $389,899

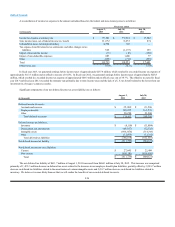

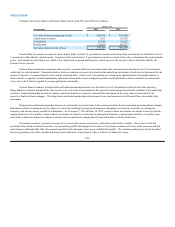

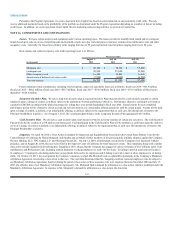

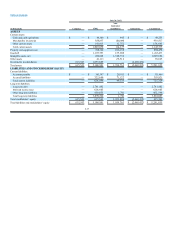

The table below sets forth a summary of changes in the fair value of our Pension Plan’s Level 3 investment assets for the fiscal years 2013 and 2012.

Fiscal years

(in thousands) 2013 2012

Balance, beginning of year $132,074 $163,219

Purchases 133,462 32,697

Sales (96,672)(63,431)

Realized gains 15,257 5,998

Unrealized losses relating to investments sold (17,041)(9,278)

Unrealized gains relating to investments still held 14,068 2,869

Balance, end of year $ 181,148 $ 132,074

F-29