Neiman Marcus 2012 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2012 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

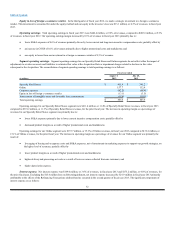

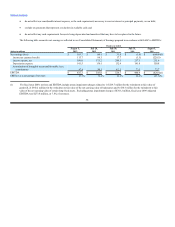

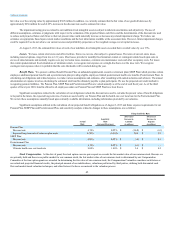

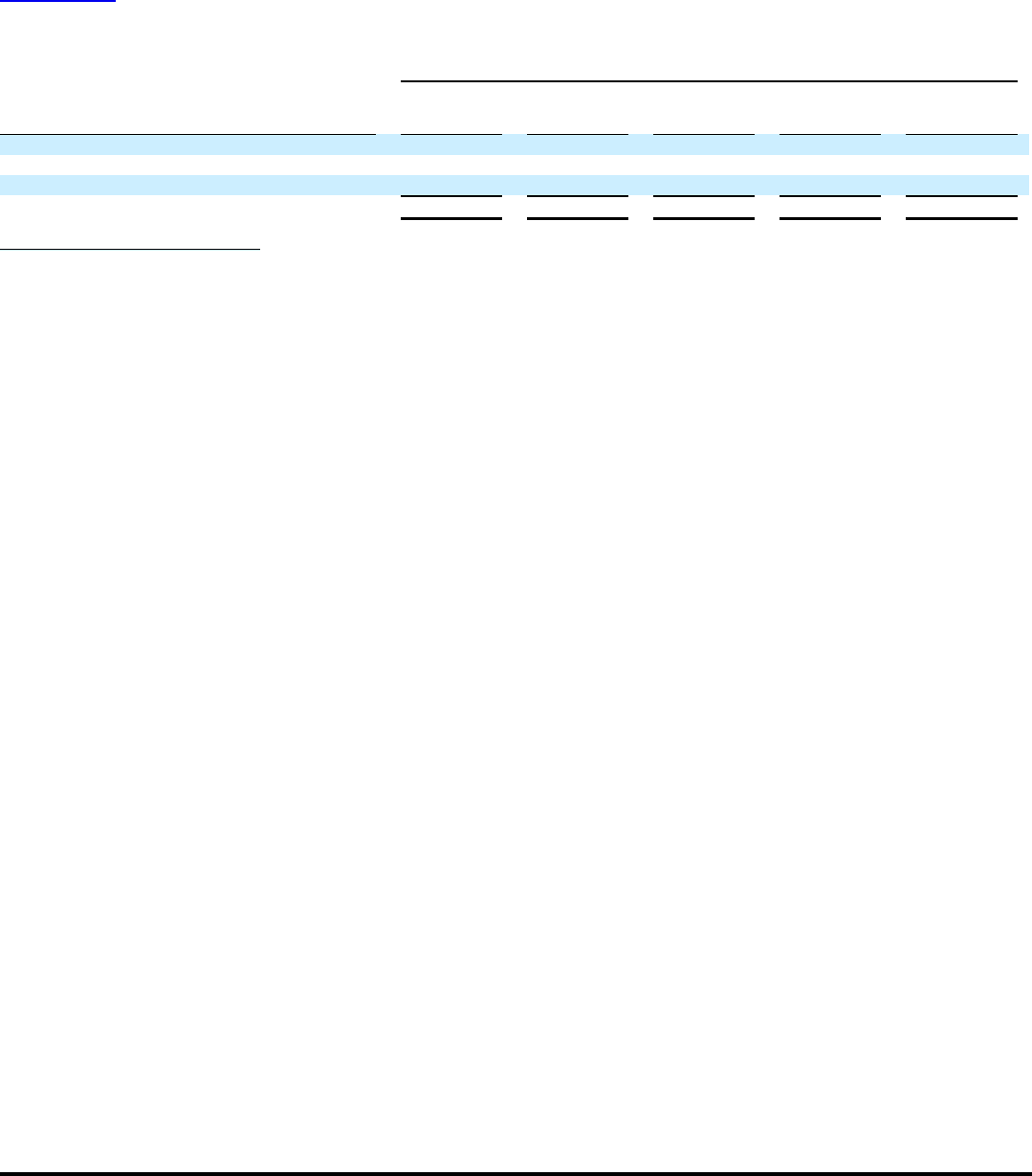

The following table summarizes the expiration of our other significant commercial commitments outstanding at August 3, 2013:

Amount of Commitment by Expiration Period

Fiscal Fiscal Fiscal Fiscal Year

Year Years Years 2019 and

(in thousands) Total 2014 2015-2016 2017-2018 Beyond

Other commercial commitments:

Senior Secured Asset-Based Revolving Credit Facility (1) $700,000 $ — $ 700,000 $ — $ —

Surety bonds 5,066 4,901 165 — —

$705,066 $ 4,901 $ 700,165 $ — $ —

(1) As of August 3, 2013, we had $15.0 million of borrowings outstanding under our Senior Secured Asset-Based Revolving Credit Facility, no

outstanding letters of credit and $615.0 million of unused borrowing availability. Our working capital requirements are greatest in the first and

second fiscal quarters as a result of higher seasonal requirements. See “—Financing Structure at August 3, 2013—Senior Secured Asset-Based

Revolving Credit Facility” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Seasonality.”

In addition to the items presented above, our other principal commercial commitments are comprised of common area maintenance costs, tax and

insurance obligations and contingent rent payments.

We had no off-balance sheet arrangements, other than operating leases entered into in the normal course of business, during fiscal year 2013.

OTHER MATTERS

Factors That May Affect Future Results

Matters discussed in this Annual Report on Form 10-K include forward-looking statements. Forward-looking statements generally can be identified

by the use of forward-looking terminology such as “may,” “plan,” “predict,” “expect,” “estimate,” “intend,” “would,” “could,” “should,” “anticipate,”

“believe,” “project” or “continue.” We make these forward-looking statements based on our expectations and beliefs concerning future events, as well as

currently available data. While we believe there is a reasonable basis for our forward-looking statements, they involve a number of risks and uncertainties.

Therefore, these statements are not guarantees of future performance and you should not place undue reliance on them. A variety of factors could cause our

actual results to differ materially from the anticipated or expected results expressed in our forward-looking statements. Factors that could affect future

performance include, but are not limited, to:

General Economic and Political Conditions

· weakness in domestic and global capital markets and other economic conditions and the impact of such conditions on our ability to obtain

credit;

· general economic and political conditions or changes in such conditions including relationships between the United States and the countries

from which we source our merchandise;

· economic, political, social or other events resulting in the short- or long-term disruption in business at our stores, distribution centers or offices;

Customer Considerations

· changes in consumer confidence resulting in a reduction of discretionary spending on goods;

· changes in the demographic or retail environment;

· changes in consumer preferences or fashion trends;

· changes in our relationships with customers due to, among other things, our failure to provide quality service and competitive loyalty

programs, our inability to provide credit pursuant to our proprietary credit card

41