Neiman Marcus 2012 Annual Report Download - page 127

Download and view the complete annual report

Please find page 127 of the 2012 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Pursuant to the Program Agreement, we receive payments from Capital One based on sales transacted on our proprietary credit cards. We may

receive additional payments based on the profitability of the portfolio as determined under the Program Agreement depending on a number of factors including

credit losses. In addition, we receive payments from Capital One for marketing and servicing activities we provide to Capital One.

NOTE 16. COMMITMENTS AND CONTINGENCIES

Leases. We lease certain property and equipment under various operating leases. The leases provide for monthly fixed rentals and/or contingent

rentals based upon sales in excess of stated amounts and normally require us to pay real estate taxes, insurance, common area maintenance costs and other

occupancy costs. Generally, the leases have primary terms ranging from two to 99 years and include renewal options ranging from two to 80 years.

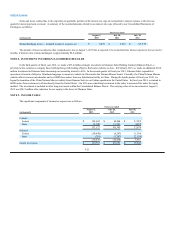

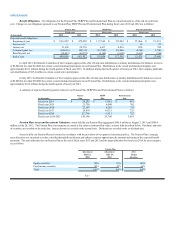

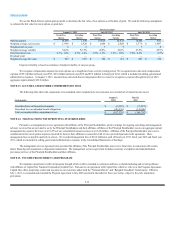

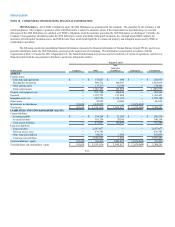

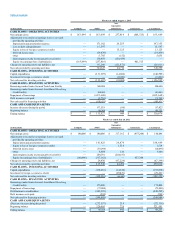

Rent expense and related occupancy costs under operating leases is as follows:

Fiscal year ended

August 3, July 28, July 30,

(in thousands) 2013 2012 2011

Minimum rent $60,100 $58,300 $55,800

Contingent rent 28,200 25,600 23,900

Other occupancy costs 16,300 14,800 14,400

Amortization of deferred real estate credits (7,900)(6,800) (6,500)

Total rent expense $96,700 $91,900 $ 87,600

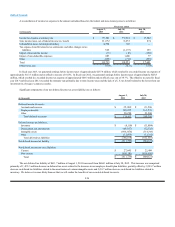

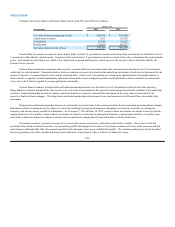

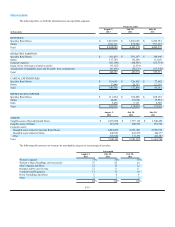

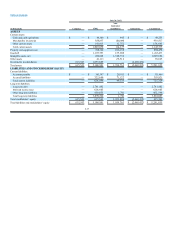

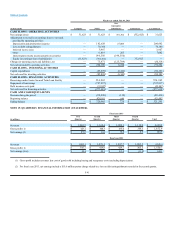

Future minimum rental commitments, excluding renewal options, under non-cancelable leases are as follows: fiscal year 2014—$61.9 million;

fiscal year 2015—$60.2 million; fiscal year 2016—$58.3 million; fiscal year 2017—$54.6 million; fiscal year 2018—$51.6 million; all fiscal years

thereafter—$628.6 million.

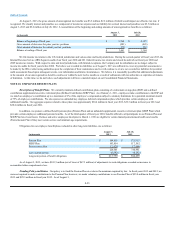

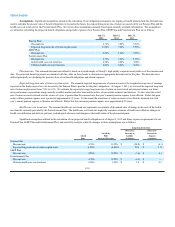

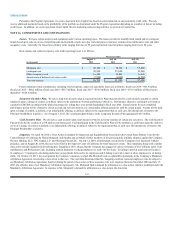

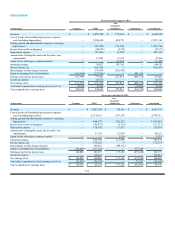

Long-term Incentive Plan. We have a long-term incentive plan (Long-term Incentive Plan) that provides for a cash incentive payable to certain

employees upon a change of control, as defined, subject to the attainment of certain performance objectives. Performance objectives and targets are based on

cumulative EBITDA (as defined in the plan) percentages for rolling three year periods beginning in fiscal year 2006. Earned awards for each completed

performance period will be credited to a book account and will earn interest at a contractually defined annual rate until the award is paid. Awards will be paid

upon a change of control, as defined, or an initial public offering, as defined, subject to the requirement that, in each case, the internal rate of return to the

Principal Stockholders is positive. As of August 3, 2013, the vested participant balance in the Long-term Incentive Plan aggregated $10.6 million.

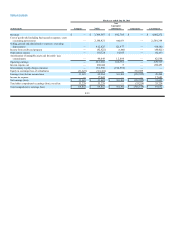

Cash Incentive Plan. We also have a cash incentive plan (Cash Incentive Plan) to aid in the retention of certain key executives. The Cash Incentive

Plan provides for the creation of a $14 million cash bonus pool. Each participant in the Cash Incentive Plan will be entitled to a cash bonus upon the earlier to

occur of a change of control, as defined, or an initial public offering, as defined, subject to the requirement that, in each case, the internal rate of return to the

Principal Stockholders is positive.

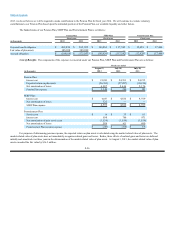

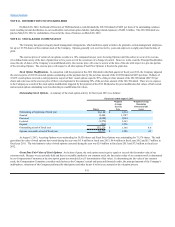

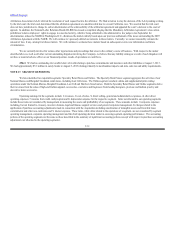

Litigation. On April 30, 2010, a Class Action Complaint for Injunction and Equitable Relief was filed in the United States District Court for the

Central District of California by Sheila Monjazeb, individually and on behalf of other members of the general public similarly situated, against the Company,

Newton Holding, LLC, TPG Capital, L.P. and Warburg Pincus LLC. On July 12, 2010, all defendants except for the Company were dismissed without

prejudice, and on August 20, 2010, this case was refiled in the Superior Court of California for San Francisco County. This complaint, along with a similar

class action lawsuit originally filed by Bernadette Tanguilig in 2007, alleges that the Company has engaged in various violations of the California Labor Code

and Business and Professions Code, including without limitation 1) asking employees to work “off the clock,” 2) failing to provide meal and rest breaks to

its employees, 3) improperly calculating deductions on paychecks delivered to its employees and 4) failing to provide a chair or allow employees to sit during

shifts. On October 24, 2011, the court granted the Company’s motion to compel Ms. Monjazeb and a co-plaintiff to participate in the Company’s Mandatory

Arbitration Agreement, foreclosing a class action in that case. The court then determined that Ms. Tanguilig could not represent employees who are subject to

our Mandatory Arbitration Agreement, thereby limiting the putative class action to those associates who were employed between December 2004 and July 15,

2007 (the effective date of our Mandatory Arbitration Agreement). Ms. Monjazeb filed a demand for arbitration as a class action, which is prohibited under the

Mandatory Arbitration Agreement. In response to Ms. Monjazeb’s demand for arbitration as a class action, the American

F-33