Neiman Marcus 2012 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2012 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

· increased product margins of approximately 0.4% of revenues driven by favorable merchandise mix, higher levels of full-price sales and lower

net markdowns and promotions costs, primarily attributable to our Specialty Retail Stores segment; and

· the leveraging of buying and occupancy costs by 0.2% of revenues on higher revenues; partially offset by

· higher delivery and processing net costs of 0.3% of revenues from our Online segment.

Selling, general and administrative expenses (excluding depreciation). SG&A expenses as a percentage of revenues increased to 23.4% of

revenues in fiscal year 2012 compared to 23.3% of revenues in fiscal year 2011. The net increase in SG&A expenses by 0.1% of revenues in fiscal year 2012

was primarily due to:

· higher marketing and selling costs of approximately 0.3% of revenues primarily due to higher web marketing expenditures at our Online

segment; partially offset by

· favorable payroll and other costs, net of costs incurred in connection with our corporate initiatives, of approximately 0.3% of revenues,

primarily due to the net leveraging of these expenses on higher revenues.

Income from credit card program. We earned credit card Program Income of $51.6 million, or 1.2% of revenues, in fiscal year 2012 compared to

$46.0 million, or 1.1% of revenues, in fiscal year 2011. The increase in income from credit card program is primarily due to improvements in the overall

profitability and performance of the credit card portfolio.

Depreciation expense. Depreciation expense was $130.1 million, or 3.0% of revenues, in fiscal year 2012 compared to $132.4 million, or 3.3% of

revenues, in fiscal year 2011. The decrease in depreciation expense resulted primarily from lower levels of capital expenditures in recent years.

Amortization expense. Amortization expense of intangible assets (primarily customer lists and favorable lease commitments) aggregated

$50.1 million, or 1.1% of revenues, in fiscal year 2012 compared to $62.5 million, or 1.6% of revenues, in fiscal year 2011. The decrease in amortization

expense is primarily due to certain short-lived intangible assets becoming fully amortized.

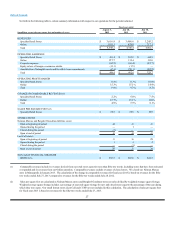

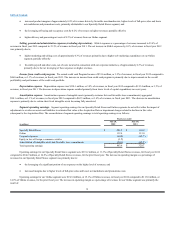

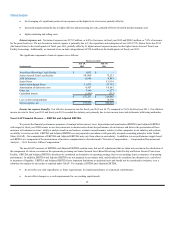

Segment operating earnings. Segment operating earnings for our Specialty Retail Stores and Online segments do not reflect either the impact of

adjustments to revalue our assets and liabilities to estimated fair value at the Acquisition Date or impairment charges related to declines in fair value

subsequent to the Acquisition Date. The reconciliation of segment operating earnings to total operating earnings is as follows:

Fiscal year ended

July 28, July 30,

(in millions) 2012 2011

Specialty Retail Stores $ 391.2 $ 344.9

Online 132.4 113.0

Corporate expenses (68.4)(65.7)

Equity in loss of foreign e-commerce retailer (1.5) —

Amortization of intangible assets and favorable lease commitments (50.1)(62.5)

Total operating earnings $403.6 $ 329.7

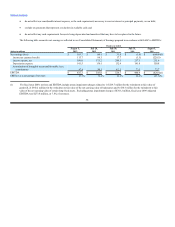

Operating earnings for our Specialty Retail Stores segment were $391.2 million, or 11.3% of Specialty Retail Stores revenues, for fiscal year 2012

compared to $344.9 million, or 10.6% of Specialty Retail Stores revenues, for the prior fiscal year. The increase in operating margin as a percentage of

revenues for our Specialty Retail Stores segment was primarily due to:

· the leveraging of a significant portion of our expenses on the higher level of revenues; and

· increased margins due to higher levels of full-price sales and lower net markdowns and promotions costs.

Operating earnings for our Online segment were $132.4 million, or 15.1% of Online revenues, in fiscal year 2012 compared to $113.0 million, or

14.9% of Online revenues, for the prior fiscal year. The increase in operating margin as a percentage of revenues for our Online segment was primarily the

result of:

34