Neiman Marcus 2012 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2012 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

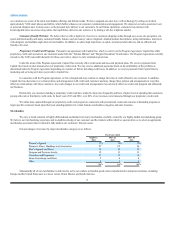

apparel, men’s apparel, shoes and handbags are typically ordered six to nine months in advance of the products being offered for sale while jewelry and other

categories are typically ordered three to six months in advance.

If our sales during any season are significantly lower than we anticipated, we may not be able to adjust our expenditures for inventory and other

expenses in a timely fashion and may be left with unsold inventory. If that occurs, we may be forced to rely on markdowns or promotional sales to dispose of

excess inventory. This could have an adverse effect on our gross margins and operating earnings. Conversely, if we fail to purchase a sufficient quantity of

merchandise, we may not have an adequate supply of products to meet consumer demand, thereby causing us to lose sales or adversely affect our customer

relationships. Any failure on our part to anticipate, identify and respond effectively to changing consumer demands, fashion trends and consumer shopping

preferences could adversely affect our results of operations.

The specialty retail industry is highly competitive.

The specialty retail industry is highly competitive and fragmented. We compete for customers with luxury and premium multi-branded retailers,

designer-owned proprietary boutiques, specialty retailers, national apparel chains, individual specialty apparel stores and online retailers. Many of our

competitors have greater financial resources than we do.

Competition is strong in both the in-store and online channels to attract new customers, maintain relationships with existing customers and obtain

merchandise from key designers. We compete for customers principally on the basis of quality and fashion, customer service, value, assortment and

presentation of merchandise, marketing and customer loyalty programs and store and online ambiance. Our failure to compete successfully based on these and

other factors may have an adverse effect on our results of operations.

Online retailing is rapidly evolving and we expect competition in online markets to intensify in the future. With the expansion of online retailing, we

believe our overall business has become and will continue to become more complex. These changes have forced us to develop new expertise in response to the

new challenges, risks and uncertainties inherent in the delivery of an integrated omni-channel retailing model. For example, we face the risk that our online

operations might cannibalize a significant portion of our specialty retail store sales. Through our omni-channel strategy, we seek to attract as many new

customers as possible to both channels. We also continually analyze our operating results and trends of our online and store channels, as well as the

relationships between these channels, to maximize opportunities to drive incremental sales.

A number of other competitive factors could have an adverse effect on our business, results of operations and financial condition, including:

· competitive pricing strategies, including discounting of merchandise prices and/or the discounting or elimination of revenues collected for

delivery and processing or other services;

· expansion of product or service offerings by existing competitors;

· entry by new competitors into markets in which we currently operate; and

· alteration of the distribution channels used by designers related to the sale of their goods to consumers.

Our business and performance may be affected by our ability to implement our expansion and growth strategies.

To maintain and grow our position as a leading luxury retailer, we must make ongoing investments to support our business goals and objectives. We

make capital investments in our new and existing stores, websites, and distribution and support facilities as well as information technology. We also incur

expenses for headcount, advertising and marketing, professional fees and other costs in support of our growth initiatives. Costs incurred in connection with

our business goals and objectives require us to anticipate our customers’ needs, trends within our industry and our competitors’ actions. In addition, we must

successfully execute the strategies identified to support our business goals and objectives. If we fail to identify appropriate business goals and objectives or if

we fail to execute the actions required to accomplish these goals and objectives, our revenues, customer base and results of operations could be adversely

affected.

New store openings involve certain risks, including constructing, furnishing and supplying a store in a timely and cost effective manner, accurately

assessing the demographic or retail environment at a given location, negotiating favorable lease terms, hiring and training quality staff, obtaining necessary

permits and zoning approvals, obtaining commitments from a core group of vendors to supply the new store, integrating the new store into our distribution

network and building customer awareness and loyalty. We routinely evaluate the need to expand and/or remodel our existing stores. In undertaking store

expansions or remodels, we must complete the expansion or remodel in a timely, cost effective manner, minimize

13