Neiman Marcus 2012 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2012 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

shopping experience for our customers. Capital expenditures for existing stores include 1) expenditures to maintain the ambiance and luxurious shopping

experience within our stores, 2) designer shops within our stores to deepen our relationships with our designers and increase the visibility of select fashion

brands, 3) ongoing investments in technology to support our omni-channel efforts and improve the overall in-store customer experience, 4) minor renovations

of certain areas within the store, including in-store “shop in shops”, and 5) major remodels and renovations and store expansions. With respect to our major

remodels, we only expand after extensive analysis of our projected returns on capital. We generally experience an increase in total revenues at stores that

undergo a remodel or expansion.

We also believe capital investments for information technology in our stores, websites, distribution facilities and support functions are necessary to

support our business strategies. As a result, we are continually upgrading our information systems to improve efficiency and productivity.

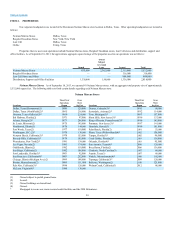

In the past three fiscal years, we have made capital expenditures aggregating $393.5 million related primarily to:

· the construction of a new store in Walnut Creek, California and construction of a distribution facility in Pittston, Pennsylvania;

· e-commerce and technology investments;

· enhancements to merchandising and store systems; and

· the renovation of our main Bergdorf Goodman store on Fifth Avenue in New York City and Neiman Marcus stores in Bal Harbour, Florida and

Chicago, Illinois.

Currently, we project gross capital expenditures for fiscal year 2014 to be approximately $190 to $200 million. Net of developer contributions,

capital expenditures for fiscal year 2014 are projected to be approximately $170 to $180 million.

We receive allowances from developers related to the construction of our stores thereby reducing our cash investment in these stores. We received

construction allowances aggregating $7.2 million in fiscal year 2013 and $10.6 million in fiscal year 2012.

Competition

The specialty retail industry is highly competitive and fragmented. We compete for customers with specialty retailers, luxury and premium multi-

branded retailers, national apparel chains, vendor-owned proprietary boutiques, individual specialty apparel stores and direct-to-consumer marketing firms.

We compete for customers principally on the basis of quality and fashion, customer service, value, assortment and presentation of merchandise, marketing

and customer loyalty programs and, in the case of Neiman Marcus and Bergdorf Goodman, store ambiance. Retailers that compete with us for distribution of

luxury fashion brands include Saks Fifth Avenue, Nordstrom, Bloomingdale’s, Barneys New York, Net-a-Porter, vendor boutiques and other national,

regional and local retailers.

We believe we differ from other national retailers by our approach to omni-channel retailing, distinctive merchandise assortments, which we believe

are more upscale than other luxury and premium multi-branded retailers, excellent customer service, prime real estate locations, premier online websites and

elegant shopping environments. We believe we differentiate ourselves from regional and local luxury and premium retailers through our omni-channel approach

to business, strong national brand, diverse product selection, loyalty program, customer service, prime shopping locations and strong vendor relationships

that allow us to offer the top merchandise from each vendor. Vendor-owned proprietary boutiques and specialty stores carry a much smaller selection of brands

and merchandise, lack the overall shopping experience we provide and have a limited number of retail locations.

Employees

As of September 18, 2013, we had approximately 15,700 employees. Our staffing requirements fluctuate during the year as a result of the

seasonality of the retail industry. We hire additional temporary associates and increase the hours of part-time employees during seasonal peak selling periods.

Except for certain employees of Bergdorf Goodman representing less than 1% of our total employees, none of our employees are subject to a collective

bargaining agreement. We believe that our relations with our employees are good.

11