Neiman Marcus 2012 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2012 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

more than a prorated portion of the target bonus for the year of termination, an amount representing the monthly premium cost of certain continued medical

benefits for eighteen months, 1.5 times annual base salary, and 1.5 times annual target bonus. The agreements contain an eighteen-month noncompetition

agreement along with related confidentiality, non-disparagement, and intellectual property provisions and conditions receipt of the severance pay just described

on compliance with those provisions.

Confidentiality, Non-Competition and Termination Benefits Agreements

Messrs. Koryl and Schulman are each a party to a confidentiality, non-competition and termination benefits agreement that will provide for severance

benefits if the employment of the affected individual is terminated by the Company other than in the event of death, “disability” or termination for “cause.”

These agreements provide for a severance payment equal to one and one-half annual base salary payable over an eighteen-month period, and reimbursement for

COBRA premiums for the same period. Each confidentiality, non-competition and termination benefits agreement contains restrictive covenants as a condition

to receipt of any payments payable thereunder.

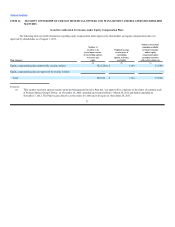

Cash Incentive Plan

Following the consummation of the Acquisition, the Neiman Marcus Group LTD Inc. Cash Incentive Plan (referred to as the Cash Incentive Plan)

was adopted to aid in the retention of certain key executives, including the named executive officers. The Cash Incentive Plan provides for a $14 million cash

bonus pool to be shared by the participants based on the number of eligible stock options, as determined by the Compensation Committee, granted to each

such participant pursuant to the Management Equity Incentive Plan. Each participant in the Cash Incentive Plan will be entitled to a cash bonus upon the

earlier to occur of a change of control or an initial public offering in which at least 20% of the outstanding shares are registered, provided that, in each case, the

internal rate of return to certain of our investors is positive. If the internal rate of return to certain of our investors is not positive, no amounts will be paid

under the Cash Incentive Plan. The Cash Incentive Plan was adopted in connection with the acquisition of NMG by the Principal Stockholders, and was

intended to align the interests of certain key executives with those of the Principal Stockholders. Furthermore, it has been our experience that it often takes a

long period of time to consummate a change of control transaction with a large retail company. As a result, it was our view and the view of the Principal

Stockholders that a “single trigger” payment upon a qualifying “initial public offering” or “change of control” of us (as those terms are defined under the Cash

Incentive Plan) correctly aligns the interests of management, on the one hand, and us and our stockholders, on the other hand, and also provides us with an

effective and durable retention mechanism that incentivizes each named executive officer to remain with us prior to the consummation of such an event.

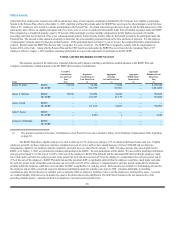

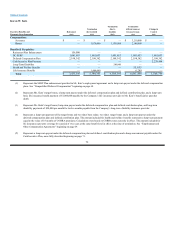

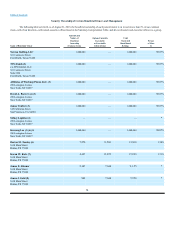

Currently, each of the named executive officers would be entitled to receive the following percentages of the $14 million cash bonus pool (less the

$3,080,911 payable to Mr. Tansky) on August 3, 2013, assuming there was a “change of control” or an “initial public offering” on that date, and the rate of

return to the Principal Stockholders was positive:

Percentage of

Name Cash Bonus Pool

Karen W. Katz 20.42%

James E. Skinner 10.21

James J. Gold 10.21

John E. Koryl 4.28

Joshua G. Schulman 2.24

All required federal, state, or local government tax will be withheld from all payments made to participants under the Cash Incentive Plan. No

payments have been made under the Cash Incentive Plan.

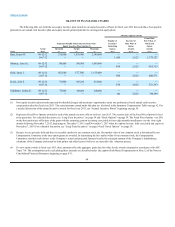

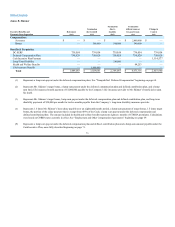

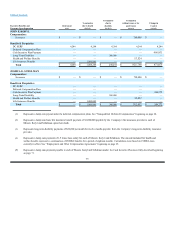

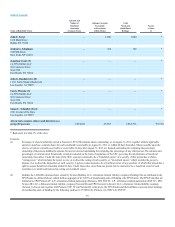

Potential Payments Upon Termination or Change-in-Control

The tables below show certain potential payments that would have been made to the other named executive officers if his or her employment had

terminated on August 3, 2013 under various scenarios, including a change of control. Because the payments to be made to a named executive officer depend

on several factors, the actual amounts to be paid out upon a named executive officer’s termination of employment can only be determined at the time of an

executive’s separation from us.

71