Neiman Marcus 2012 Annual Report Download

Download and view the complete annual report

Please find the complete 2012 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

(Mark One)

xx ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT

OF 1934

For the fiscal year ended August 3, 2013

OR

¨¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE

ACT OF 1934

For the transition period from to

Commission file no. 333-133184-12

Neiman Marcus Group LTD Inc.

(Exact name of registrant as specified in its charter)

Delaware

(State or other jurisdiction of

incorporation or organization)

20-3509435

(I.R.S. Employer

Identification No.)

1618 Main Street

Dallas, Texas

(Address of principal executive offices)

75201

(Zip code)

Registrant’s telephone number, including area code: (214) 743-7600

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of

1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing

requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data file

required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was

required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained,

to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to

this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company.

See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ¨Accelerated filer ¨

Non-accelerated filer x

(Do not check if a smaller reporting company)

Smaller reporting company ¨

Table of contents

-

Page 1

... period from Commission file no. 333-133184-12 to Neiman Marcus Group LTD Inc. (Exact name of registrant as specified in its charter) Delaware (State or other jurisdiction of incorporation or organization) 20-3509435 (I.R.S. Employer Identification No.) 1618 Main Street Dallas, Texas (Address... -

Page 2

... is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x The aggregate market value of the registrant's voting and non-voting common equity held by non-affiliates of the registrant is zero. The registrant is a privately held corporation. As of September 18, 2013, the registrant had... -

Page 3

... Disclosures about Market Risk Financial Statements and Supplementary Data Changes in and Disagreements with Accountants on Accounting and Financial Disclosure Controls and Procedures Other Information Directors, Executive Officers and Corporate Governance Executive Compensation Security Ownership... -

Page 4

... in New York City. Neiman Marcus and Bergdorf Goodman cater to a highly affluent customer, offering distinctive luxury women's and men's apparel and accessories, handbags, cosmetics, shoes and designer and precious jewelry. In addition, we operate 36 off-price, smaller format stores under the brand... -

Page 5

... most cases, in-store restaurants. When combined with our strong selling culture, our stores provide our customers with a luxurious and enjoyable shopping experience. Through Bergdorf Goodman, we believe we are the premier luxury multi-branded retailer in New York City, providing our customers with... -

Page 6

... Our senior leadership team has deep experience across a broad range of disciplines in the retail industry including sales, marketing, merchandising, operations, logistics, information technology, e-commerce, real estate and finance. Karen Katz, our Director, President and Chief Executive Officer... -

Page 7

...of our retail stores, our upscale direct-to-consumer retailing operation (Online) conducts online sales of fashion apparel, handbags, shoes, accessories and home furnishings through the Neiman Marcus and Bergdorf Goodman brands and online sales of home furnishings and accessories through the Horchow... -

Page 8

... weeks ended July 30, 2011. References to fiscal year 2014 and years thereafter relate to our fiscal years for such periods. We make our annual reports on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K, and related amendments, available free of charge through our website... -

Page 9

.... Neiman Marcus and Bergdorf Goodman's social media platforms include blogs, Twitter feeds and facebook pages. Social content includes insider fashion news, designer profiles, product promotion, customer service and event support. Posts and replies to customers are updated multiple times per day... -

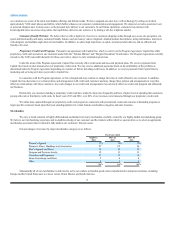

Page 10

... address our customers' lifestyle needs. Our percentages of revenues by major merchandise category are as follows: Fiscal year ended August 3, 2013 July 28, 2012 July 30, 2011 Women's Apparel Women's Shoes, Handbags and Accessories Men's Apparel and Shoes Designer and Precious Jewelry Cosmetics... -

Page 11

...in handbags. Men's Apparel and Shoes: Men's apparel and shoes include suits, dress shirts and ties, sport coats, jackets, trousers, casual wear and eveningwear as well as business and casual footwear. Bergdorf Goodman has a fully dedicated men's store on Fifth Avenue in New York. Our primary vendors... -

Page 12

...addition, our sales associates can use the program to ship items directly to our customers, thereby improving customer service and increasing productivity. This program also helps us to restock inventory at individual stores more efficiently, to maximize the opportunity for full-price selling and to... -

Page 13

... apparel stores and direct-to-consumer marketing firms. We compete for customers principally on the basis of quality and fashion, customer service, value, assortment and presentation of merchandise, marketing and customer loyalty programs and, in the case of Neiman Marcus and Bergdorf Goodman, store... -

Page 14

... the performance of the financial, equity and credit markets; the level of consumer spending, debt and savings; and current and expected tax rates and policies. The merchandise we sell consists of luxury retail goods. The purchase of these goods by customers is discretionary, and therefore highly... -

Page 15

... and fashion, customer service, value, assortment and presentation of merchandise, marketing and customer loyalty programs and store and online ambiance. Our failure to compete successfully based on these and other factors may have an adverse effect on our results of operations. Online retailing is... -

Page 16

... of capital. In response, our vendors may attempt to increase their prices, alter historical credit and payment terms available to us or take other actions. Any of these actions could have an adverse impact on our relationship with the vendor or constrain the amounts or timing of our purchases from... -

Page 17

... in business and increased costs. We outsource some technology-related business processes to third parties. These include credit card authorization and processing, insurance claims processing, payroll processing, record keeping for retirement and benefit plans and certain information technology... -

Page 18

... to customers and have a related marketing and servicing alliance with affiliates of Capital One Financial Corporation (Capital One). Pursuant to an agreement with Capital One, which we refer to as the Program Agreement, Capital One currently offers credit cards and non-card payment plans. Pursuant... -

Page 19

... and/or govern the importation, promotion and sale of merchandise, regulate wage and hour matters with respect to our employees and govern the operation of our retail stores and warehouse facilities. Although we undertake to monitor changes in these laws, if these laws or the interpretations of... -

Page 20

... contain restrictions that may limit our flexibility in operating our business. Neiman Marcus Group LTD Inc. is a holding company and, accordingly, substantially all of our operations are conducted through NMG. The credit agreements governing our senior secured credit facilities and the indenture... -

Page 21

...in other business activities. Risks Related to Our Organization and Structure Because NMG accounts for substantially all of our operations, we are subject to all risks applicable to NMG and dependent upon NMG's distributions to us. Neiman Marcus Group LTD Inc. is a holding company and, accordingly... -

Page 22

... Online Dallas, Texas New York, New York Dallas, Texas Irving, Texas Properties that we use in our operations include Neiman Marcus stores, Bergdorf Goodman stores, Last Call stores and distribution, support and office facilities. As of September 18, 2013, the approximate aggregate square footage... -

Page 23

... Bergdorf Goodman stores, both of which are located in Manhattan at 58 th Street and Fifth Avenue. The following table sets forth certain details regarding these stores: Bergdorf Goodman Stores Fiscal Year Operations Locations Began Gross Store Sq. Feet New York City (Main)(1) New York City (Men... -

Page 24

... COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES Holders. There is no established public trading market for our common stock. At September 18, 2013, there were 32 holders of record of our common stock. Dividends. On March 28, 2012, the Board of Directors of NMG... -

Page 25

... 1, 2009 Fiscal year ended (in millions, except number of stores and sales per square foot) July 28, 2012 OTHER OPERATING DATA Net capital expenditures (6) Depreciation expense Rent expense and related occupancy costs Change in comparable revenues (7) Number of full-line stores open at period end... -

Page 26

... weeks ended July 28, 2012. (6) (7) (8) Sales per square foot are calculated as Neiman Marcus stores and Bergdorf Goodman stores net sales divided by weighted average square footage. Weighted average square footage includes a percentage of year-end square footage for new and closed stores equal... -

Page 27

...Ares Management LLC and Canada Pension Plan Investment Board (collectively, our Future Sponsors). Under the Merger Agreement, we will be acquired for a purchase price based on a total enterprise value of $6.0 billion (the Future Sponsors' Acquisition). A portion of the purchase price will be used at... -

Page 28

... associated with our growth strategies, during the next twelve months. · OPERATING RESULTS Performance Summary The following table sets forth certain items expressed as percentages of net revenues for the periods indicated. Fiscal year ended August 3, 2013 (a) July 28, 2012 July 30, 2011... -

Page 29

...-two weeks ended July 28, 2012. (2) Sales per square foot are calculated as Neiman Marcus stores and Bergdorf Goodman stores net sales divided by weighted average square footage. Weighted average square footage includes a percentage of year-end square footage for new and closed stores equal to... -

Page 30

... specifically, on luxury goods; our ability to acquire goods meeting customers' tastes and preferences; changes in the level of full-price sales; changes in the level of promotional events conducted; changes in the level of delivery and processing revenues collected from our customers; our ability... -

Page 31

... economic conditions such as rising health care costs. Income from credit card program. We maintain a proprietary credit card program through which credit is extended to customers and have a related marketing and servicing alliance with affiliates of Capital One Financial Corporation (Capital 29 -

Page 32

...our customers; increase or decrease based upon the overall profitability and performance of the credit card portfolio due to the level of bad debts incurred or changes in interest rates, among other factors; · increase or decrease based upon future changes to our historical credit card program in... -

Page 33

...; partially offset by higher planned selling and online marketing costs of approximately 0.2% of revenues incurred in connection with the continuing expansion of our e-commerce and omni-channel capabilities. Income from credit card program. We earned credit card Program Income of $53.4 million... -

Page 34

...Acquisition Date or impairment charges related to declines in fair value subsequent to the Acquisition. The reconciliation of segment operating earnings to total operating earnings is as follows: Fiscal year ended (in millions) August 3, 2013 July 28, 2012 Specialty Retail Stores Online Corporate... -

Page 35

... tax authorities or expiration of statutes of limitation. At this time, we do not believe such adjustments will have a material impact on our Consolidated Financial Statements. Fiscal Year Ended July 28, 2012 Compared to Fiscal Year Ended July 30, 2011 Revenues. Our revenues for fiscal year 2012... -

Page 36

...impairment charges related to declines in fair value subsequent to the Acquisition Date. The reconciliation of segment operating earnings to total operating earnings is as follows: Fiscal year ended (in millions) July 28, 2012 July 30, 2011 Specialty Retail Stores Online Corporate expenses Equity... -

Page 37

... - 2013 Executive Officer Compensation." The non-GAAP measures of EBITDA and Adjusted EBITDA contain some, but not all, adjustments that are taken into account in the calculation of the components of various covenants in the agreements governing our Senior Secured Asset-Based Revolving Credit... -

Page 38

... reconciles net earnings as reflected in our Consolidated Statements of Earnings prepared in accordance with GAAP to EBITDA: Fiscal year ended (dollars in millions) August 3, 2013 July 28, 2012 July 30, 2011 July 31, 2010 August 1, 2009 Net earnings (loss) Income tax expense (benefit) Interest... -

Page 39

... vendor payment terms and amounts available pursuant to the Asset-Based Revolving Credit Facility will be sufficient to fund our cash requirements through the end of fiscal year 2014, including merchandise purchases, anticipated capital expenditure requirements, debt service requirements, income tax... -

Page 40

Table of Contents related to remodels of our Bergdorf Goodman and Bal Harbour stores and information technology enhancements. During fiscal year 2013, we also incurred capital expenditures for the renovation of our Michigan Avenue Neiman Marcus store (Chicago, Illinois) as well as for the ... -

Page 41

... terms are defined in the credit agreement, for the period of the most recently ended four full consecutive fiscal quarters. Required excess cash flow payments commence at 50% of NMG's annual excess cash flow (which percentage will be reduced to 25% if NMG's leverage ratio is equal to or less than... -

Page 42

...00%, plus applicable margins. As a consequence of the LIBOR floor rate, we estimate that a 1% increase in LIBOR would not significantly impact our annual interest requirements during fiscal year 2014. At August 3, 2013 (the most recent measurement date), our actuarially calculated projected benefit... -

Page 43

... availability. Our working capital requirements are greatest in the first and second fiscal quarters as a result of higher seasonal requirements. See "-Financing Structure at August 3, 2013-Senior Secured Asset-Based Revolving Credit Facility" and "Management's Discussion and Analysis of Financial... -

Page 44

... to protect customer data or comply with regulations surrounding information security and privacy; Industry and Competitive Factors · competitive responses to our loyalty program, marketing, merchandising and promotional efforts or inventory liquidations by vendors or other retailers; changes in... -

Page 45

... Consolidated Financial Statements. Revenues. Revenues include sales of merchandise and services and delivery and processing revenues related to merchandise sold. Revenues are recognized at the later of the point of sale or the delivery of goods to the customer. Revenues associated with gift cards... -

Page 46

... the weighted average cost of capital. The assessment of the recoverability of the goodwill associated with our Neiman Marcus stores, Bergdorf Goodman stores and Online reporting units involves a two-step process. The first step requires the comparison of the estimated enterprise fair value of each... -

Page 47

... Plan are valued annually as of the end of each fiscal year. As of the third quarter of fiscal year 2010, benefits offered to all employees under our Pension Plan and SERP Plan have been frozen. Significant assumptions related to the calculation of our obligations include the discount rates used... -

Page 48

... to correct or update this information. "Bausch & Lomb, an eye health company, makes sales of human healthcare products to benefit patients in Iran under licenses issued by the U.S. Department of the Treasury's Office of Foreign Assets Control ("OFAC"). In 2012, Bausch & Lomb was granted licenses... -

Page 49

...the LIBOR floor rate described above, we estimate that a 1% increase in LIBOR would not significantly impact our annual interest requirements during fiscal year 2014. The effects of changes in the U.S. equity and bond markets serve to increase or decrease the value of pension plan assets, resulting... -

Page 50

... Consolidated Financial Statements of the Company and supplementary data are included as pages F-1 through F-42 at the end of this Annual Report on Form 10-K: Page Number Index Management's Report on Internal Control Over Financial Reporting Reports of Independent Registered Public Accounting Firm... -

Page 51

... Chief Executive Officer Executive Vice President, Chief Operating Officer, and Chief Financial Officer President of Specialty Retail President of Neiman Marcus Direct President of Bergdorf Goodman Senior Vice President, Chief Marketing Officer Senior Vice President, Properties and Store Development... -

Page 52

... President, Director of Stores and Store Operations from 2006 until 2009; and Senior Vice President, Director of Stores from 2000 until 2006. From August 2012 until July 2013, Mr. Lind was on assignment as Chief Operating Officer of Glamour Sales Holdings Limited, a privately held e-commerce company... -

Page 53

.... As a TPG Cofounder, Mr. Coulter has extensive knowledge of the capital markets and brings an entrepreneurial spirit and keen sense of business acumen to our Board of Directors. John G. Danhakl. Mr. Danhakl is a Managing Partner of Leonard Green & Partners, L.P., a private equity firm specializing... -

Page 54

... as a director and President and Chief Executive Officer of The Neiman Marcus Group, Inc. since May 2001 and as President and Chief Operating Officer from December 1998 until May 2001. He also serves on the boards of directors of Donald Pliner Shoes and The Howard Hughes Corporation. Mr. Tansky... -

Page 55

... on the skills of talented executives who are dedicated to achieving solid financial performance, providing outstanding service to our customers, and managing our assets wisely. Our compensation program, comprised of base salary, annual bonus, long-term incentives and benefits, is designed to meet... -

Page 56

... before the end of each fiscal year as part of our performance and compensation review process as well as at other times to recognize a promotion or change in job responsibilities. Merit increases are usually awarded to the named executive officers in the same percentage range as all employees and... -

Page 57

... information on the adjustments, see "Outstanding Equity Awards at Fiscal Year End" on page 65. On November 7, 2012, stock options were awarded pursuant to the Management Incentive Plan to each of the named executive officers and to twentytwo (22) other senior officers. The number of stock options... -

Page 58

... our named executive officers to take undesirable risks relating to the business. For further information, see "Risk Assessment of Compensation Policies and Programs" above. Role of Management. As part of our annual planning process, the CEO, with assistance from external consultants, develops and... -

Page 59

...We generally target our direct compensation to be positioned between the 50 th and 75th percentile levels of the compensation packages received by executives in our peer group of industry related companies. In the fourth quarter of fiscal year 2012, Haigh & Company conducted a benchmarking review of... -

Page 60

.../number of website visitors at Neiman Marcus Direct · EBITDA, sales and inventory turnover at Neiman Marcus Stores · Consolidated EBITDA and sales for The Neiman Marcus Group, Inc. · EBITDA, sales, inventory turnover and online sales for Bergdorf Goodman Mr. Koryl Mr. Schulman Metrics used... -

Page 61

...extraordinary sales and development of his senior team. Actual amounts paid are listed in the Summary Compensation Table under the heading "Non-Equity Incentive Plan Compensation" on page 62. Stock Options . On November 7, 2012, stock options were awarded to each of the named executive officers and... -

Page 62

... by a group of industry related companies. The Compensation Committee believes that these benefits are aligned with the Company's desire to attract and retain highly skilled management talent for the benefit of all stockholders. The value of these benefits to the named executive officers is set... -

Page 63

...." These agreements provide for a severance payment equal to one and one-half annual base salary of the named executive officer, payable over an eighteen month period, and reimbursement for COBRA premiums for the same period. The employment agreements of Ms. Katz and Messrs. Skinner and Gold contain... -

Page 64

... Compensation Earnings ($)(5) Option Name and Principal Position Fiscal Salary ($)(1) Bonus ($)(2) Awards ($)(3) Non-Equity Incentive Plan Compensation ($)(4) All Other Compensation ($)(6) Total ($) Year 2013 2012 2011 2013 2012 2011 Karen W. Katz President and Chief Executive Officer... -

Page 65

...the fiscal year 2012 and fiscal year 2013 present value of the pension benefits accumulated as of year-end by the named executive officers, assuming that benefit is not paid until age 65. These amounts were computed using the same assumptions used for financial statement reporting purposes under ASC... -

Page 66

... Possible Future Payouts Under NonEquity Incentive Plan Awards (1) Threshold Target Maximum ($) ($) ($) Number of Securities Underlying Options (#)(2) Exercise Or Base Price of Option Awards ($)(3) Grant Date Fair Value of Stock and Option Awards ($)(4) Katz, Karen W. 09-12-12 11-07-12... -

Page 67

Table of Contents OUTSTANDING EQUITY AWARDS AT FISCAL YEAR END The following table sets forth certain information regarding the total number and aggregate value of stock options held by each of our named executive officers at August 3, 2013. Option Awards Number of Securities Underlying Unexercised... -

Page 68

... per share. On December 15, 2013, the exercise price of the Accreting Options that were vested on March 28, 2012 will increase to $1,200.93 per share and the exercise price of the Accreting Options that were unvested on March 28, 2012 will increase to $937.75 per 10% compound rate annual increase as... -

Page 69

... the equity investor's equity sold. On October 1, 2013, the option price of the Accreting Options will increase to $1,712.15 per share per 10% compound rate annual increase as described above in this footnote. Nonqualified stock options designated as Fixed Price Options granted on October 1, 2011 at... -

Page 70

... named executive officers. Number of Years Credited Service Name Plan Name (#)(1) Present Value of Accumulated Benefit ($)(2) Payments During Last Fiscal Year ($) Karen W. Katz Pension Plan SERP Plan Pension Plan SERP Plan Pension Plan SERP Plan Pension Plan SERP Plan Pension Plan SERP Plan 25... -

Page 71

... in the event the employee is terminated for cause. Accounts are credited monthly with interest at an annual rate equal to the prime interest rate published in The Wall Street Journal on the last business day of the preceding calendar quarter. Amounts credited to an employee's account become payable... -

Page 72

.... Accounts are credited monthly with interest at an annual rate equal to the prime interest rate published in The Wall Street Journal on the last business day of the preceding calendar quarter. Vested amounts credited to an employee's account become payable in the form of five annual installments... -

Page 73

... sum equal to (A) 18 times the monthly COBRA premium applicable to Ms. Katz plus (B) two times the sum of her base salary and target bonus, at the level in effect as of the employment termination date; provided, however, that Ms. Katz shall be required to repay this payment if she violates certain... -

Page 74

... severance benefits if the employment of the affected individual is terminated by the Company other than in the event of death, "disability" or termination for "cause." These agreements provide for a severance payment equal to one and one-half annual base salary payable over an eighteen-month period... -

Page 75

...-sum payment equal to the value of 18 months of COBRA premiums. Calculations were based on COBRA rates currently in effect. The amount included for life insurance represents coverage for a period of two years at the same benefit level in effect at the time of termination. See "Employment and Other... -

Page 76

...period, a lump sum payment of target bonus, 1.5 times target bonus, the portion of the salary payment that is exempt from 409A of the Code, a lump sum payout under the deferred compensation and defined contribution plans. The amount included for health and welfare benefits represents eighteen months... -

Page 77

...an eighteen month period, a lump sum payment of target bonus, 1.5 times target bonus, the portion of the salary payment that is exempt from 409A of the Code, a lump sum payout under the defined contribution plan. The amount included for health and welfare benefits represents eighteen months of COBRA... -

Page 78

... provider. Represents a lump sum payment of 1.5 times base salary for each of Messrs. Koryl and Schulman. The amount included for health and welfare benefits represents a continuation of COBRA benefits for a period of eighteen months. Calculations were based on COBRA rates currently in effect. See... -

Page 79

... beginning on October 6, 2010 through December 31, 2013. As an employee director, Ms. Katz receives no compensation for her service as a member of our Board of Directors. In connection with the Acquisition, affiliates of the Principal Stockholders receive an annual management fee equal to the lesser... -

Page 80

... Equity compensation plans not approved by security holders Total 102,126(1) $ - 102,126 $ 1,344 13,666 - 13,666 - 1,344 Footnotes: (1) This number represents options issuable under the Management Incentive Plan that was approved by a majority of the shares of common stock of Neiman Marcus... -

Page 81

... directors and executive officers as a group. Amount and Nature of Beneficial Ownership Name of Beneficial Owner (Common Stock) Options Currently Exercisable or Exercisable within 60 days Total Stock and Stock Based Holdings Percent of Class (1) Newton Holding, LLC 301 Commerce Street Fort Worth... -

Page 82

... 1618 Main Street Dallas, TX 75201 - 1,600 1,600 * Joshua G. Schulman 754 Fifth Street New York, NY 10019 - 708 708 * Jonathan Coslet (9) c/o TPG Global, LLC 301 Commerce Street Suite 3300 - - - * Fort Worth, TX 76102 John G. Danhakl (2) (10) 11111 Santa Monica Boulevard Los Angeles... -

Page 83

.... The mailing address for each of Group Advisors, Advisors III and Messrs. Bonderman and Coulter is c/o TPG Global, LLC, 301 Commerce Street, Suite 3300, Fort Worth, TX 76102. (3) Includes the 1,000,000 shares owned by Holding over which Warburg Pincus Private Equity VIII, L.P., a Delaware limited... -

Page 84

... each directors of Holding and TPG Partners. Mr. Coslet and Ms. Wheeler each have no voting or investment power over and each disclaim beneficial ownership of any common shares held directly by the TPG Funds, WP VIII or WP IX. (10) Mr. Danhakl is a Managing Partner of LGP and a director assignee... -

Page 85

... sources for comparable services or products and 4) the terms available to or from, as the case may be, unrelated third parties or to or from employees generally. Related Person Transactions Newton Holding, LLC Limited Liability Company Operating Agreement The investment funds associated with or... -

Page 86

... to Consolidated Financial Statements for a further description of the management services agreement. Certain Charter and By-Laws Provisions Our Certificate of Incorporation and our Amended and Restated By-Laws contain provisions limiting directors' obligations in respect of corporate opportunities... -

Page 87

.... Principal Accounting Fees and Services Audit Fees. The aggregate fees billed for the audits of the Company's annual financial statements for the fiscal years ended August 3, 2013 and July 28, 2012 and for the reviews of the financial statements included in our Quarterly Reports on Form 10-Q were... -

Page 88

... Current Report on Form 8-K dated September 4, 2013. Incorporated herein by reference to the Company's Quarterly Report on Form 10-Q for the quarter ended April 30, 2011. 2.2 Agreement and Plan of Merger, dated as of September 9, 2013, among Neiman Marcus Group LTD Inc., NM Mariposa Holdings, Inc... -

Page 89

... Bank of New York Trust Company, N.A., as successor trustee. Incorporated herein by reference to the Company's Annual Report on Form 10-K for the fiscal year ended July 30, 2011. 10.1* Director Services Agreement dated April 26, 2010 by and among Neiman Marcus, Inc., The Neiman Marcus Group, Inc... -

Page 90

...The Neiman Marcus Group, Inc., Newton Acquisition, Inc., the Subsidiary Guarantors and Credit Suisse, as administrative agent and collateral agent. 10.13 Incorporated herein by reference to the Company's Annual Report on Form 10-K for the fiscal year ended August 1, 2009. Amendment No. 1, dated as... -

Page 91

... by reference to the Company's Annual Report on Form 10-K for the fiscal year ended July 28, 2012. 10.23* Second Amended and Restated Stock Option Grant Agreement dated March 28, 2012 between Neiman Marcus, Inc. and Burton M. Tansky amending stock option grant of April 1, 2010. Form of Amended and... -

Page 92

... reference to the Company's Quarterly Report on Form 10-Q for the quarter ended 10.32 Second Amended and Restated Credit Card Program Agreement, dated as of July 15, 2013, by and among The Neiman Marcus Group, Inc., Bergdorf Goodman, Inc., and Capital One, National Association. (1) 10.33 Second... -

Page 93

... Equity VIII K.G., Warburg Pincus Private Equity IX, L.P., and the other parties signatory thereto. Incorporated herein by reference to the Company's Quarterly Report on Form 10-Q for the quarter ended January 31, 2009. 10.40* The Neiman Marcus Group, Inc. Key Employee Deferred Compensation Plan... -

Page 94

... of Ratio of Earnings to Fixed Charges. The Neiman Marcus Group, Inc. Code of Ethics and Conduct. The Neiman Marcus Group, Inc. Code of Ethics for Financial Professionals. Incorporated herein by reference to the Company's Annual Report on Form 10-K for the fiscal year ended July 31, 2010. Filed... -

Page 95

... CONSOLIDATED FINANCIAL STATEMENTS Page Management's Report on Internal Control Over Financial Reporting Reports of Independent Registered Public Accounting Firm Consolidated Balance Sheets Consolidated Statements of Earnings Consolidated Statements of Comprehensive Earnings Consolidated Statements... -

Page 96

... public accounting firm that audited our consolidated financial statements included in this Annual Report on Form 10-K, has issued an unqualified attestation report on the effectiveness of our internal controls over financial reporting as of August 3, 2013. KAREN W. KATZ President and Chief... -

Page 97

... the consolidated financial position of Neiman Marcus Group LTD Inc. at August 3, 2013 and July 28, 2012, and the consolidated results of its operations and its cash flows for each of the three years in the period ended August 3, 2013, in conformity with U.S. generally accepted accounting principles... -

Page 98

... of the Public Company Accounting Oversight Board (United States), the consolidated balance sheets of Neiman Marcus Group LTD Inc. as of August 3, 2013 and July 28, 2012, and the related consolidated statements of earnings, comprehensive earnings, cash flows, and stockholders' equity for each... -

Page 99

... NEIMAN MARCUS GROUP LTD INC. CONSOLIDATED BALANCE SHEETS August 3, 2013 July 28, 2012 (in thousands, except shares) ASSETS Current assets: Cash and cash equivalents Merchandise inventories Deferred income taxes Other current assets Total current assets Property and equipment, net Customer... -

Page 100

... STATEMENTS OF EARNINGS Fiscal year ended (in thousands) August 3, 2013 July 28, 2012 July 30, 2011 Revenues $ Cost of goods sold including buying and occupancy costs (excluding depreciation) Selling, general and administrative expenses (excluding depreciation) Income from credit card program... -

Page 101

Table of Contents NEIMAN MARCUS GROUP LTD INC. CONSOLIDATED STATEMENTS OF COMPREHENSIVE EARNINGS Fiscal year ended (in thousands) August 3, 2013 July 28, 2012 July 30, 2011 Net earnings Other comprehensive earnings (loss): Change in unrealized loss on financial instruments, net of tax of ($333... -

Page 102

Table of Contents NEIMAN MARCUS GROUP LTD INC. CONSOLIDATED STATEMENTS OF CASH FLOWS Fiscal year ended (in thousands) August 3, 2013 July 28, 2012 July 30, 2011 CASH FLOWS - OPERATING ACTIVITIES Net earnings Adjustments to reconcile net earnings to net cash provided by operating activities: ... -

Page 103

... NEIMAN MARCUS GROUP LTD INC. CONSOLIDATED STATEMENTS OF STOCKHOLDERS' EQUITY Accumulated Common stock (in thousands) Additional paid-in capital other comprehensive (loss) earnings Retained earnings (deficit) Total stockholders' equity BALANCE AT JULY 31, 2010 Stock-based compensation... -

Page 104

...Contents NEIMAN MARCUS GROUP LTD INC. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS NOTE 1. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES BASIS OF PRESENTATION The Company is a luxury retailer conducting integrated store and online operations principally under the Neiman Marcus and Bergdorf Goodman brand... -

Page 105

... of the acquired merchandise and are recognized at the time the goods are sold. The amounts of vendor allowances we receive fluctuate based on the level of markdowns taken and did not have a significant impact on the year-over-year change in gross margin during fiscal years 2013, 2012 or 2011. We... -

Page 106

... Plan are valued annually as of the end of each fiscal year. As of the third quarter of fiscal year 2010, benefits offered to all employees under our Pension Plan and SERP Plan have been frozen. Significant assumptions related to the calculation of our obligations include the discount rates used... -

Page 107

...fiscal year 2012 and $0.8 million in fiscal year 2011. Income from Credit Card Program . We maintain a proprietary credit card program through which credit is extended to customers and have a related marketing and servicing alliance with affiliates of Capital One Financial Corporation (Capital F-13 -

Page 108

... to make assumptions related to customer purchasing levels and redemption rates. At the time the qualifying sales giving rise to the loyalty program points are made, we defer the portion of the revenues on the qualifying sales transactions equal to the estimated retail value of the gift cards to be... -

Page 109

... the first quarter of fiscal year 2014. We do not expect that the implementation of this standard will have a material impact on our Consolidated Financial Statements. In July 2013, the FASB issued guidance to improve the reporting of unrecognized tax benefits when a net operating loss carryforward... -

Page 110

... and goodwill, by our reportable operating segments, are as follows: Favorable Lease Commitments (in thousands) Customer Lists Tradenames Goodwill Specialty Retail Stores Balance at July 30, 2011 Amortization Balance at July 28, 2012 Amortization Balance at August 3, 2013 Online $ 268,698 (29... -

Page 111

... reserves, plus (b) 85% of the amounts owed by credit card processors in respect of eligible credit card accounts constituting proceeds from the sale or disposition of inventory, less certain reserves. NMG must at all times maintain excess availability of at least the greater of (a) 10% of the... -

Page 112

... interest in personal property consisting of inventory and related accounts, cash, deposit accounts, all payments received by NMG or the subsidiary guarantors from credit card clearinghouses and processors or otherwise in respect of all credit card charges for sales of inventory by NMG and the... -

Page 113

... of separate financial statements of such subsidiary in accordance with applicable Securities and Exchange Commission's (SEC) rules. As a result, the collateral under NMG's Asset-Based Revolving Credit Facility will include shares of capital stock or other securities of subsidiaries of NMG or any... -

Page 114

... of 1.00% and 3) the adjusted one-month LIBOR rate plus 1.00% or (b) an adjusted LIBOR rate (for a period equal to the relevant interest period, and in any event, never less than 1.00%), subject to certain adjustments, in each case plus an applicable margin. The "applicable margin" with respect to... -

Page 115

... interest in personal property consisting of inventory and related accounts, cash, deposit accounts, all payments received by NMG or the subsidiary guarantors from credit card clearinghouses and processors or otherwise in respect of all credit card charges for sales of inventory by NMG and the... -

Page 116

... as follows: Fiscal year ended (in thousands) August 3, 2013 July 28, 2012 July 30, 2011 Asset-Based Revolving Credit Facility Senior Secured Term Loan Facility 2028 Debentures Senior Notes Senior Subordinated Notes Amortization of debt issue costs Other, net Capitalized interest $ 1,453 108... -

Page 117

... expense at the time our quarterly interest payments are made. A summary of the recorded amounts related to our interest rate caps reflected in our Consolidated Statements of Earnings is as follows: Fiscal year ended (in thousands) August 3, 2013 July 28, 2012 July 30, 2011 Realized hedging... -

Page 118

... year ended (in thousands) August 3, 2013 July 28, 2012 July 30, 2011 Income tax expense at statutory rate State income taxes, net of federal income tax benefit Unbenefitted losses in foreign subsidiary Tax expense (benefit) related to tax settlements and other changes in tax liabilities Impact... -

Page 119

... the next twelve months as a result of settlements with tax authorities or expiration of statutes of limitation. At this time, we do not believe such adjustments will have a material impact on our Consolidated Financial Statements. NOTE 10. EMPLOYEE BENEFIT PLANS Description of Benefit Plans. We... -

Page 120

... $ 61 871 (1,556) 690 66 For purposes of determining pension expense, the expected return on plan assets is calculated using the market related value of plan assets. The market related value of plan assets does not immediately recognize realized gains and losses. Rather, these effects of realized... -

Page 121

Table of Contents Benefit Obligations. Our obligations for the Pension Plan, SERP Plan and Postretirement Plan are valued annually as of the end of each fiscal year. Changes in our obligations pursuant to our Pension Plan, SERP Plan and Postretirement Plan during fiscal years 2013 and 2012 are as ... -

Page 122

... integrating relative credit information, observed market movements and sector news, all of which is applied to pricing applications and models. Pension Plan investments in hedge funds and limited partnership interests are classified as Level 3 investments within the fair value hierarchy. Hedge... -

Page 123

...hierarchy, the Pension Plan's assets at fair value as of August 3, 2013 and July 28, 2012. August 3, 2013 (in thousands) Level 1 Level 2 Level 3 Total Equity securities: Common/collective trusts Hedge funds Limited partnership interests Fixed income securities: Corporate debt securities Mutual... -

Page 124

... to our employee benefit plans include the discount rates used to calculate the present value of benefit obligations to be paid in the future, the expected long-term rate of return on assets held by our Pension Plan and the health care cost trend rate for the Postretirement Plan. We review these... -

Page 125

... the date of grant, the stock option exercise price equals or exceeds the fair market value of our common stock. Because we are privately held and there is no public market for our common stock, the fair market value of our common stock is determined by our Compensation Committee at the time option... -

Page 126

... of Capital One Financial Corporation (Capital One). Pursuant to our agreement with Capital One, which we refer to as the Program Agreement, Capital One offers proprietary credit card accounts to our customers under both the "Neiman Marcus" and "Bergdorf Goodman" brand names. Effective July 1, 2013... -

Page 127

... completed performance period will be credited to a book account and will earn interest at a contractually defined annual rate until the award is paid. Awards will be paid upon a change of control, as defined, or an initial public offering, as defined, subject to the requirement that, in each case... -

Page 128

... Neiman Marcus, Bergdorf Goodman, Last Call and Horchow brand names. Both the Specialty Retail Stores and Online segments derive their revenues from the sales of high-end fashion apparel, accessories, cosmetics and fragrances from leading designers, precious and fashion jewelry and decorative home... -

Page 129

... table presents our revenues by merchandise category as a percentage of net sales: Years ended August 3, 2013 July 28, 2012 July 30, 2011 Women's Apparel Women's Shoes, Handbags and Accessories Men's Apparel and Shoes Designer and Precious Jewelry Cosmetics and Fragrances Home Furnishings and... -

Page 130

... of its Bergdorf Goodman stores, and NM Nevada Trust, which holds legal title to certain real property and intangible assets used by NMG in conducting its operations. The following condensed consolidating financial information represents the financial information of Neiman Marcus Group LTD Inc... -

Page 131

Table of Contents July 28, 2012 NonGuarantor Subsidiaries (in thousands) Company NMG Eliminations Consolidated ASSETS Current assets: Cash and cash equivalents Merchandise inventories Other current assets Total current assets Property and equipment, net Goodwill Intangible assets, net Other ... -

Page 132

... expenses (excluding depreciation) Income from credit card program Depreciation expense Amortization of intangible assets and favorable lease commitments Equity in loss of foreign e-commerce retailer Operating earnings Interest expense, net Intercompany royalty charges (income) 135,946 (4,738) 13... -

Page 133

...) Income from credit card program Depreciation expense Amortization of intangible assets and favorable lease commitments Operating earnings Interest expense, net Intercompany royalty charges (income) Equity in (earnings) loss of subsidiaries Earnings (loss) before income taxes Income tax expense Net... -

Page 134

...) during the period Beginning balance Ending balance $ $ 135,827 $ $ $ Fiscal year ended July 28, 2012 NonGuarantor Subsidiaries (in thousands) Company NMG Eliminations Consolidated CASH FLOWS - OPERATING ACTIVITIES Net earnings (loss) Adjustments to reconcile net earnings (loss) to... -

Page 135

F-40 -

Page 136

... during the period Beginning balance Ending balance - - - - (118) 844 $ $ $ 726 $ $ 321,591 NOTE 19. QUARTERLY FINANCIAL INFORMATION (UNAUDITED) Fiscal year 2013 Third Quarter First (in millions) Quarter Second Quarter Fourth Quarter Total Revenues Gross profit (1) Net earnings... -

Page 137

...Ares Management LLC and Canada Pension Plan Investment Board (collectively, our Future Sponsors). Under the Merger Agreement, we will be acquired for a purchase price based on a total enterprise value of $6.0 billion (the Future Sponsors' Acquisition). A portion of the purchase price will be used at... -

Page 138

... Date /s/ KAREN W. KATZ Karen W. Katz /s/ JAMES E. SKINNER James E. Skinner President and Chief Executive Officer, Director September 25, 2013 Executive Vice President, Chief Operating Officer and Chief Financial Officer (principal financial officer) Senior Vice President and Chief Accounting... -

Page 139

... at Beginning of Description Period Charged to Costs and Expenses Charged to Other Accounts Balance at End of Deductions Period Reserve for estimated sales returns Year ended August 3, 2013 Year ended July 28, 2012 Year ended July 30, 2011 Reserves for self-insurance $ $ $ 34,015 $ $ $ 739... -

Page 140

EXHIBIT 12.1 Neiman Marcus Group LTD Inc. Computation of Ratio of Earnings to Fixed Charges (Unaudited) Fiscal year ended (in thousands, except ratios) August 3, 2013 July 28, 2012 July 30, 2011 July 31, 2010 August 1, 2009 Fixed Charges: Interest on debt Amortization of debt discount and ... -

Page 141

... The Neiman Marcus Group, Inc. as "NMG" or the "Company," and both terms should be treated interchangeably. All references to the "associates" means all full time, part time, temporary and seasonal associates of NMG, Neiman Marcus Stores, Neiman Marcus Direct, Neiman Marcus Online, Bergdorf Goodman... -

Page 142

... disciplinary action by simply filing a report, as evidence of misconduct may still be grounds for appropriate disciplinary action. COMPLIANCE WITH LAWS AND RELATED POLICIES FAIR DEALING Associates must deal fairly with all co-workers, customers, vendors, suppliers, competitors, and third parties... -

Page 143

... as value to the customer, costs and competitive pressure in the marketplace. Associates must not communicate either directly or indirectly with competitors concerning sensitive information such as prices charged, sale dates or percentages, business or marketing strategies, profit margins or credit... -

Page 144

..., associates shall notr · · · · share inside information with individuals outside the Company; use or disclose any non-public or inside information about other companies; trade stock or securities of the Company or other firms based on inside information; or advise others to buy or sell... -

Page 145

...can be generally made beginning two (2) business days after the release. For information in a report mailed to stockholders, purchases and sales should not be made until at least one (1) week after the date of mailing. Associates must not discuss Company affairs with securities analysts, members of... -

Page 146

... problems, including, but not limited to, changing an associate's job or changing the reporting relationship between the parties. IMMIGRATION Associates in a supervisory position are required to ensure that they and any associates who work for them comply with all applicable immigration laws... -

Page 147

... majority of an associate's day-to-day problems can and should be handled in this way. Likewise, an associate should talk with his or her manager or supervisor if he or she has any ideas about how to improve the workplace. NMG RESOLUTIONS A 4-Step Process The Neiman Marcus Group, Inc. has adopted... -

Page 148

..., with a few very specific exceptions described in a separate booklet entitled "The Neiman Marcus Group, Inc. Mandatory Arbitration Agreement." It applies to all associates. From top to bottom, all employees of the Company are covered, except for two very specific exclusions that are described in... -

Page 149

... very simple form is available on www.mynmg.com. If you prefer not to use the form, you can email your concerns to [email protected], or send a letter via the U.S. Postal Service addressed tor Neiman Marcus Group c/o Associate Relations One Marcus Square 1618 Main Street Dallas, TX... -

Page 150

...you worked. It usually lasts a day but can last as long as necessary for the evidence to be heard. Associates who are still employed by the Company will not be penalized by loss of pay for attending the arbitration. The Company will pay JAMS arbitration fees and other costs directly to JAMS relating... -

Page 151

... health and safety of its associates, visitors, and the public. The Company's policy is to maintain its facilities and run its business operations in compliance with all occupational health and safety laws. Associates must follow all applicable laws and regulations and promptly report to management... -

Page 152

... sold in the United States must meet required flammability standards. Associates involved in buying apparel are responsible for obtaining from vendors copies of test results indicating that the fabrics used in clothing sold to the Company meet applicable flammability standards. Note that stricter... -

Page 153

... used to identify and distinguish a product, line of products or services from those belonging to another person or company. The Company owns a number of trademarks which are extremely valuable and well recognized by the public. Associates must vigilantly protect all Company trademarks by using... -

Page 154

.... Associates shall not, at any time, either directly or indirectly, divulge, disclose or communicate any confidential or non-public information relating to Company business, including information regarding customers, product pricing, Company operations strategies, practices, business plans... -

Page 155

... United States. Associates are required to report all violations or questionable transactions of U.S. Customs laws to either their supervisor, an NMG attorney, the Human Resources Department, the Associate Relations Department, or to the Compliance Committee. Customs and trade laws provide that all... -

Page 156

... ethics laws, including those prohibiting the use of Company funds, assets, facilities, or services tor (1) support or oppose political parties or candidates; or (2) reimburse associates who make donations to support or oppose political parties or candidates. Associates who make personal political... -

Page 157

... store. An associate must never offer a customer the option to ship a purchase in order to avoid paying sales tax. Failure to adhere to these rules will result in disciplinary action up to and including termination of employment. FALSE STATEMENTS AND SCHEMES TO DEFRAUD It is the Company's policy... -

Page 158

... report; providing any products to any person or entity in violation of any Company policy; retaining any uncustomary personal benefit from current or prospective customers, vendors, suppliers, government agencies or other business contacts; and using the Company's proprietary information, trade... -

Page 159

PROTECTING CUSTOMER INFORMATION Neiman Marcus is committed to protecting the privacy of its customers, including clientele and account information. The Company considers such customer information to be confidential and proprietary to the Company. The Company expects all of our associates entrusted ... -

Page 160

... solely through the Corporate Communications, Investor Relations, or Public Relations departments. ADVERTISING Federal and state laws and regulations prohibit false, misleading or deceptive advertising in the promotion and sale of products offered or sold by the Company. Associates are therefore... -

Page 161

... similar locations. Associates are further prohibited from developing or establishing websites or web pages using the Company's name, images, or trademarks without proper authorization from the Legal Department. NO EXPECTATION OF PRIVACY All of the data, documents and messages transmitted or stored... -

Page 162

... employed by, consult, serve as a director, volunteer or otherwise render services to any vendor, distributor, supplier, customer, or competitor of the Company; be a creditor of any vendor, distributor, supplier, customer, or competitor of the Company; use Company property, information, or position... -

Page 163

... value); or (2) are product samples, clearly marked with company or brand names, and distributed to a large group of associates on an equal basis. Associates are prohibited from returning conclave or vendor gifts for cash or credit. Associates are also prohibited from selling or bartering gifts... -

Page 164

... safe and productive work environment for all associates. Associates are prohibited from using, possessing, selling, distributing, purchasing or being under the influence of illegal narcotics or other controlled substances at any time while on Company property or on Company business. Exceptions may... -

Page 165

... information about this program is available from the Human Resources Department or on the websiter members.mhn.com. An associate whose job performance or behavior indicates that he or she may be unfit for duty will not be permitted to work. If allowed under applicable state laws, the Company... -

Page 166

...changes. The Company may also periodically distribute additional guidelines regarding compliance with individual policies. TRAINING AND EDUCATION The Compliance Committee oversees and coordinates the training of designated associates regarding the Code and its related policies. The Legal Department... -

Page 167

...TO ALLEGATIONS OF VIOLATIONS All reported violations of the law and/or the Code will be investigated promptly and will be treated with as much confidentiality as reasonably possible. The Compliance Committee has a duty to coordinate all investigations and confer with Company management regarding any... -

Page 168

...1 COMPLIANCE COMMITTEE MEMBERS THE NEIMAN MARCUS GROUP, INC. 1618 Main Street Dallas, TX 75201 800-937-9146 / 214-741-6911 NMG Senior Vice President - General Counsel 214-743-7610 LIM SKINNER NMG Executive Vice President - Chief Operating Officer and Chief Financial Officer 214-743-7630 Jim_Skinner... -

Page 169

... [email protected] KURT BEALE NMG Vice President - Chief Audit Executive 214-761-2761 [email protected] SCOTT SEALE NMG Vice President - Employee Benefits 214-757-2888 [email protected] BILL HOUGH NMG Vice President - Credit Management 214-761-2699 Bill_Hough... -

Page 170

...2 LEGAL DEPARTMENT DIRECTORY THE NEIMAN MARCUS GROUP, INC. Legal Department 1618 Main Street Dallas, TX 75201 (800) 937-9146 (214) 741-6911 (214) 743-7611 Facsimile KIM YEE Vice President - Assistant General Counsel 214-743-7618 [email protected] MARGARET LESESNE Vice President - Assistant... -

Page 171

..., the Associate Relations Department, any attorney in the Legal Department, or to the Compliance Committee. I have received and had an opportunity to review the "NMG Dispute Resolution Plan" which contains the 4-Step process for dispute resolution which, as a condition of my employment, the Company... -

Page 172

...The Neiman Marcus Greup, Inc. The Neiman Marcus Greup, Inc. The Neiman Marcus Greup, Inc. The Neiman Marcus Greup, Inc. The Neiman Marcus Greup, Inc. The Neiman Marcus Greup, Inc. (90%) Bergderf Geedman, Inc. (10%) Neiman Marcus Greup LTD Inc. NM Financial Services, Inc. NMG Media, Inc. NMG Glebal... -

Page 173

... the consolidated financial statements and schedule of Neiman Marcus Group LTD Inc. and the effectiveness of internal control over financial reporting of Neiman Marcus Group LTD Inc., included in this Annual Report (Form 10-K) for the year ended August 3, 2013. /s/ ERNhT & YOUNG LLP Dallas, Texas... -

Page 174

... financial information; and b) any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant's internal control over financial reporting. Date: September 25, 2013 /s/ KAREN W. KATZ Karen W. Katz President and Chief Executive Officer -

Page 175

... information; and b) any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant's internal control over financial reporting. Date: September 25, 2013 /s/ JAMES E. SKINNER James E. Skinner Executive Vice President, Chief Operating... -

Page 176

...) the information contained in the Report fairly presents, in all material respects, the financial condition and results of operations of the Company. Dated: September 25, 2013 /S/ KAREN W. KATZ Karen W. Katz President and Chief Executive Officer Certification of Chief Financial Officer Pursuant... -

Page 177