Mazda 2016 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2016 Mazda annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Derivative transactions are conducted in compliance with internal control rules and procedures

that prescribe transaction authority. The policies for derivative transactions of the Group are

approved by the Company’s President or Financial Officer. Transactions are approved in advance

by either the Company’s Financial Services Division General Manager or Treasury Department

General Manager. Based on these approvals, the Treasury Department conducts and books the

transactions as well as confirms the balance between the counterparty of the derivatives contract.

The operation of the transaction is segregated from its clerical administration, in order to

maintain internal check within the Treasury Department, and is audited periodically by the Global

Auditing Department. Derivative transactions are reported, upon execution, to the Company’s

Financial Officer, Financial Services Division General Manager, and Treasury Department General

Manager. The consolidated subsidiaries also follow internal control rules and procedures pursuant

to those of the Company, obtain approval of the Company, and conduct and manage the transactions

according to the approval.

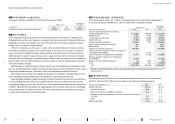

The following summarizes hedging derivative financial instruments used by the Group and

items hedged:

Hedging instruments: Hedged items:

Forward foreign exchange contracts Foreign currency-denominated

transactions planned in the future

Interest rate swap contracts Interest on borrowings

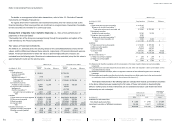

The following tables summarize fair value information as of March 31, 2016 and 2015 of derivative

transactions for which hedge accounting has not been applied:

Millions of yen Thousands of U.S. dollars

As of March 31, 2016

Contract

amount

Estimated

fair value

Valuation

gain (loss)

Contract

amount

Estimated

fair value

Valuation

gain (loss)

Forward foreign

exchange contracts:

Sell:

U.S. dollar ¥18,579 ¥ 615 ¥ 615 $164,416 $ 5,442 $ 5,442

Euro 1,275 4 4 11,283 36 36

Canadian dollar 7,409 (105) (105) 65,567 (929) (929)

Australian dollar 15,901 (381) (381) 140,717 (3,372) (3,372)

Sterling pound 1,722 112 112 15,239 991 991

Buy:

Thai baht 6,944 (280) (280) 61,451 (2,478) (2,478)

Total ¥51,830 ¥ (35) ¥ (35) $458,673 $ (310) $ (310)

Millions of yen

As of March 31, 2015

Contract

amount

Estimated

fair value

Valuation

gain (loss)

Forward foreign

exchange contracts:

Sell:

U.S. dollar

¥ 4,205 ¥ 4 ¥ 4

Euro

2,016 62 62

Canadian dollar

5,663 (21) (21)

Australian dollar

9,702 51 51

Sterling pound

727 16 16

Buy:

Thai baht

4,099 157 157

Total

¥26,412 ¥269 ¥269

For forward foreign exchange contracts, fair values at year-end are estimated based on prevailing

forward exchange rates at that date.

Notes to Consolidated Financial Statements

MAZDA ANNUAL REPORT 2016

Financial Section

Message from

Management

Review of Operations

Drivers of Value Creation

Foundations Underpinning

Sustainable Growth

Contents