Mazda 2016 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2016 Mazda annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Business Management System

Overview of the Corporate Governance Structure

Format Company with Audit & Supervisory Board

Number of directors 10

Number of outside corporate directors 2

Term of directors 2 years

Incentives for directors

Short-term incentives:

Earnings-based compensation

Medium-to-long-term incentives:

Compensation in the form of stock options

Individual disclosure of director compensation No

Number of Audit & Supervisory Board members 5

Number of outside Audit & Supervisory Board members 3

Independent officers (filed with Tokyo Stock Exchange) 5 (2 outside directors, 3 outside auditors)

Procedures in appointing and determining

remuneration of the officers

Officer Lineup Advisory Committee

Officer Remuneration Advisory Committee

Accounting auditor KPMG AZSA LLC

Adoption of executive officer system Yes

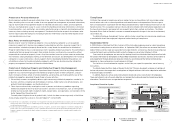

Corporate Governance

Mazda is enhancing its corporate governance by working to increase management transparency

and expedite decision making. The Company respects the intent of the Corporate Governance

Code set by Tokyo Stock Exchange and shall implement its all principles.

Basic Views on Corporate Governance

While working to build a good relationship with its stakeholders, including shareholders, custom-

ers, suppliers, the local community, and its employees, the Company shall strive to sustain

growth and enhance its corporate value over the medium and long terms through transparent,

fair, prompt and decisive decision making and to continue to enhance its corporate governance

in line with the following basic philosophy.

i. The Company shall ensure that the rights of shareholders are effectively secured, create

an environment in which their rights can be properly exercised, and ensure shareholders’

equality.

ii. The Company shall foster a corporate culture and climate that respect stakeholders’ rights

and status and sound business ethics and have a dialogue and collaborate with stakeholders

appropriately.

iii. The Company will disclose information appropriately based on laws and regulations and take

the initiative to provide other information as well based on laws and regulations.

iv. Based on its fiduciary responsibility and accountability to shareholders, the Company’s

Board of Directors shall lay out a broad direction for corporate strategy, establish an envi-

ronment that will support appropriate risk-taking, and exercise highly effective supervision

over the management team from their independent and objective stance.

v. The Company shall engage in constructive dialogue with shareholders and take a proper

interest in their interests and concerns while endeavoring to explain the Company’s manage-

ment policies in a clear manner and gain shareholders’ understanding.

CHECK Main Initiatives since the March 2016 Fiscal Year

Officer Lineup Advisory Committee and

Officer Remuneration Advisory Committee

Establishment of Officer Lineup Advisory Committee and Officer Remuneration

Advisory Committee with outside directors servicing as committee chair in order to

reinforce the supervisory functions of the Board of Directors and further improve

management transparency

Stock Options as Compensation

Introduction of stock options as compensation to the Company’s inside directors in order

to have them share the risks and benefits of stock price fluctuations with stockholders

and to further enhance their desire to contribute to boosting share prices and increasing

corporate value over the medium and long terms

Analysis and Evaluation of Board of Director Effectiveness

Analysis and evaluation of the Board of Directors in order to steadily promote efforts to

further improve the Board’s effectiveness

Please refer to the “Corporate Governance Report” for policies and details on Mazda’s

initiatives regarding the Corporate Governance Code.

http://www.mazda.com/en/investors/library/governance/

MAZDA ANNUAL REPORT 2016

30 Foundations Underpinning

Sustainable Growth

Message from

Management

Review of Operations

Drivers of Value Creation

Financial Section

Contents