Mazda 2016 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2016 Mazda annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

New CX-9

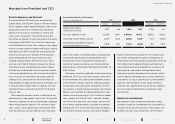

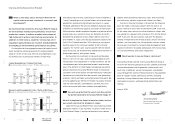

Sales Volume

■ Sales Volume in United States (Thousands of units)

■Sales Volume in Canada and Other Markets

(Thousands of units)

Market Share in United States (%)

Review by Market

Overview of March 2016 Fiscal Year Results

Total demand in the United States rose 5% from the previous

year, to 17.6 million units, for the sixth consecutive year of

growth since the March 2011 fiscal year following the decline in

the wake of the 2008 global financial crisis. In Canada, year-on-

year increases have continued since the March 2011 fiscal year,

and in the March 2016 fiscal year total demand rose 4%, to 1.93

million units.

Mazda’s sales volume in North America grew 3% from the

previous year, to 438,000 units. In the United States, sales

volume was 306,000 units, which was flat with the previous

year, with controlled fleet sales as well as growth in retail sales.

The updated Mazda CX-5 maintained strong retail sales, and

full-scale sales of the CX-3 and the new Mazda MX-5 contributed

as well. In Canada, sales of the CX-5 grew, and although the

CX-3, introduced in May 2015, contributed to sales volume, an

increasingly competitive environment led to lower sales volume

for the Mazda3, and overall sales volume decreased 0.8%, to

71,000 units. As in the United States, we continue to focus on

business growth led by retail sales, with limited fleet sales. In

Mexico, Mazda’s sales volume grew 30%, to 59,000 units, and

our market share rose to 4.2% from 3.8%, for record results in

both sales volume and market share. In addition to the locally

manufactured Mazda3 and Mazda2, the CX-3 contributed to the

increase in sales volume.

The U.S. Environmental Protection Agency (EPA)’s

Light-Duty

Automotive Technology, Carbon Dioxide Emissions, and Fuel

Economy Trends

report,*1 released in December 2015, listed

Mazda’s 2014 model year as having the highest overall Manufac-

turer Adjusted Fuel Economy,*2 giving Mazda the No. 1 ranking

for the third year in a row. Mazda’s overall average fuel economy

for the 2014 model year was 29.4 miles per gallon (mpg), a 1.3

mpg improvement from the previous model year.

March 2017 Fiscal Year Forecast

Demand is expected to remain high in the United States, under-

pinned by a robust economy. Accordingly, Mazda is projecting a

3% increase in sales volume, to 449,000 units, in the North

American market. This includes 6% growth in the United States,

to 325,000 units, with continued right-price sales of main

models including the CX-5 and Mazda3 at the previous year’s

level, plus growth from a full-year contribution from the CX-3

and the launch of the new Mazda CX-9. In Canada, with the

launch of the new CX-9 we are forecasting a 3% rise, to 73,000

units, but with the remarkable worsening of the exchange rate

with Mexico, we are expecting an 18% decline in that market, to

48,000 units.

FOCUS Working to Enhance Brand Value

We are pursuing sales reforms in North America to provide

high-quality customer care, raise the level of customer reten-

tion, and establish a brand presence. We are working to appeal

to customers based on our brand and product value by setting

up a training structure that enables cascade of the brand value

management and penetration of the concepts of

Jinba-ittai

from distributors to dealers.

We are also focusing on enriching customers’ car experi-

ences by providing thorough explanations of the special fea-

tures of our products and technologies at showrooms and

offering test-drive opportunities, as well as creating additional

customer experiences through occasions for interaction among

customers and between

customers and Mazda at

motor shows and fan events.

*1

Light-Duty Automotive Technology, Carbon Dioxide Emissions, and

Fuel Economy Trends:

An annual report published by the EPA since

1975, which summarizes the fuel economy trends of new passenger

vehicles and light trucks.

*2 Manufacturer Adjusted Fuel Economy: The average fuel economy of

all vehicles sold by a manufacturer over a one-year period. In the

Light-Duty Automotive Technology, Carbon Dioxide Emissions, and

Fuel Economy Trends

report, the EPA uses adjusted combined city

and highway fuel economy figures for each model by model year, and

the average is weighted for sales volume.

Global Mazda MX-5 Cup

North America

372 391 425 438 449

1.9

99

2013 2014 2015 2016 2017

107 119 132 124

273 284 306 306 325

1.8 1.8 1.7

(Forecast)

Years ended

March 31

MAZDA ANNUAL REPORT 2016

11 Review of Operations

Drivers of Value Creation

Foundations Underpinning

Sustainable Growth

Financial Section

Message from

Management

Contents