Mazda 2016 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2016 Mazda annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Analysis of Business Results, Financial Position, and Cash Flows

production declined ¥14.6 billion, or 18.5%, to ¥64.4 billion, while sales of parts grew ¥12.5

billion, or 5.4%, to ¥244.2 billion, and other sales rose ¥13.7 billion, or 6.2%, to ¥236.5 billion.

Operating Income

Operating income rose ¥23.9 billion, or 11.8%, from the previous year, to ¥226.8 billion.

Despite an adverse effect from exchange rate movements and an increase in expenses

related to future growth, including stepped-up investment for development and a rise in fi xed

costs for a new plant in Mexico, higher unit sales and an improved model mix from SKYACTIV-

equipped models, and continued cost reductions through Monotsukuri Innovation, resulted in

an overall increase.

Ordinary Income and Net Income Attributable to Owners of the Parent

Ordinary income included a ¥22.0 billion gain from equity in net income of affi liated companies

as well as a ¥16.0 billion foreign exchange loss, for an overall increase of ¥11.0 billion, or

5.2%, to ¥223.6 billion. Net income attributable to owners of the parent declined ¥24.4 billion,

or 15.4%, to ¥134.4 billion, due to factors including a one-time extraordinary loss from a

reserve for product warranties and ¥29.7 billion of total income taxes.

Segment Information

Net sales in Japan grew ¥287.5 billion, or 11.4%, to ¥2,815.7 billion, with a ¥20.1 billion, or

14.1%, increase in operating income, to ¥162.5 billion. These increases were mainly from a

rise in unit sales and an improved model mix, combined with progress in cost reductions.

In North America, net sales rose ¥184.3 billion, or 14.7%, to ¥1,440.4 billion, while

operating income declined ¥8.1 billion, or 21.3%, to ¥29.8 billion. Although unit sales moved

up and the model mix improved, profi t declined due to an increase in depreciation expenses

associated with the new plant in Mexico.

European net sales rose ¥67.1 billion, or 10.8%, to ¥690.0 billion, while operating income

declined ¥6.2 billion, or 41.5%, to ¥8.7 billion. These results mainly refl ected increased unit

sales and an improved model mix in major countries, partially offset by the yen’s appreciation

against the euro and the effect of the contraction of demand in Russia.

In other markets, net sales rose ¥111.6 billion, or 23.1%, to ¥595.0 billion, and operating

income increased ¥8.1 billion, or 60.0%, to ¥21.6 billion, primarily from higher unit sales and

an improved model mix.

Financial Position

Total assets as of March 31, 2016, were ¥2,548.4 billion, a gain of ¥75.1 billion from the end of

the previous fi scal year, resulting from increases in items including cash and time deposits and

deferred tax assets.

Total liabilities were ¥1,571.7 billion, a decrease of ¥10.3 billion from the previous fi scal

year-end, mainly from a reduction in long-term loans payable. Interest-bearing debt was

reduced by ¥83.9 billion, to ¥617.1 billion, and net interest-bearing debt (interest-bearing debt

minus cash and cash equivalents) as of the fi scal year-end totaled ¥48.4 billion, a ¥123.5

billion decrease from the end of the previous fi scal year. The net debt-to-equity ratio improved

14.7 percentage points, to 5.1%.

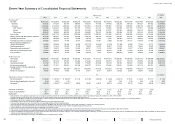

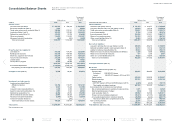

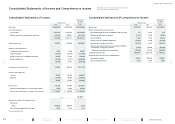

Net sales by Segment*1 (Billions of yen)

(Years ended

March 31) 2012 2013 2014 2015 2016

Japan 1,745.0 1,893.6 2,263.3 2,528.1 2,815.7

North America 571.6 650.0 843.6 1,256.1 1,440.4

Europe 360.4 354.8 540.5 622.9 690.0

Other markets 294.2 418.7 414.2 483.4 595.0

Adjustment (938.1) (1,111.8) (1,369.4) (1,856.7) (2,134.5)

Consolidated 2,033.1 2,205.3 2,692.2 3,033.9 3,406.6

Operating Income (Loss) by Segment*2

(Billions of yen)

(Years ended

March 31) 2012 2013 2014 2015 2016

Japan (18.4) 108.4 173.5 142.4 162.5

North America (40.3) (48.9) 1.3 37.9 29.8

Europe 5.6 3.1 8.5 14.9 8.7

Other markets 10.1 16.8 5.8 13.5 21.6

Adjustment 4.3 (25.5) (7.0) (5.8) 4.1

Consolidated (38.7) 53.9 182.1 202.9 226.8

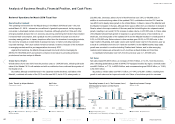

Years ended March 31

108.9

154.7

(95.5)

204.5

(108.1)

262.8

2012 2013 2014 2015 2016

(79.4)

8.7

(9.1)

(70.3)

49.0

(40.3)

16.3

(120.1)

136.4

891.3

2,473.3

2012 2013 2014 2015 2016

35.2

976.7

2,548.4

37.4

1,915.9 1,978.6

513.2

474.4 676.8

2,246.0

29.4

25.1

24.5

■ Total Assets ■ Net Assets Equity Ratio ■ Cash Flows from Operating Activities

■ Cash Flows from Investing Activities

Free Cash Flow

*1 Net sales by geographic area based on reportable segments *2 Operating income by geographic area based on reportable

segments

Total Assets / Net Assets / Equity Ratio

(Billions of yen / %)

Cash Flows

(Billions of yen)

MAZDA ANNUAL REPORT 2016

43 Financial Section

Message from

Management

Review of Operations

Drivers of Value Creation

Foundations Underpinning

Sustainable Growth

Contents