Mazda 2016 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2016 Mazda annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

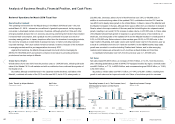

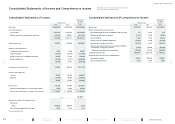

Analysis of Business Results, Financial Position, and Cash Flows

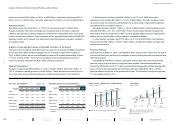

Years ended March 31

1,534

2012 2013 2014 2015 2016

225

425

229

215

303

232

438

257

235

3721,247 1,235 1,331

206 216

1,397

244

391

207

196

293

372

172

175

300

372

183

223

263

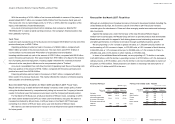

3,033.9

2,416.5

617.4

3,406.6

2,745.7

660.9

2,033.1

1,472.9

560.2

2,692.2

2,036.5

655.7

2,205.3

1,617.3

588.0

2012 2013 2014 2015 2016

Years ended March 31

158.8

202.9

134.4

226.8

2012 2013 2014 2015 2016

(38.7)

53.9 34.3

(107.7)

135.7

182.1

Volume and mix

+56.0

YoY +23.9

Foreign exchange

(42.4)

Cost

improvements

+43.7

Marketing

expenses

+1.7

Others

(35.1)

202.9 226.8

2015 2016

Years ended March 31

Review of Operations for March 2016 Fiscal Year

Operating Environment

The operating environment for the Mazda Group in the March 2016 fi scal year – the year

ended March 31, 2016 – showed an overall trend of gradual improvement, led by ongoing

recoveries in developed market economies. Overseas, although growth in China and other

emerging markets slowed, the U.S. economy was strong, stemming from factors that included

increased retail consumption, and a gradual recovery continued in Europe as a result of

monetary easing policies. In Japan, despite an effect from the slowdown in emerging markets,

the economy showed an overall trend of gradual recovery on factors including improved

corporate earnings. The future outlook remains uncertain, however, because of the slowdown

in emerging markets and the yen’s appreciation since early 2016.

Against this backdrop, the Mazda Group pursued structural reforms leveraging its

SKYACTIV TECHNOLOGY and worked to enhance brand value by providing attractive

products and services unique to Mazda.

Global Sales Volume

Global sales volume rose 9.8% from the previous year, to 1,534,000 units, refl ecting full-scale

sales of the Mazda CX-3 in all markets and with a contribution from continued strong sales of

the Mazda CX-5.

By market, although overall demand in the Japanese market declined, solid sales of the

Mazda2, combined with sales of the CX-3 and the new MX-5, led to 3.5% sales growth, to

232,000 units. Overseas, sales volume in North America rose 3.0%, to 438,000 units. In

addition to continued strong sales of the updated CX-5, contributions from the CX-3 and the

new MX-5 led to steady sales growth in the United States. In Mexico, sales of the Mazda2 and

the Mazda3 increased. In Europe, although there was an effect from a contraction in demand in

Russia, sales in the major markets of Germany and the United Kingdom far outpaced market

growth, resulting in an overall 12.0% increase in sales volume, to 257,000 units. In China, sales

of the Mazda3 showed high growth in response to a government policy of tax reductions on

small cars, and strong sales of the updated CX-5 and the Mazda6 resulted in overall growth of

9.5%, to 235,000 units. Sales volume in other markets grew 22.6%, to 372,000 units. In the

major market of Australia, both sales volume and market share rose from the previous year as

a result of contributions from the CX-3 and the new MX-5. In the ASEAN market, large sales

growth was recorded in countries including Thailand and Vietnam, and in other emerging

markets record sales were achieved in such countries as Saudi Arabia and Colombia.

Consolidated wholesales rose 9.2% from the previous year, to 1,307,000 units.

Net Sales

Net sales totaled ¥3,406.6 billion, an increase of ¥372.7 billion, or 12.3%, from the previous

year, refl ecting global sales growth of SKYACTIV-equipped models. By region, domestic sales

rose ¥43.5 billion, or 7.1%, to ¥660.9 billion, and overseas sales grew ¥329.2 billion, or 13.6%,

to ¥2,745.7 billion.

By product, vehicle sales rose ¥361.1 billion, or 14.4%, to ¥2,861.5 billion, resulting from

growth in unit sales and an improved model mix. Sales of knockdown parts for overseas

Sales Trends by Major Markets

(Thousands of units)

■ Japan ■ North America ■ Europe ■ China

■ Other markets

■ Domestic ■ Overseas ■ Operating Income (Loss)

■ Net Income (Loss) Attributable to Owners of the Parent

■ Improvement ■ Deterioration

Net Sales

(Billions of yen)

Operating Income (Loss) / Net Income (Loss)

Attributable to Owners of the Parent

(Billions of yen)

Operating Income Change

(Billions of yen)

MAZDA ANNUAL REPORT 2016

42 Financial Section

Message from

Management

Review of Operations

Drivers of Value Creation

Foundations Underpinning

Sustainable Growth

Contents