Mazda 2016 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2016 Mazda annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

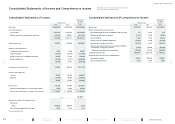

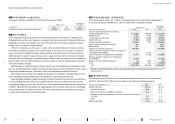

9 SHORT-TERM DEBT AND LONG-TERM DEBT

Short-term debt as of March 31, 2016 and 2015 consisted of loans, principally from banks with

interest averaging 1.38% and 1.42% for the respective years.

Long-term debt as of March 31, 2016 and 2015 consisted of the following:

Millions of yen

Thousands of

U.S. dollars

As of March 31 2016 2015 2016

Domestic unsecured bonds due serially 2016 through

2019 at rate of 0.32% to 0.35% per annum ¥ 20,350

(*)

¥ 40,450

$ 180,088

Loans principally from banks, maturing through 2072:

Secured loans 40,930

48,946

362,212

Unsecured loans 433,529

489,964

3,836,540

Lease obligations, maturing through 2023 5,180

4,982

45,841

Subtotal 499,989

584,342

4,424,681

Amount due within one year (143,044)

(96,132)

(1,265,876)

Total ¥ 356,945

¥488,210

$ 3,158,805

(*) As of March 31, 2016, certain of these unsecured bonds amounting to ¥350 million ($3,097 thousand) are bank- guaranteed under the

condition that assets are pledged to the bank as collateral by the issuer of the bonds.

The annual interest rates applicable to long-term loans and lease obligations outstanding

averaged 1.07% and 1.33%, respectively, for obligations due within one year and 2.23% and

1.35%, respectively, for obligations due after one year at March 31, 2016.

The annual interest rates applicable to long-term loans and lease obligations outstanding

averaged 1.68% and 1.51%, respectively, for obligations due within one year and 1.95% and

1.47%, respectively, for obligations due after one year at March 31, 2015.

As is customary in Japan, general agreements with banks include provisions that security and

guarantees will be provided if requested by banks. Banks have the right to offset cash deposited

with them against any debt or obligation that becomes due and, in the case of default or certain

other specified events, against all debts payable to banks.

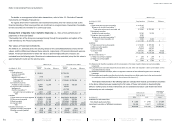

The annual maturities of long-term debt at March 31, 2016 were as follows:

Year ending March 31 Millions of yen

Thousands of

U.S. dollars

2017

¥143,044 $1,265,876

2018

90,316 799,257

2019

94,814 839,062

2020

45,809 405,389

2021

32,932 291,434

Thereafter

93,074 823,663

Total

¥499,989 $4,424,681

The assets pledged as collateral for short-term debt of ¥34,099 million ($301,761 thousand) and

¥33,973 million, and long-term debt of ¥41,280 million ($365,310 thousand) and ¥49,396 million

at March 31, 2016 and 2015, respectively, were as follows:

Millions of yen

Thousands of

U.S. dollars

As of March 31 2016 2015 2016

Property, plant and equipment, at net book value ¥420,323

¥412,999

$3,719,673

Inventories 68,911

61,797

609,832

Other 47,891

63,498

423,814

Total ¥537,125

¥538,294

$4,753,319

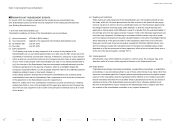

10 EMPLOYEES’ SEVERANCE AND RETIREMENT BENEFITS

The Group has contributory defined contribution plans and defined benefit plans, and

non-contributory defined benefit plans. For the accounting policies for retirement benefits,

refer to Note 2, “Employees’ severance and retirement benefits”.

Reconciliations of beginning and ending balances of the retirement benefit obligations and the

plan assets for the years ended March 31, 2016 and 2015 were as follows:

Millions of yen

Thousands of

U.S. dollars

For the years ended March 31 2016 2015 2016

Movements in retirement benefit obligations:

Balance at beginning of year ¥314,252

¥301,619

$2,780,991

C umulative effects of changes in

accounting policies —

(3,082)

—

Restated balance 314,252

298,537

2,780,991

Service cost 11,126

9,900

98,460

Interest cost 3,864

4,611

34,195

Actuarial losses/(gains) 25,497

14,543

225,637

Benefits paid (15,148)

(16,074)

(134,053)

Past service costs 14

—

124

Other (2,188)

2,735

(19,363)

Balance at end of year ¥337,417

¥314,252

$2,985,991

Notes to Consolidated Financial Statements

MAZDA ANNUAL REPORT 2016

59 Financial Section

Message from

Management

Review of Operations

Drivers of Value Creation

Foundations Underpinning

Sustainable Growth

Contents