Mazda 2016 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2016 Mazda annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

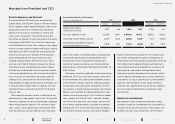

Message from President and CEO

2016 fiscal year, we paid a full-year dividend of ¥30 per

share, consisting of a ¥15 per share interim dividend

and a ¥15 per share year-end dividend. We plan to raise

the dividend by ¥5 per share for the March 2017 fiscal

year, to ¥35 per share, consisting of a ¥15 per share

interim dividend and a ¥20 per share year-end dividend.

Structural Reform Plan

The Structural Reform Plan medium-term business

plan was formulated in February 2012 to address an

increasingly challenging external environment. The

plan set four major initiatives, which we have steadily

pursued, making solid progress with structural

reforms leveraging SKYACTIV TECHNOLOGY.

The first major initiative was business innovation

through SKYACTIV TECHNOLOGY, and in this regard

we have progressed on plan with the introduction of

new models, bringing the percentage of SKYACTIV-

equipped vehicles sold to 86%. Both SKYACTIV prod-

ucts and KODO design have been highly recognized in

Japan and overseas, and they have enabled us to

achieve growth in global sales volume while maintain-

ing our right-price sales policy.

In terms of the second initiative—accelerate further

cost improvement through Monotsukuri Innovation—

we have enhanced our product strength while making

major improvements in the efficiency of development

spending and capital investment, through manufactur-

ing that faithfully reproduces designs and the devel-

opment and use of designer colors such as “Soul Red”

and “Machine Gray.” These moves have reduced costs

while also contributing to brand value enhancement.

With regard to the third initiative of establishing a

global production footprint, the Mexico plant that

commenced operations in January 2014 has expanded

the number of models produced as planned, including

the Mazda3, the Mazda2, and compact cars for Toyota.

The powertrain plant in Thailand has also begun

producing SKYACTIV engines in addition to automatic

transmissions. As a result, our overseas production

ratio has risen to around 40%, contributing to our

global supply capacity and our resistance to exchange

rate movements.

We are promoting global alliances, the fourth

initiative, by pursuing optimal and complementary

tie-up strategies by product, technology, and region,

including the commencement of production and

supply to Toyota from our plant in Mexico and to Fiat

Chrysler Automobiles from our Hiroshima plant. After

gaining deeper mutual understanding through the

task force that handled the operational tie-up with

Toyota, which was concluded and announced in May

2015, we are making steady progress in exploring a

broader range of areas for cooperation with a medi-

um-to-long-term time frame.

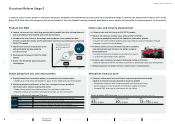

Structural Reform Stage 2

Under the Structural Reform Plan, we were able to

achieve a certain level of success toward the realiza-

tion of a stable earnings structure, including substan-

tial progress in major initiatives in the areas of prod-

ucts, sales, manufacturing, and alliances, while

investing for future growth. Nevertheless, there is still

room for further improvement in each of these areas,

and we believe we need to strengthen these initia-

tives further. We have therefore formulated Struc-

tural Reform Stage 2, a medium-term business plan

that begins with the March 2017 fiscal year and seeks

to increase brand value through qualitative business

growth for continuous growth in the future.

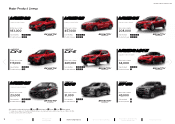

In the area of products and development, we will

introduce six new models (including one derivative

model) that provide driving pleasure and outstanding

environmental and safety performance. We will also

continue to advance our new-generation product

lineup with updated models featuring the latest de-

signs and technologies, and we aim to expand our

lineup of crossover models, which are registering

growth in demand globally, to step up sales volume

and raise profitability. Our technological development

MAZDA ANNUAL REPORT 2016

4Message from

Management

Review of Operations

Drivers of Value Creation

Foundations Underpinning

Sustainable Growth

Financial Section

Contents